Three things happened in early March that had a real impact in the sales market.

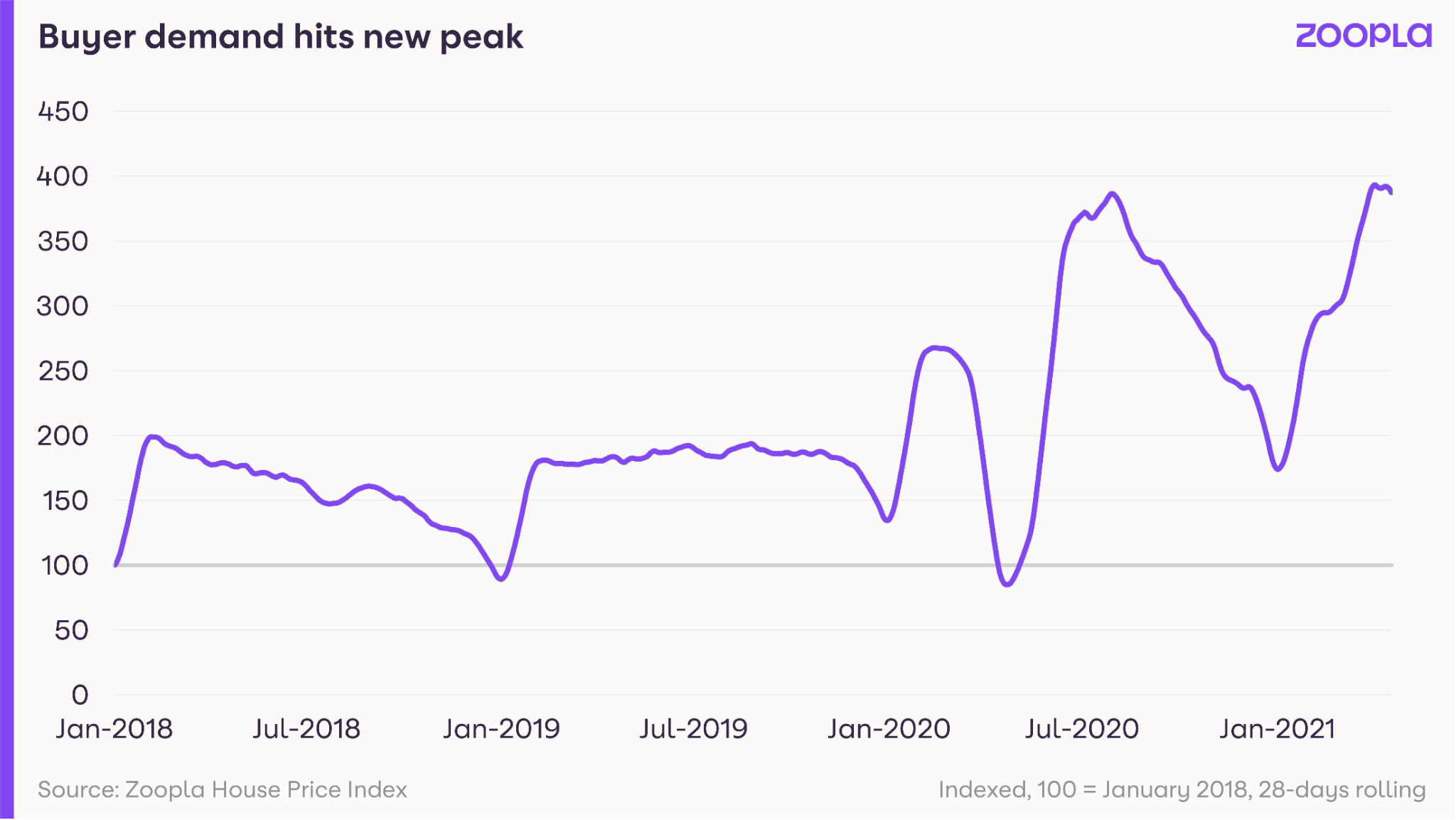

Firstly, the Chancellor’s announcement of the stamp duty extension, second, his announcement of a 95% mortgage guarantee scheme and finally, the end of home-schooling for many families as schools reopened. We saw the immediate impact of these factors in the data, with buyer demand surging through March and into April as more households decided to make a move.

The ‘search for space’ among homeowners continued, with some families freed up to pursue finding their next home once the kids were studying away from the kitchen table. First-time buyers, who were squeezed last year as mortgage finance for those with small deposits became more scarce, continue to ramp up their activity amid a wider selection of home loans – with some mortgage deals even offering higher loan-to-income thresholds.

This took overall buyer demand to a new peak – running ahead of the levels seen even last summer.

