It is now five years since George Osborne introduced a series of measures aimed, principally, at cooling what was at the time an overheated housing market, and create what the then Conservative chancellor described as a “level playing field” between homeowners and property investors.

It is now five years since George Osborne introduced a series of measures aimed, principally, at cooling what was at the time an overheated housing market, and create what the then Conservative chancellor described as a “level playing field” between homeowners and property investors.

The government’s plan has certainly worked. Buy-to-let is now a lot tougher than it once was.

From a landlord’s perspective, it has been a tough few years, with a raft of changes, including the introduction of the 3% stamp duty surcharge and the phasing out of mortgage interest relief, and landlords have bought fewer homes as a consequence.

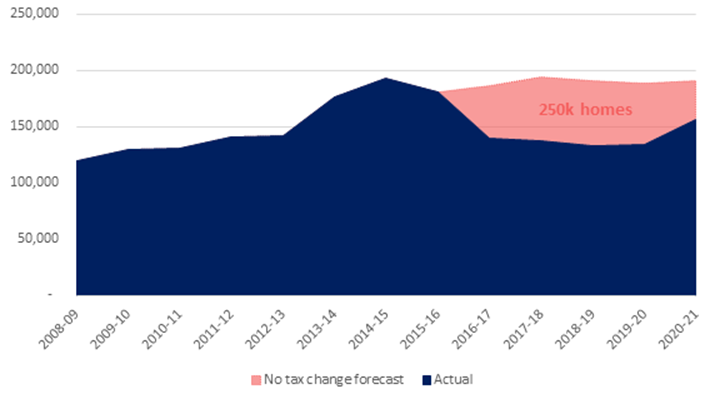

Between April 2016 and the end of March 2021 landlords purchased 700,100 homes across Great Britain. But research by Hamptons International suggests that without the tax changes, introduced in April 2016, landlords would have bought an extra 249,800 or 36% more homes.

Number of homes bought by landlords by region (1 April 2016 – 31 March 2021)

| Actual number of homes bought by landlords | Estimated number of homes without tax change | Difference | % Difference | |

| London | 61,300 | 103,300 | 42,000 | 69% |

| East of England | 53,300 | 89,400 | 36,100 | 68% |

| South East | 78,400 | 127,400 | 49,000 | 63% |

| Wales | 28,100 | 43,200 | 15,100 | 54% |

| South West | 65,500 | 89,600 | 24,100 | 37% |

| West Midlands | 79,900 | 104,900 | 25,000 | 31% |

| East Midlands | 66,000 | 84,900 | 18,900 | 29% |

| Scotland | 55,800 | 71,000 | 15,200 | 27% |

| Yorks & The Humber | 67,800 | 78,700 | 10,900 | 16% |

| North East | 52,700 | 60,800 | 8,100 | 15% |

| North West | 106,200 | 121,000 | 14,800 | 14% |

| Great Britain | 700,100 | 949,900 | 249,800 | 36% |

Source: Hamptons & HMRC

Fewer landlord purchases have meant there were 4.91m privately rented homes in Great Britain in 20/21 accounting for 17.5% of households – 381,990 fewer than the sectors peak in 16/17. Had these tax changes not been introduced Hamptons calculate there would have been 5.16m rented homes in Great Britain today making up 18.4% of households – still 132,270 fewer than the sector’s peak.

This has been driven by the proportion of homes bought by landlords falling since 2015. Back in 2015 landlords purchased 16% of homes in Great Britain, but by 2018 this figure fell to a low of 11%.

Over the last year the lure of a stamp duty holiday in England has seen landlord purchases pick up marginally, to 13% of sales.

Number of homes bought by landlords in Great Britain

| % of homes bought by landlords | No. homes bought by landlords | No. homes bought by landlords if no tax changes | |

| 2008-09 | 15% | 119,500 | 119,500 |

| 2009-10 | 15% | 130,000 | 130,000 |

| 2010-11 | 15% | 130,400 | 130,400 |

| 2011-12 | 15% | 140,200 | 140,200 |

| 2012-13 | 16% | 141,500 | 141,500 |

| 2013-14 | 16% | 175,800 | 175,800 |

| 2014-15 | 16% | 193,300 | 193,300 |

| 2015-16 | 14% | 181,200 | 181,200 |

| 2016-17 | 12% | 139,500 | 186,200 |

| 2017-18 | 12% | 137,400 | 193,800 |

| 2018-19 | 11% | 133,200 | 190,600 |

| 2019-20 | 12% | 133,900 | 188,200 |

| 2020-21 | 13% | 156,100 | 191,100 |

| Total since 2015 | – | 700,100 | 949,900 |

Source: Hamptons & HMRC

However, 72% of all rental homes in Great Britain today were bought before April 2016.

