How do you actually value a property?

How do you actually value a property?

I ask that question because I genuinely don’t know the answer, though you may think I should having been involved in in the sale of property for over 40 years!

The reason I ask, is that I hear constant laments from estate agents and industry commentators that “other agents over value properties” to get the instructions and this may even be true. The idea as I understand it, is that an agent knowingly over values a house and then ties seller in for 12, 16, 20 or even 24 weeks to a sole agency.

The allegation is that the agent then spends the next few months reporting that there is minimal interest, a low volume of viewings compared to other homes and that the asking price needs to be reduced in order to increase viewings. Whether or not this cynical approach (knowingly over valuing a property as opposed to making a genuine mistake) is actually rife is clearly open to debate.

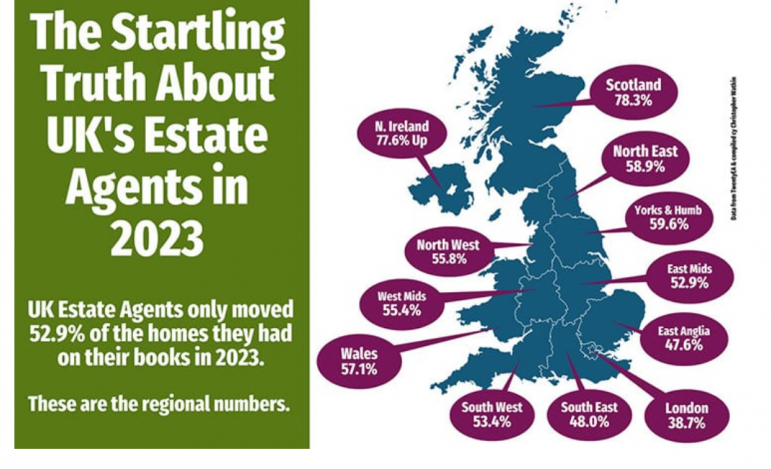

However, it appears to be a problem if one looks at the statistics provided by Chris Watkin (who regularly shares a whole range of housing market statistics in this publication) which he collects from the excellent TwentyEA.

I concede that these statistics relate to 2023 and that things may have improved since then but let’s assume that they are about the same in 2024. If they are accurate, it looks as though agents only actually complete on about 53% of all the properties they list on average. A sobering statistic if ever there was one!

Some regions, London for example, apparently complete on less than 40% of the instructions that come to market.

Is this the fault of the agent or the seller and what can we do, if anything, to improve the situation?

Well before you ask, my own track record is NOT a good one. Having been properly open as an agent for a little over 6 weeks I have listed 4 properties and sold just one so far. Not a sparking start but there we are and perhaps I have been guilty of over valuing (definitely not consciously) in order to secure instructions for a new business… we will see.

I would contend that the well known adage that the 3 most important factors for selling a property is actually not true anymore and possibly never was.

I would contend that the well known adage that the 3 most important factors for selling a property is actually not true anymore and possibly never was.

Perhaps LOCATION, LOCATION, LOCATION should be replaced with…

PRICE, PRICE, PRICE.

In simple terms, even a property in the worst location will sell at the right price and I would further suggest that the most fantastically located home will not sell if the asking price is massively above what the evidence shows.

And there’s the thing. What does the evidence show?

Well, this is my approach to “valuing” a home…

Frankly (and you may disagree with this) I genuinely believe that no agent can actually value a property and that’s the very first thing I say to a seller after I have looked around and just before I present my services and discuss the various charges and fees. I find that most sellers at least verbally agree with this premise, though they may change their mind if they are not presented with a figure that meets with their own expectations!

I emphasise to them that a house is worth what a buyer is prepared to pay (subject of course to a valuation from any lender), that it will be in competition with other homes and that they (the vendor) can choose the asking price after reviewing the evidence that I present to them. As I say, I always attempt to seek agreement from the vendor that neither they or I can value the property – only buyers can. It does not matter what they actually want, how much they paid for the property or even how much they may have spent on improvements, it ONLY matters what a buyer is prepared to finally offer, further f course to any negotiations via the agent. That offer may or may not be acceptable to enable the seller to achieve whatever their objective is but it IS the actual market value.

That evidence I present is taken from a variety of sources – comparable properties that are either sold or available, various AI generated “Instant Valuations” (I find that the Nationwide House Price Index to be generally reliable) and known square footage figures which I find to be particularly useful for standard house designs.

I them ask the potential client to comment on that evidence, advise on an initial asking price and invite them to instruct me as to the precise asking price with an agreement that we will review the situation after 4 to 6 weeks. I do of course educate them with examples of properties that have been reduced in price and ended up selling at considerably below what the evidence had originally demonstrated.

I have refused instructions for two properties where I thought that the vendors opinion on price was WAY above what the evidence showed. They have gone to market with competitor agents and remain unsold.

As I say, I have not intentionally over valued in order to get instructions and the market will ultimately decide what the actual value is. I have taken my vendor instructions after sharing with them all of the pertinent facts.

