Margaret Thatcher is often blamed for closing the mines or taking away free school milk, but now it appears she is also responsibility for the period of the highest house price growth in London.

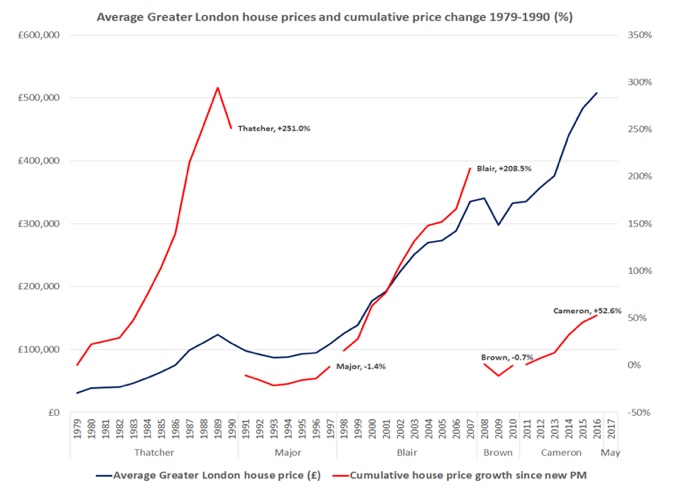

Data from agents Stirling Ackroyd shows that the Iron Lady’s tenure between 1979 and 1990 saw prices rise 251% from £31,379 to £110,110. This is equivalent to a 12.1% rise for each year she was in charge.

That is just ahead of Labour Prime Minister Tony Blair who presided over increases of 209% between 1997 and 2007, an equivalent of 11.9% each year.

However, it was bad news for those selling in the Major and Brown era as prices fell 1% during both, according to the agents. This is down to them being in charge during recessionary periods.

In 1991, the average London home cost £110,110, dropping to £108,620 at the time Major left office.

When Brown entered office in 2007 you could pay £335,040 to secure a London home. By 2010, property had become more affordable, but to the tune of £332,720.

David Cameron’s time in Downing Street between 2010 and 2016 saw prices grow 53% to £507,880.

Andrew Bridges, managing director of Stirling Ackroyd, said: “With great power comes great responsibility but there’s one thing the PM can’t control – London house prices.

“Under Thatcher’s tenure, the property market was turned on its head – seeing dramatic house price growth in London.

“There’s always talk of spiralling house price growth in the capital, but compared to the 1980s, the rate of growth is lagging behind.

“Even the boom years under Blair couldn’t keep up with this pace of growth. Under New Labour, London’s property market reached new heights, and became a global competitor. As demand soared, so did prices. Places like Shoreditch became solid investments and a buy-to-let surge started, with those properties snapped up still returning a profit today.”

Bridges suggests that new PM Theresa May could face a static London market: “The City’s property sphere has been pushed to its limits with new legislation and political events in the last year.

“But there’s a new advantage – London’s property market is more resilient and probably the safest real estate investment globally.

“The comparisons of May and Thatcher have already begun – but London’s property market can be tamed by no one.”

Comments are closed.