It now takes 144 days to buy a property, compared with only 88 days in June 2021 and 93 days in June 2019, according to new research from TwentyEA.

It now takes 144 days to buy a property, compared with only 88 days in June 2021 and 93 days in June 2019, according to new research from TwentyEA.

Northern Ireland is the slowest place to buy property by far at over 7.5 months. The South West is the second slowest region at over 5.5 months. The highest priced properties (£1m+) are taking significantly longer to buy compared to pre-pandemic. It now takes 5.2 months to close a deal on one of these properties.

Since June 2019 it now takes a buyer 56% longer to buy a property than it did pre-pandemic.

Consequently, more time means a greater risk of sales agreed falling through.

However, the percentage of properties falling through has barely risen when compared with pre-pandemic. At a national level, in June 2019, 21% of properties with a sale agreed had at least one fallen through occurrence. If we advance to June 2022, this has moved to 21.1%.

In June 2022, 21.1% properties with a sale agreed fell through. Whereas in 2019, this was 21%. There is no relationship between the length of time to buy a property increasing and fallen through rates rising, as in both Northern Ireland and the South West, we see a fall in the fallen through rates.

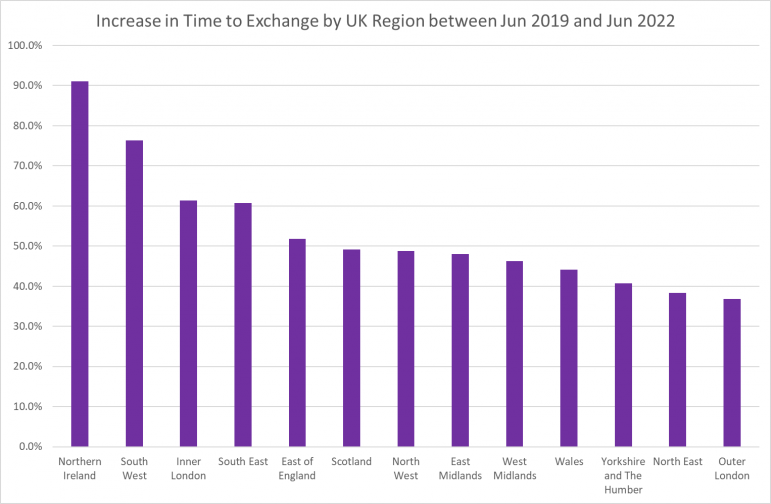

TwentyEA: The increase in the time to buy a property by UK region comparing now to pre-pandemic:

TwentyEA, which specialises in the UK home mover market, providing smart, specific and intelligent home mover data and insight to help agents better understand the challenges of the industry, also revealed that the time to buy a property varies by UK region and price band.

The data shows that times to buy have increased in all regions of the UK. Northern Ireland and the South West have been disproportionately affected. In Northern Ireland, the length of time to buy a property has shot up from 120 days to 229 – that’s over 7.5 months. In the South West, the length of time to buy a property has shot up from 96 days to 169 – which is over 5.5 months.

TwentyEA: The change in time to buy, cutting the data by price band:

Most affected is the higher priced properties of £1m+, where it now takes 5.2 months to buy a property.

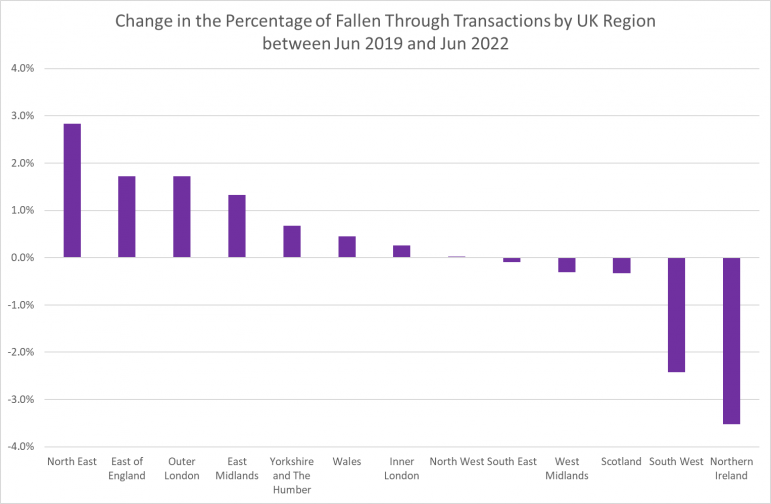

TwentyEA: The change in the percentage of fallen through transactions by UK region between June 2019 and June 2022:

This data shows that sales falling through are in fact rising in the North East, the East of England, Outer London and the East Midlands. However, the percentage of sales falling through has fallen dramatically in the South West and Northern Ireland.

