Just over two years ago, in the summer of 2019, annual house price growth was running at 1.3%, the lowest rate of growth since 2013, when the market (and the economy) was still recovering from the global financial crisis.

This low rate of price growth was caused by uncertainty around Brexit, which acted as a brake activity and on prices.

The July election in 2019 was a turning point – a new leader with a sizeable majority meant certainty for markets, and this was immediately reflected in the housing market, with price growth rising above 2% by the end of the year, the first time it had reached this level in 12 months.

Several months later – the pandemic emerged and the first lockdown was announced. There were fears that the nascent housing market activity would be curbed again as a result. Instead we have seen one of the busiest 18 month periods in the housing market in more than a decade.

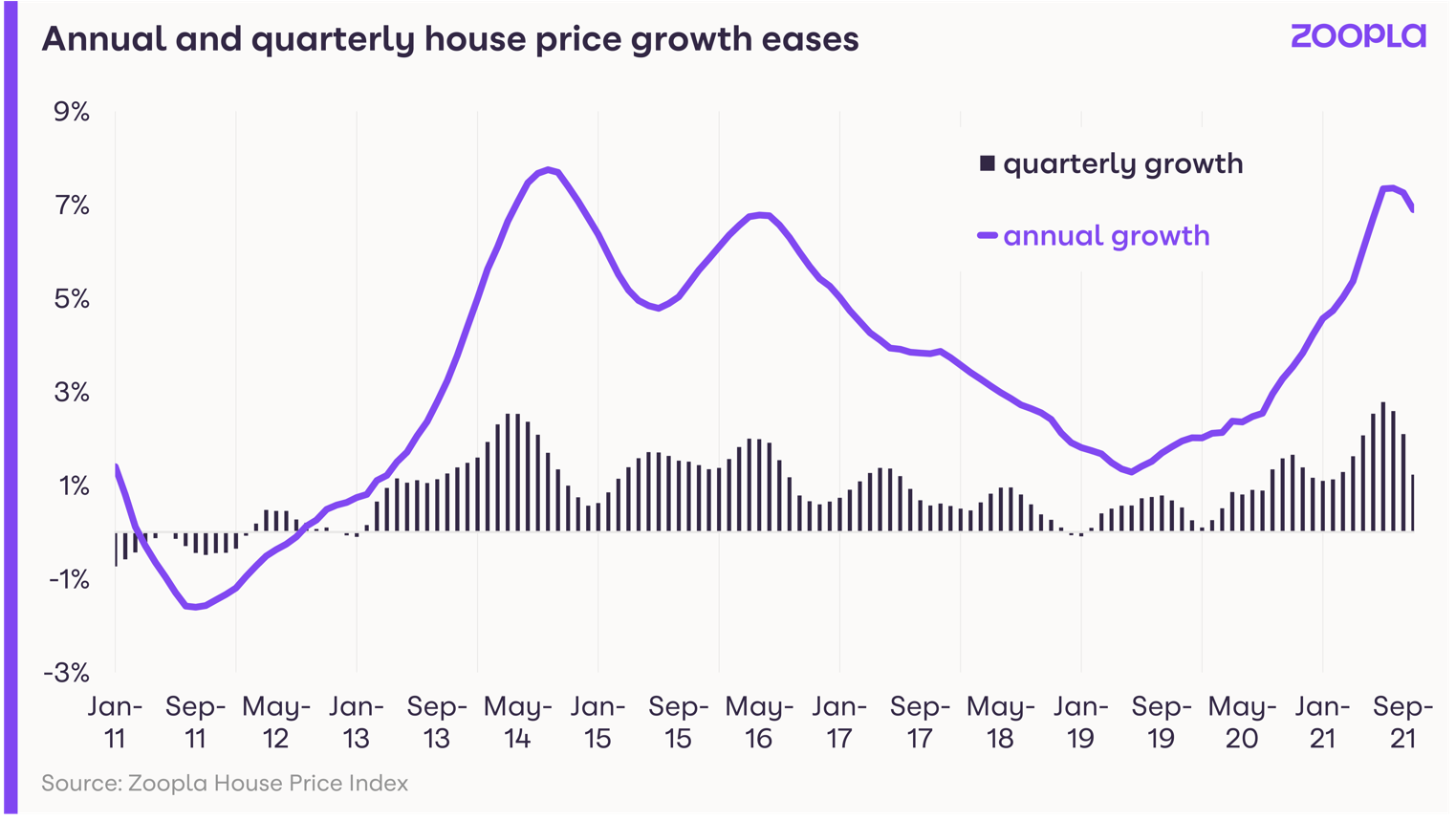

The mix of the pandemic-led ‘reassessment of home’ – with households deciding they want to live in a different space or location, coupled with the tax break of the stamp duty holiday, is set to have resulted in around one in 16 homes changing hands this year. The demand in the market has caused a tightening of stock levels, and also put upward pressure on pricing – with the annual rate of house price growth now at 6.9%.

But as the chart above shows, while the annual rate of house price growth remains elevated, the rate of quarterly growth has started to ease, suggesting that house price growth may start to moderate – although this is unlikely to be a linear progression.

While the stamp duty holiday has ended, demand from purchasers remains higher than typical levels, suggesting that the ‘reassessment of home’ has further to run in 2022.

There will be a slowing in demand and activity as we move closer to Christmas – in line with seasonal trends, but we expect buyer demand to climb again as we move into Q1 next year.

Supply levels will also rise – new listings are typically 50% higher at the end of January compared to the beginning of December.

As we move through 2022, supply pipelines will have a chance to start to build after the busy early year market as the market normalises. This is one of the factors that will ease the upward momentum on pricing. Alongside this, next year will mark the emergence of economic headwinds as the rising cost of living, and potentially mortgages, impacts household finances.

At the same time however, even with several quarter point interest rate rises, mortgages will remain relatively low compared to longer-term norms, and the fact that many homeowners with mortgages are on fixed rates will shelter parts of the market from any immediate impact.

By the end of next year, we expect house price growth to be running at 3%. House prices will continue to rise in value in 2022 – the slowdown in the rate at which they do so may well have started.

Gráinne Gilmore is head of research at Zoopla.

When the market gets like this people begin to sit tight, exacerbating the shortage of stock. Most agents have never sold in a market like this before,many ( anyone under 33) weren’t born! (05- 08 was nothing like what’s happening now)

