The UK property market for the week ending Sunday, 17th March 2024 (Week 11), continues its onward journey with regard to decent levels of transactions and house prices achieved.

The UK property market for the week ending Sunday, 17th March 2024 (Week 11), continues its onward journey with regard to decent levels of transactions and house prices achieved.

In this week’s UK Property Market Stats Show with Rob Smith, the headlines are as follows:

+ House Prices on the 68k Sale Agreed homes in March stood at £341/sq.ft (Feb ’24 £339/sq.ft & Jan ’24 to £331/sq.ft)

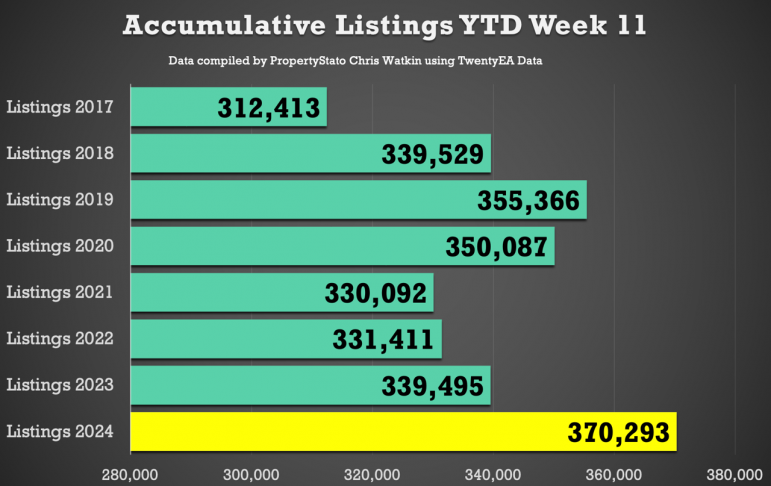

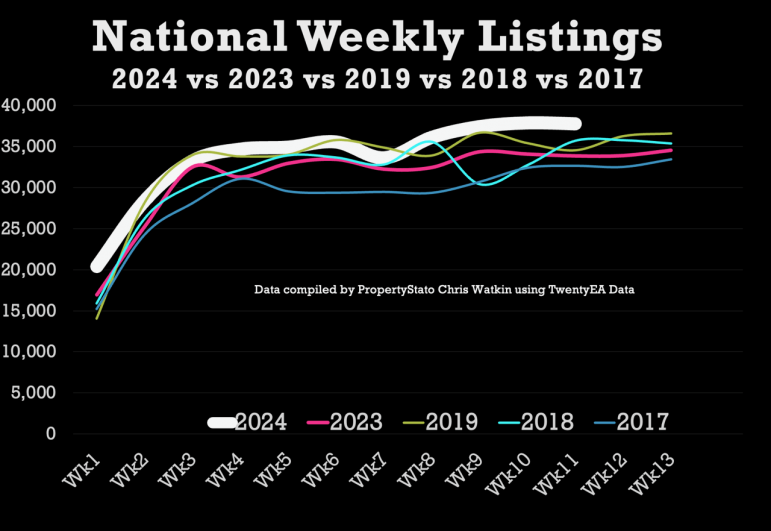

+ Listings for last week (Week 11), like last week, are 8% higher than Wk 11 average (2017 to 2024).

