The rental market continues to perform strongly, with rents across most of the UK remaining high as strong demand from prospective tenants puts upward pressure on values.

The rental market continues to perform strongly, with rents across most of the UK remaining high as strong demand from prospective tenants puts upward pressure on values.

The demand for property has increased in recent months, though the number of homes coming onto the market remains low.

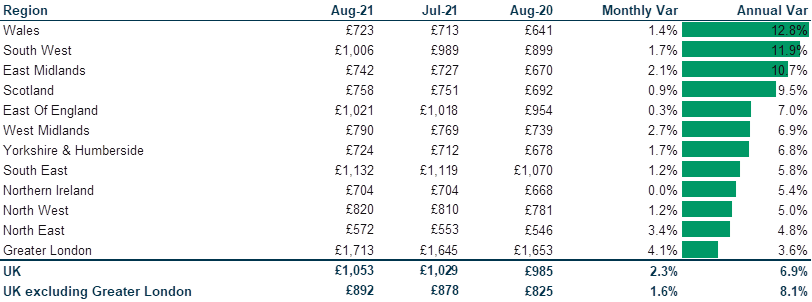

The supply-demand imbalance has seen the average rent in the UK hit another record high of £1,061 per calendar month (pcm), up 7.5% on the corresponding period last year, and up 0.8% from the previous month’s figures.

The market in London continues to recover, with prices up 6.4%, taking the average price to £1,752pcm; the monthly jump of 2.3% is the biggest in the country.

Excluding London, the average UK rent price is up to £891pcm – an increase of 7.6% y-o-y.

The South West of England has seen a significant monthly drop in rent price, with the average rent now at £971pcm, down 3.5% compared to last month.

Elsewhere, every single region has seen a y-o-y price rise, with Wales and Scotland seeing the most significant annual increases, up 12.9% and 10.8% respectfully.

Matthew Carter, heat of marketing at HomeLet and Let Alliance, said: “UK rents are up by 9.7% on pre-pandemic levels [2019], but most of the increases have happened this year. At first, we saw rents outside London surge whilst prices in the capital dipped, but we’re now seeing rents in London rise much more rapidly, fuelling the record rental levels we see across the country.

“Typically, rental prices rise in line with inflation and wage growth; that’s something we’ve continued to see. Despite record rents, tenants moving home spend a similar percentage of their income on their monthly rent. In September, the average household spent 29.6% of their gross income on rent, compared with 30.9% in September 2019, before the pandemic.

“Housing follows the same fundamental laws of economics as other goods that consumers need. Ultimately demand, coupled with lower stock levels for certain types of property, are driving up rental values. The concern is that we’re at a point where there are some areas with exceptionally high demand.

“Landlords and the lettings market have faced a continued raft of changes and legislation; the Government needs to carefully consider how any future policy might impact the 4.5 million households in the private rented sector. The Governments push on homeownership shouldn’t be done to the detriment of an industry that plays a critical role in UK housing.”

Well well, are we surprised? Keep on increasing regulation costs and tax hikes then what do you expect?

Real what you sow.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register