People sit tight watching prices rise, people pull out of agreed sales because prices rise on the homes they want to buy, some pull out because although affordability isn’t a problem it isn’t a problem for other buyers too.

It take massive confidence to say what will happen in a market like this but anyone making comment should be including transaction volumes too.

Instruction volumes are down, agreed sales are sat there not completing, a lot of buyers cannot find anything to buy. We are in a bubble- it will either deflate slowly or it will burst. How agents handle themselves now will determine their future

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I’m not a fan of re-writing history, particularly recent history. The election in July 2019 was a Conservative Party leadership election, and the strong mandate to which Grainne refers came from the General Election in December.

Our experience was clearly different with uncertainty throughout that year, not helped by crucial Brexit related votes in March and October serving to scupper the valuable spring and autumn market periods.

I would rather forget 2019. The turning point for us was much later, in January 2020.

The election in December 2019 and Brexit certainty did restore confidence to two market sectors; second home and retirement purchasers who’d been sitting on their hands throughout most of the Brexit shenanigans, and we saw that recovery in early 2020 with investment purchasers hard on their heels. The pandemic stalled all that activity and a new demand accumulated from those able to re-consider where they could live with a reduced need/desire to commute.

It remains to be seen how long the momentum from that demand will carry forward. My guess is that it will, but that prices will plateau, held back by the prudence of lending sources. .

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Predicting what will happen in the housing market has become increasingly difficult, but that is what people like Grainne are paid to do and in fairness, I think she is one of the best and most sensible market analysists.

I also agree with Robert May and I am not sure what it is going to take for sellers to start coming back to the market, which is the major issue at the moment. Stock levels are dangerously low across the country. Buyer demand has not dropped, it is just the lack of stock that is making it appear quieter. What effect an interest rate rise might have is anybody’s guess, but unless there is an influx of stock at the start of the year, Q1 and Q2 2022 could be extremely difficult, hopefully picking up in the second half of the year.

I expect to see modest house priced inflation next year, it surely cannot continue at the levels we have seen in 2021, but whenever I say that, the market continues to confound and defy logic!

I am expecting a very tough year and we are going to have to adapt, change and be more creative to attract sellers in a rapidly changing market place.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register