The maximum amount UK private tenants can claim in housing benefit or universal credit is increasing for the first time since April 2020, but the rise is failing to keep pace with growth in rental prices, new research shows.

The maximum amount UK private tenants can claim in housing benefit or universal credit is increasing for the first time since April 2020, but the rise is failing to keep pace with growth in rental prices, new research shows.

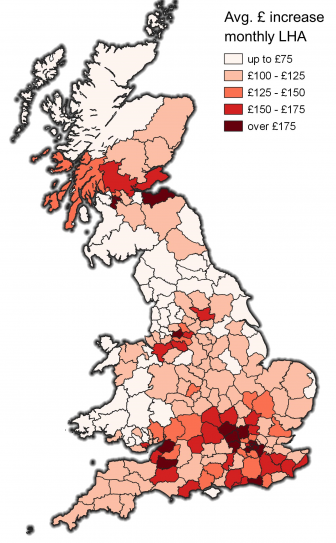

According to fresh research carried out by Savills, the increase in Local Housing Allowance (LHA) across the UK from April averages 17%, or £110 per month.

However, Savills’ analysis shows this is less than the 29% average growth in private rents in the period from April 2020 to November 2023.

Steve Partridge, a director at Savills affordable housing consultancy, said: “While the increase in LHA rates is welcome and widens the choice of private rental homes available to people on the lowest incomes, significant challenges remain.

“Our analysis suggests private rents continue to rise faster than LHA rates, on average, and in almost all parts of the country. As a result, those reliant on housing benefit will continue to struggle in the highly competitive private rented sector.

“Private rents will remain out of reach for most and particularly for homeless households that local authorities are trying to move out of temporary accommodation. A policy emphasis on supply that provides substantially more much-needed affordable housing across all tenures is required to alleviate pressure and continue to improve access to private rented homes.”

As a proportion of existing rents, the greatest average LHA increase will be in Bristol at 34%, equating to £293 more per month (see maps, below). This is generally in line with the increase in private rents since April 2020, with growth of 33% to November 2023 according to Zoopla. Manchester will see the second greatest increase of 32% (£221), however this falls below the 36% growth in rents in the same period.

Many areas will see much lower increases to LHA despite significant rental growth that reflects continued constraints on the availability of private rental housing in many areas. In Ceredigion in Wales, Darlington, and Dumfries and Galloway, rates will increase by just 7%, equating to less than £30 more per month. Yet these areas have had rental growth of 20%, 16% and 12% respectively since the rates were last increased.

The increases come in the wake of recent Savills research, which examined the state of the private rented sector in London. This found that only 2.3% of London new rental listings on Rightmove were affordable in 2022-23 for those reliant on housing benefit, falling from 18.9% in 2020-21.

Savills also analysed the situation across England, finding that non-benefit-capped claimants could only afford the cheapest 3% of homes listed for rent in 2022-23, far below the intention for LHA to cover the cheapest 30% of homes.

Source: Savills Research using data from the Department for Work and Pensions and the Valuation Office Agency

Comments are closed.