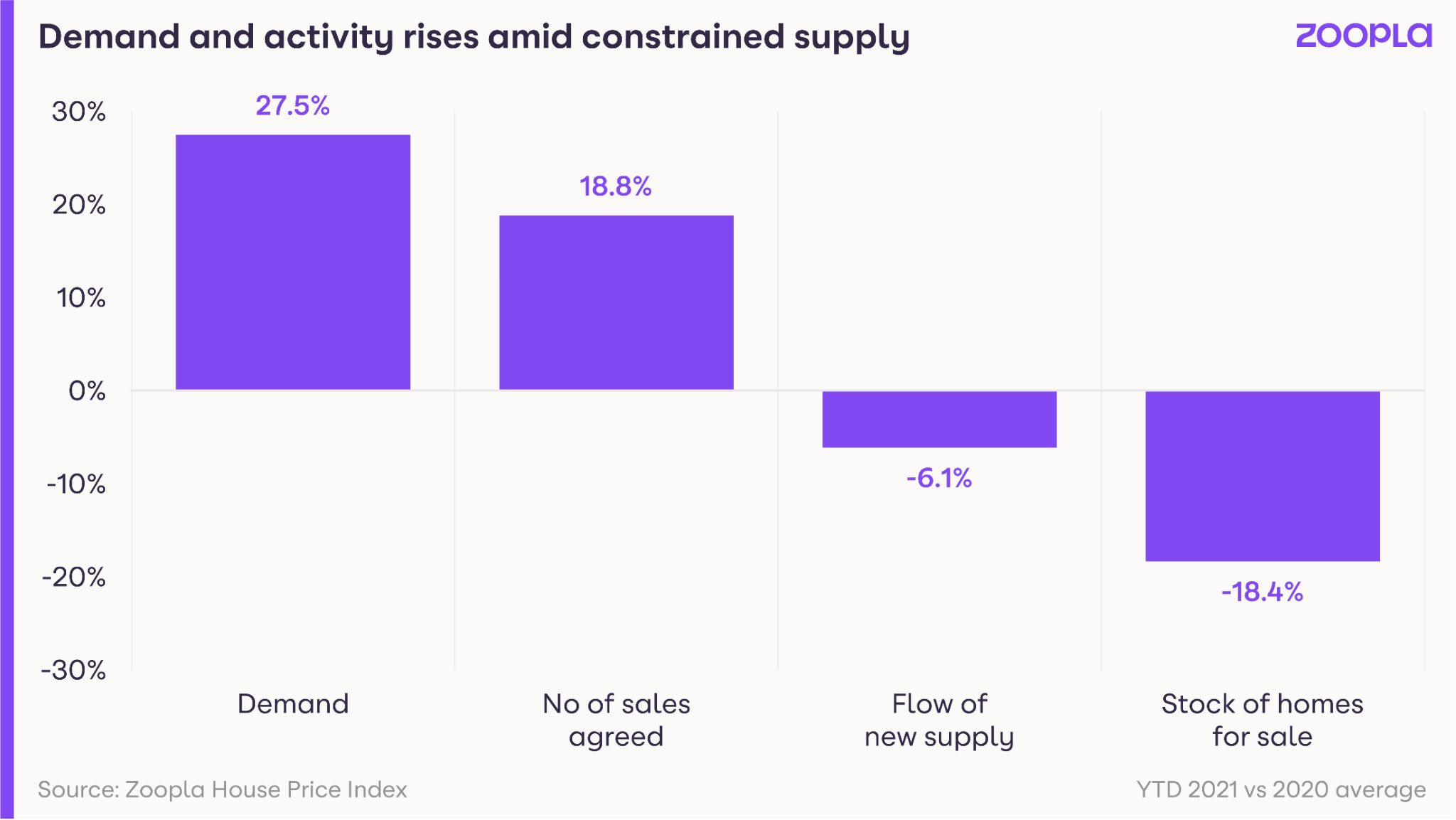

This higher demand is not being matched by new supply however, resulting in a widening demand/supply imbalance – something which continues to underpin pricing.

