House prices have increased by 7.6% over the past 12 months, the fastest rate of property inflation in over four years according to Halifax, but there are growing signs that prices will fall in January and February as the post-lockdown boom ends.

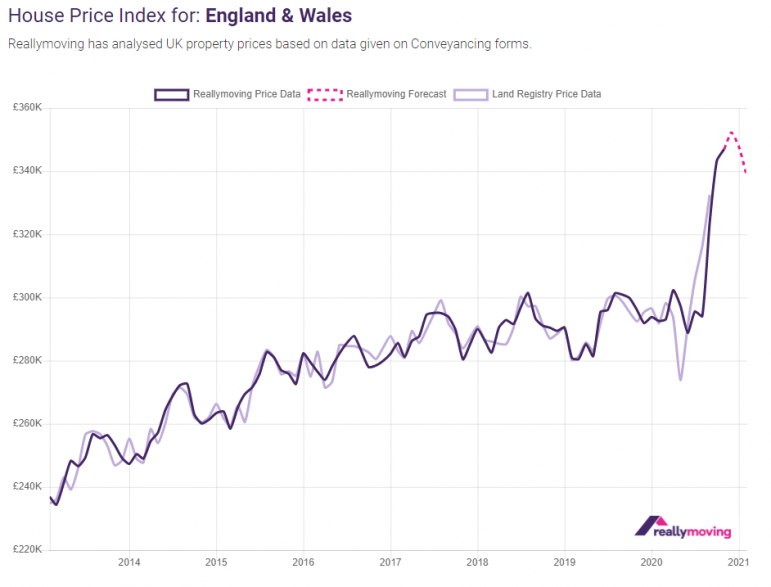

The New Year will herald a turning point for the housing market, with a Christmas peak in prices followed by negative growth of -1.2% in January and -2.5% in February 2021, according to the Reallymoving house price forecast.

Collected at the start of the homebuying process, when buyers agree a deal and seek conveyancing quotes, the data provides one of the earliest snapshots of the short-term property market outlook and confirms that the post-lockdown boom will come to an end at Christmas, with prices beginning to decline heading into the New Year.

Based on analysis of purchase price data from 30,000 conveyancing quotes on the price comparison site for home movers between September and November, Reallymoving predicts that the average property price in England and Wales will peak at £352,239 in December, before falling to £343,312 by February 2021.

Rob Houghton, CEO of reallymoving, said: “Our prediction of a New Year change in fortunes for the housing market has been further strengthened by the latest data which clearly shows price growth entering a downward trend in January and accelerating in February.

“The mask is beginning to slip on the two-tier housing market of recent months, which has seen activity from equity-rich homeowners who are less affected by the pandemic, concealing problems at the lower end of the market where First Time Buyers have benefited little from the stamp duty holiday and faced considerable challenges securing higher loan to value mortgages.

“The kind of growth we’ve seen over the last few months was never sustainable. Despite positive vaccine news, which will certainly boost confidence that the end of the pandemic is now in sight, there are significant challenges for the housing market to overcome in the short term, including the end of both the stamp duty holiday and the furlough scheme on 31st March, which is likely to result in further downward movement in prices over the first half of next year.”

The stamp duty holiday has increased demand, but also substantially increased supply. The New Year will see a seasonal decrease in supply as well as a decrease in demand. The economic laws of supply and demand dictate that one must outweigh the other in order for prices to move in either direction. I can’t see prices dropping dramatically next year because of exactly this reason. What we are likely to see which is more important for estate agents is a decrease in numbers of transactions. If Boris comes through on his conference suggestion that if he will get 95% mortgages back in the market, we may actually see prices increase as demand from unencumbered purchases and first-time buyers increases beyond supply.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Supply is a massive issue in our neck of the woods, the area will test historic low stock levels in the next two months.

As the industry sells more than is new to market and vendors remove homes from the market for the winter months.

In a market with suck low stock levels and as mentioned above the possibility of 95% mortgages coming back I see a flat market at worst.

Probably a rising market if I were a betting man.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register