Existing rental homes bought before the 3% surcharge introduction (Apr-16)

| London | 81% |

| South East | 77% |

| Eastern | 74% |

| South West | 73% |

| Yorkshire & Humber | 70% |

| East Midlands | 68% |

| Wales | 68% |

| North East | 68% |

| West Midlands | 68% |

| North West | 65% |

| England & Wales | 72% |

Source: Hamptons & Land Registry

Southern regions, where properties are more expensive, have been hit hardest by the tax changes. In London, the share of homes bought by landlords fell from a high of 20% in 2015 to 11% during Q1 2021. As a result, landlords have purchased 61,300 homes in London since 2016. However, this number would have risen to 103,300 or 69% more homes had the tax changes not been introduced.

This drop-off in new investment means 81% of all rental homes in the capital today were bought before April 2016, compared to just 65% in the North West where landlord purchases have remained more resilient. Higher yields and lower entry costs mean just 14% or 14,800 more homes would have been bought by investors in the North West without the tax change.

Rental growth

Across Great Britain rents rose 5.9% annually in April, the fastest rate since January 2015. Growth remains driven by regions beyond the capital, with rents outside London up 10.4% on the same time in 2020.

Annual rental growth

| Apr-20 | Apr-21 | YoY | |

| Greater London | £1,690 | £1,646 | -2.6% |

| Inner London | £2,643 | £2,103 | -20.4% |

| Outer London | £1,509 | £1,560 | 3.4% |

| East of England | £968 | £1,024 | 5.8% |

| South East | £1,039 | £1,146 | 10.3% |

| South West | £824 | £917 | 11.3% |

| Midlands | £704 | £740 | 5.0% |

| North | £647 | £695 | 7.5% |

| Wales | £678 | £696 | 2.7% |

| Scotland | £664 | £712 | 7.2% |

| Great Britain | £981 | £1,039 | 5.9% |

| Great Britain (Excluding London) | £827 | £913 | 10.4% |

Source: Hamptons

This is the first time since the index began in 2012 that average growth rates outside of London have hit double digits, partly driven by the drop in rents in April 2020 (-2.2%). Over the last 24 months, rents rose 8.0% outside London.

The South West saw faster rental growth than anywhere else in the country, with prices up 11.3% on the same time last year. Rental growth in the South East also surpassed 10% last month.

Rental growth remains linked to an unprecedented fall in the number of rental homes on the market. There were 45% fewer homes available to let in April 2021 than in April 2019, with half of regions recording falls of 50% or more.

As with rental growth, the South West topped the stock shortage league with 62% fewer homes to rent than at the same time in 2019. London recorded the smallest fall of 20%. Rental stock in cities was down 24% over the same period, while in country locations it fell by 65%.

Aneisha Beveridge, head of research at Hamptons, commented: “The tax changes introduced from 2016 onwards have undoubtedly taken the heat out of the buy-to-let market. Landlord purchases have dropped and consequently the rental sector is 7% smaller than it was at its peak in 2017.

“Even without the tax changes, we still think the rental sector would be slightly smaller today than it was in 2017. Growth in the sector was slowing in the lead up to 2015 and the lure of government support measures such as Help to Buy and the removal of stamp duty have seen more first-time buyers (would-be tenants) become homeowners.

“But the longer-term impact of fewer rental homes is driving rental growth now, with rents rising six times faster than inflation. Tenants face half the choice they had two years ago and each new instruction has brought a deluge of enquiries within hours of homes going onto the market. While the current stamp duty holiday has boosted investor purchases a little, we are yet to see these flow into new instructions and improve choice for tenants.”