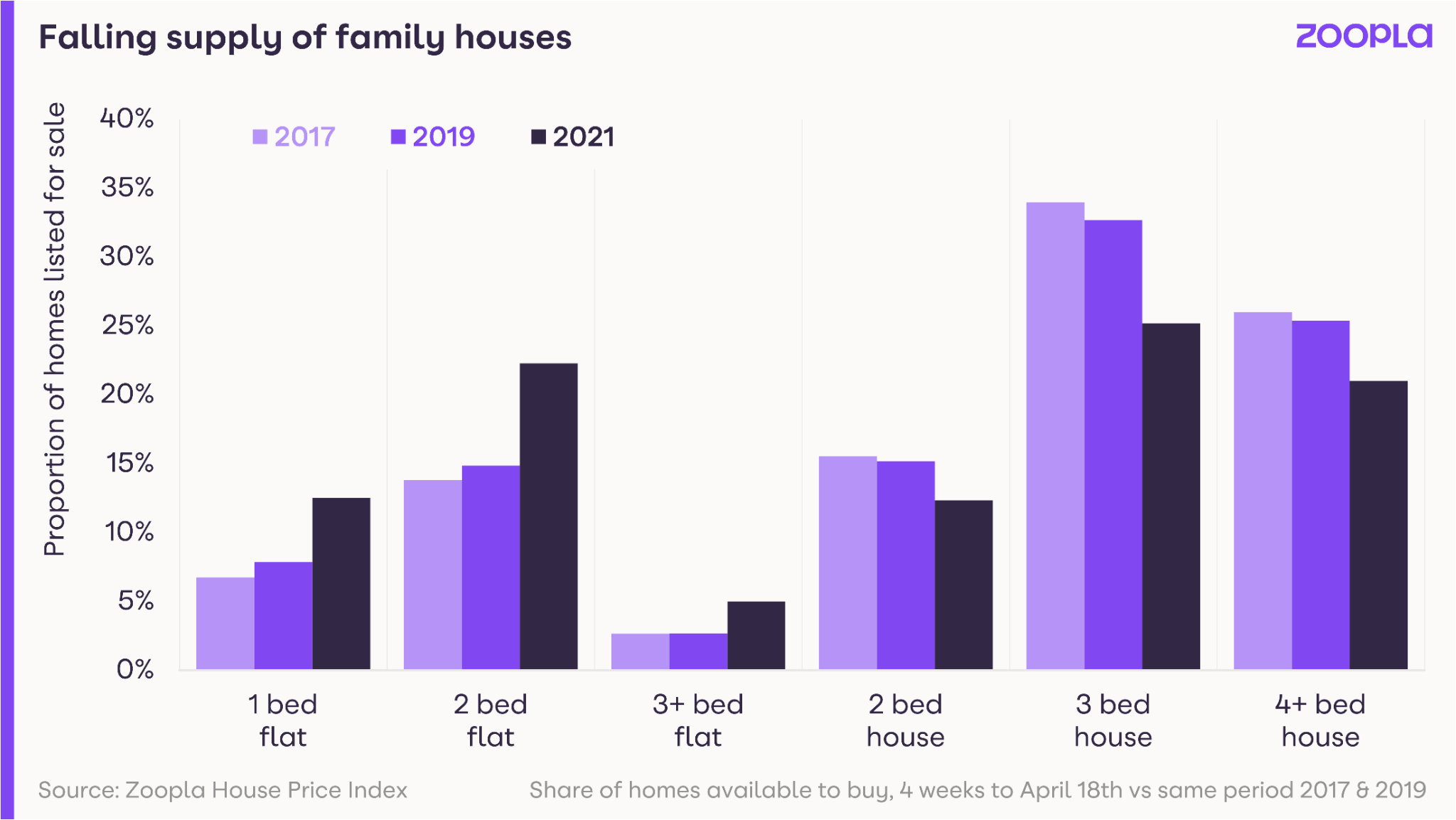

However, when we get under the bonnet of the supply/demand imbalance, we can see that the dislocation is focused particularly in one section of the housing market. As examined in our recent House Price Index – buyer demand is primarily focused on three-bed family houses.

This demand has eroded supply and there is now a distinct supply squeeze on three and four-bed homes available for purchase.

This shortage of homes for sale, in the face of so much demand, could impact transaction levels in this part of the market in the short-term.

However, the most recent data is showing us that the very large discrepancies between demand and supply may be starting to ease slightly.

The country is now on the road out of lockdown, at slightly different speeds depending on whether you are in England, Scotland, Wales or Northern Ireland. The ‘status quo’ that has been in place since at least January is changing as households can emerge from their homes to see friends and family, go shopping (for non-essentials) and enjoy a night out at a bar or restaurant (in a large coat or thermals).

As shown in the first chart above, the levels of buyer demand have started to fall back slightly after the first step out of lockdown in England on April 12th.

As the economy continues to open up, buyer demand levels will continue to recede from the highs of early April as households are able to engage in a wider range of activities.

But demand will remain elevated compared to levels seen in previous years, as the factors that have been driving demand remain in place. The ‘search for space’ as homeowners reassess how and where they are living has further to run – especially as businesses start to confirm how their working practices will operate in the coming years. Office-based workers who now know they will have a longer-term option for working away from the office will be able to look at homes for sale in a wider range of locations. First-time buyers are also much more active in the market – and they have nothing to sell.

We are also seeing signs of increased supply – with new listings rising 29% in the weeks following Easter. This is not enough to meet demand however. So homeowners considering a move from a three or four-bedroom house remain in pole position.

Grainne Gilmore is head of research at Zoopla.

Comments are closed.