Research by Wayhome has revealed the number of first-time buyers (FTB) purchasing a home has fallen significantly over the last year.

Research by Wayhome has revealed the number of first-time buyers (FTB) purchasing a home has fallen significantly over the last year.

The gradual homeownership provider analysed transaction levels to see how many FTBs made it onto the ladder during the pandemic property market boom and how this has changed.

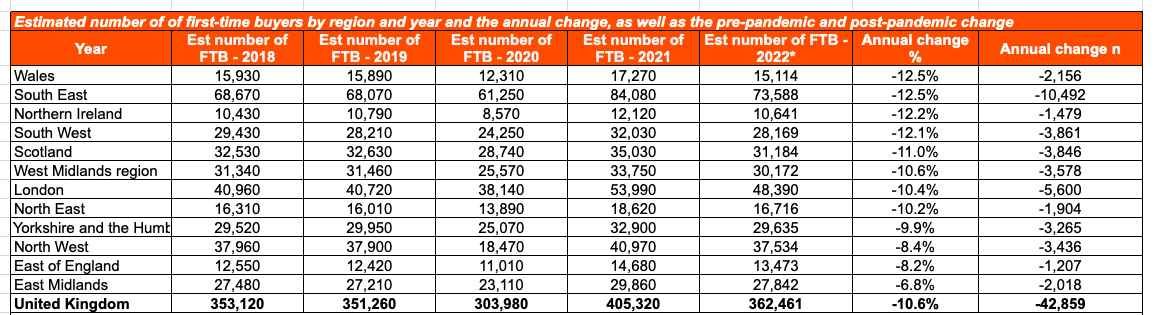

When the pandemic struck in 2020, FTB property purchases plummeted, with the number of those buying their first home falling to 303,980. This marked a 13.5% annual drop, the largest year-on-year decline in the last decade (2012 to 2022) and just the third annual decline seen between 2012 and 2020.

However, the introduction of the stamp duty holiday in July 2020 helped to rejuvenate the market to a huge extent, with the estimated number of FTBs rocketing to 405,320 in 2021, climbing 33.3% in a single year. Not only was this the highest annual increase in the last decade, but it also pushed the number of FTBs within the market far beyond any level seen since 2012.

However, Wayhome says there are signs that “the pandemic property market party may be over” as there has been a sharp annual decline in FTB numbers over the last year. In 2022, there were an estimated 362,461 FTBs, a year-on-year dip of 10.6% versus the record levels seen in 2021. With the exception of the 13.5% reduction spurred by the pandemic in 2020, this is just the fourth and by far the largest annual decline seen in the last decade.

There is one silver lining to this decline, as despite such a sharp annual reduction, the number of FTBs in 2022 remained some way above pre-pandemic market levels and represents the second highest annual level in the last decade.

The largest annual reductions in FTB levels by region have come across Wales (12.5%), the South East (12.5%), Northern Ireland (12.2%) and the South West (12.1%).

Co-founder and CEO of Wayhome, Nigel Purves, commented: “The cost of borrowing remains substantially more expensive despite mortgage rates starting to level out and we’re yet to see any real reduction in the already sky-high cost of a home.

“What’s more, the Help to Buy scheme has all but shut up shop and so there is very little help available for the nation’s first-time buyers when it comes to tackling the sizeable cost of homeownership.”

Comments are closed.