Stuart Ducker, strategic solutions director of TwentyEA, commented: “What this suggests is that even though it takes the longest amount of time to buy property in these two UK regions, their fall through rates have actually fallen.

“In Northern Ireland for example, even though the amount of time it takes to buy a property now is 7.5 months, and this has risen from 3.9 months pre pandemic, the fallen through rate has fallen from 18.5% in 2019 to 15% today.

“In the South West, the amount of time it takes to buy a property now is 5.5 months, and this has risen from 3.1 months pre pandemic, the fallen through rate has fallen from 23.2% in 2019 to 20.7% today.”

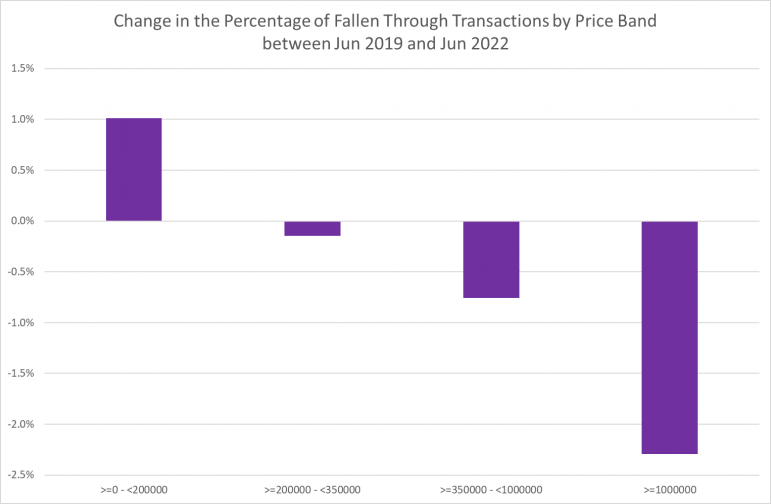

TwentyEA: The change in the percentage of fallen through transactions by price band between June 2019 and June 2022:

The above displays a radical difference in the changes of fallen through rates. With the cheapest properties worth less than £200,000, there is an increase in the rate of fallen through sales. Here the fallen through rate in 2019 was 20.2% and this has now risen to 21.2%.

However, with properties over £1m, the fallen through rate in 2019 was 21.1% and this has now fallen to 18.8%. And the £350,000 to £1m price bracket has also experienced a reduction in fallen throughs.

Ducker continued: “Where there are dramatic increases in the amount of time it takes to buy a property, fallen through rates have fallen. The opposite is also true in that, where we have not seen larger than average increases in the amount of time it takes to buy a property, fallen through rates have risen.

“There has been industry talk that suggests that the number of sales agreed on properties that subsequently fall through are rising, and that many properties are now being sold multiple times as a result. We believe that this is related to low supply which prevents chains from forming as fast as they used to. In other words, if I agree a sale on my property today, I must find somewhere else to live that I am happy with, and this means more ‘hunting’ than it used to due to comparatively low levels of stock.

“The only rational explanation, therefore, is price. Where people are buying medium to expensive properties, they are less likely to pull out of the transaction that they have commenced. Traditionally, people who buy <£200k properties are either landlords, first time buyers or second steppers where cash is tighter. Let’s rule out the landlords, because most of the ones I know are looking to divest rather than invest at the minute.

“So, people who are starting out tend to be on lower incomes than people who buy more expensive properties, and as such, they are disproportionately affected by the squeeze on household incomes and the economic consequences of inflation. And of course, there is also the availability of mortgages, as they tend to have higher loan to value ratios and represent more of a risk to lenders.

“However, the people that are buying properties that are >£200k are clearly not affected as much. But we all realise that a healthy property market can’t exist in the long-run, without strong demand from first time buyers. At the minute, the buyers are being replaced, the underlying demand is very strong (especially at the lower property prices as we have shown previously).”

Comments are closed.