So in conclusion, who actually IS responsible for the apparent fact that only about half of all properties that come to market actually end up selling? Is it the agent, the seller or a combination of the two?

I would love to hear your thoughts as well as your approach to valuing, particularly if you think that as an agent you can actually value a home!

Simon Bradbury is a consultant specialising in securing new instructions and runs a (very) small estate agency powered by eXp

Those estate agents who have kindly spoken to me during my research present the “evidence” and advise, but ultimately it is the seller…….their client who states what value the property will be listed at.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I have said to clients before when valuing for rental, that I tell them what I believe we can achieve, but that at the end of the day they know what they need to achieve per month. If they say they want to rent it for £2.50 and a tin of cat food a week, then we can certainly look at it. If they say they want £2,500 a week, then I would have to decide if I feel that is a realistic price. I am open to trying a landlord’s price, as long as I feel it is in the bounds of what the market will rent.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Sorry Simon but your quote “I genuinely believe that no agent can actually value a property”

Valuation: an estimation/rough calculation of the worth of something.

I’m sure you can do this Simon.

Of course the higher the price the wider, the band but you would know the approximate valuation.

Sellers want advice from an expert. You are their expert.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Has been happening since the dawn of time and always will

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

And in other breaking news….

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

When I was renovating to sell the agents tried to read our reactions, no conversation just went “I’d value it at £X”

The agents spoke about similar sales for £Y and watched our expression. They then talked about possible values and kept a close eye on us. My sister in law who insisted on being present was unable to keep a poker face, and frowned at the market valuations and smiled proudly at the unrealistic high estimates, so guess what – they called it at the high end. Sister in law was already working out the profit on half the value in her mind before it was even marketed.

The irony was when sister in law wanted to keep one and buy out my share of the property she changed her mind and wanted the lowest valuation used. Suddenly it wasn’t worth quite as much, what a shock. It went for market rate – like most others, and I know you could argue the final sale price is always the market rate, but bidding wars do happen, and occasionally someone grabs a bargain.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Valuation or Market Appraisal?

A market appraisal and a valuation both indicate a property’s possible value, but they are not the same and are carried out for different purposes:

A market appraisal is a general estimate of a property’s market value, which is what most estate agents provide when invited round to put a property onto the market. Agents use their local market knowledge and experience to look at recent local sales, current conditions, and the appeal of the property. The result should be a realistic idea of what the property is worth, but it’s not as specific as a valuation.

A valuation is usually performed by a chartered surveyor or FNAEA or RIBA or similar qualified practitioner. The purpose of a valuation is to provide a reliable estimate of value that can be used for legal and financial decisions, such as lending, inheritance or capital gains tax, or divorce or probate. The valuer will consider the property’s condition, recent sale prices of similar properties, and current market conditions. The result is a detailed report that includes comparable evidence and other reasons for the figure stated.

You can be sued on a valuation but it is almost impossible to get sued on a market appraisal, so using the phrase “market appraisal” often makes more sense. Boring, but there is a difference between the two!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

A chartered surveyor asks agents for help. A surveyor is not at the coal face gauging local demand. High demand in one week can push up the value. The next week seven props come on the market and push the value down. Some sell off market.

A good agent will have a better idea on likely offers than a surveyor.

Of course if a paid for detailed report is needed to conform to legal processes an agent would be able to take this on.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Surveyors are usually clueless

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I was taught that Valuation is an Art, not a Science and advise potential vendors that they have to put themselves in the shoes of a prospective buyer. I then give appropriate comparable evidence of recent sales and similar properties that are currently on the market, and how long they have been on the market, then ask why a buyer would choose theirs over the competitors. This helps to give them a realistic perspective on the current market conditions.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

It’s not only surveyors who carry out formal valuations. Lots of qualified estate agents do them as well and are in a much better position to value than chartered surveyors who I’m sure we all agree are not the best judges of value and often phone up us estate agents for advice!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Zero week contract will help sort this issue. Abolish the long contract times!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

We have not had a tie in period for over 30 years.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

And I’m guessing you rarely over cook marketing prices?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Everyone can get it wrong occasionally, particularly for unique “Marmite” properties, as beauty is in the eye of the beholder and you have no comparable market evidence. We market a lot of properties with the prefix “offers over”, so any properties that are sold slightly below asking price are offset by the ones that go over. Since Covid our combined sale price has run at almost 100% of our combined initial asking prices. Last year a vendors thought that I was too ambitious with their country property when I advised them to market at “offers over £480,000” and reduced the asking price by £20,000, but we achieved £530,000 (15% extra). I had valued a similar property within 3 miles at £480,000, but lost instructions to two agents who marketed at £600,000 – but sold it for £435,000.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

If corporate agencies rewarded on actual sales achieved and not instructions, the practice of over valuing would diminish. If a valuer has no skin in the game for marketing costs or if the property doesn’t actually sells, there is no accountability to not over value. They get rewarded for what they are targeted on ( the branch gets to shout about market share with their pie chart) but the business and the seller pay the price.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register