There has been a degree of false optimism by some landlords since these draconian changes came into effect, which has hidden the true impact on the rental market. But when you see the facts in black and white; 24% less stock in cities and 65% in the country, it’s obvious that renters face 50% less choice than just 2 years ago, and most of that has been during lockdown when no tenants have been evicted and churn has been minimal. These figures, plus the disaster of zero evictions and mountainous rent arrears, confirm the PRS is in a critical position, and the Government must now act to reverse the trend. My concern is they will use this to further delay evictions.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Inability to get rid of rent defaulting tenants within 45 days with no CC action required will do for the PRS especially the mortgaged LL.

BTL is over.

When tenants are paying rent then it is a worthwhile enterprise.

As soon as tenants stop paying rent it becomes a nightmare; easily bankrupting a LL.

Is that a viable business model!?

I think NOT!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Most landlords are making money apart from the low level lodger-landlords, ie the bottom feeders, as well as landlords who are so heavily geared that they can hardly sleep at night. Whose fault is that?

I am ecstatic with the gains I have made as a landlord in the last 12 months. A gnat’s whisker short of 10% gain across my portfolio and no arrears.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Define heavily geared for a start. I have 75% but I consider anything more than 50% is very risky due to the inability of being able to get rid of feckless rent defaulting tenants quickly. I’d agree with you that when tenants are paying rent even LL geared above 50% are making good money. The problems begin for any leveraged LL when rent defaulting occurs. You just can’t get rid of these feckless waster tenants. This is the major vulnerability of the leveraged LL. Rent defaulting tenants cause LL £9 billion a year of losses. Most of this is caused by rent defaulting though every year about 30 BTL properties are repossessed per year due to rent defaulting tenants and the inability to remove the rent defaulting tenants quickly. You have been very fortunate not to have been a victim of any of these feckless rent defaulting tenants. But £9 billion a year is a significant amount for LL to lose every year. I would suggest that such losses undermine the BTL business model. I do believe that BTL should be ended leaving just the cash rich to be LL. Such LL are by definition financially resilient to feckless rent defaulting tenants. Many leveraged LL could convert to become cash rich LL by getting rid of properties to become mortgage free. That will mean a 50% reduction almost in the PRS and gratifyingly would result in millions of homeless tenants. It would also result in most LL getting rid of ALL DSS tenants to be replaced by higher paying tenants when 50% of the PRS disappears. For many LL reducing to a few mortgage free properties makes eminent business sense with no future vulnerability from feckless rent defaulting tenants. Yes it means for the cash rich LL that they are still victim of the completely dysfunctional repossession process but at least they don’t face repossession by a lender. Converting to become a cash rich LL from a BTL one is a business imperative as Govt intends to eradicate leveraged LL. They can’t do much to cash rich LL. If they allow the dysfunctional repossession process to continue then all Govt will be doing is preventing tax being paid on rental income. It won’t force Cash rich LL to sell up unlike with leveraged LL. There are many leveraged LL that could take the wise financial decision to become cash rich ones. Even if it means reduction to one mortgage free property. Govt wants rid of all small LL. It can more easily get rid of leveraged LL first. But it will come for cash rich LL. This will be mostly achieved through penal CGT that makes it pointless remaining a LL. .2nd property asset value is where Govt will go to rob that hard fought for asset value because they can and it is easy to achieve. Essentially 2nd property asset value is where the money is. Govt wants this money and it knows that electorally robbing 2nd property owners of asset values will cause few lost votes. There will be a Mansion Tax along soon as well. Somebody has to pay for all the Govt losses caused by CV19. 2nd property owners are easy victims to rob. Paying S24 taxes on leveraged property makes no business sense. Reducing the PRS to mortgage free LL would be great for those LL but an absolute nightmare for Govt; tenants and councils who will be faced with millions of homeless tenants. But that would not be the fault of private LL!! Converting to cash rich status seems to me the most effective way to be financially resilient to Govt attempts to eradicate LL. It will be very interesting to see in the face of even more repossession difficulties how many LL will choose to remain leveraged. The very real risks of property repossession caused by rent defaulting tenants imposes a business imperative on leveraged LL to perhaps NOT be leveraged. The business dynamics of BTL are no longer what they were primarily because of the repossession difficulties. That is why I’m getting out of the game. Not enough cash to be cash rich. So it means leaving the sector. Good luck to all those LL remaining cos you are certainly going to need it.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register