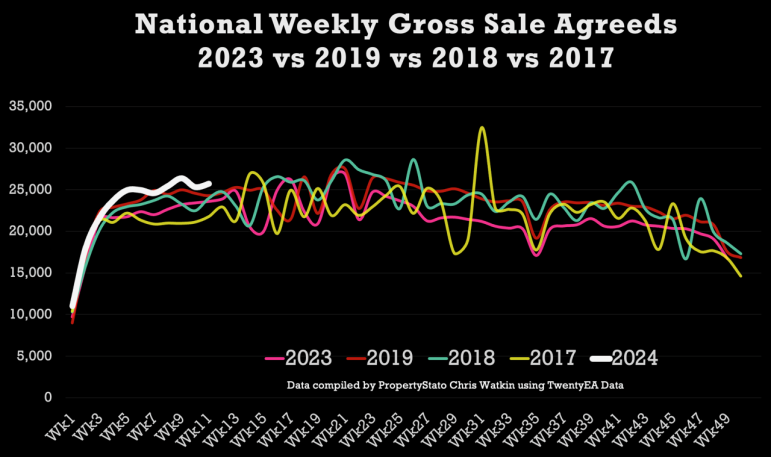

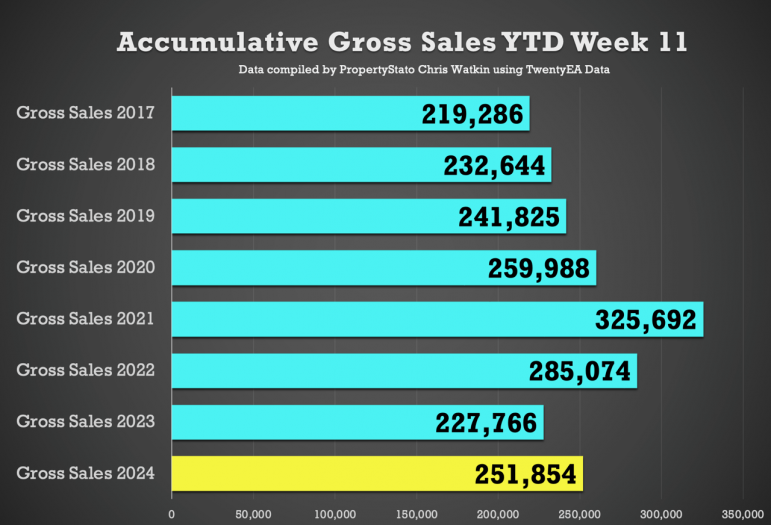

+ Total Gross Sales YTD are 10.6% than 2023 YTD levels & 8.9% higher than 2017/18/19 levels

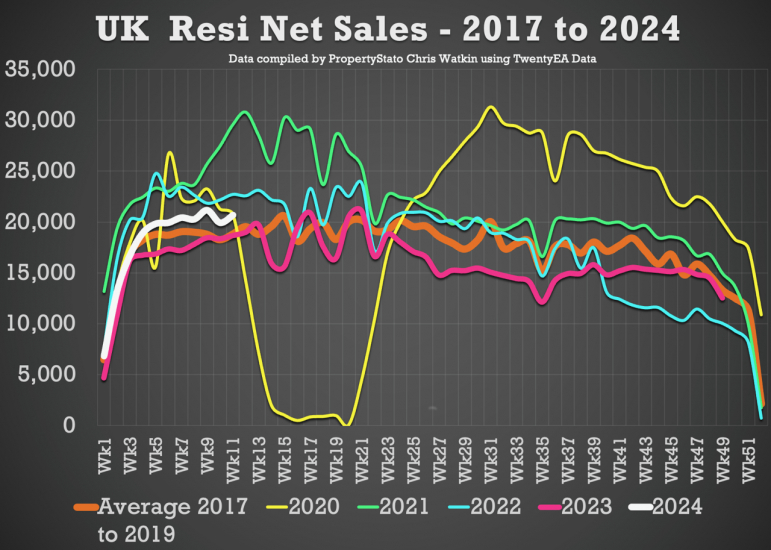

+ Net Sales last week 10.6% higher than Week 11 2023

+ Sale fall-throughs drop slightly to just under 1 in 5 sales.

+ Chris’s In-Depth Analysis (Week 11) :

New Properties to Market: The UK saw 37,791 new listings. This year’s YTD listings stand at 370,293, 9.1% higher than the historical 8 year YTD average of 341,086 and 9.1% higher YTD 2023.

Average Listing Price: £441,290.

Average Asking Price of this week’s Listings vs Average Asking Price of the Properties that Sale Agreed this week: Dropped slightly to 21%. The long-term average is between 16% and 17%.

Price Reductions: Last week, 20,320 properties saw price reductions, a significant number compared to the 8-year Week 10 average of 14,435. This means 1 in 7.3 properties each month are being reduced (Long term average 1 in 9.5 per month)

Average Asking Price for Reduced Properties: £397,405.

Gross Sales: 25,718 properties were sold stc last week (a 1.6% increase from last week’s Gross Sales figures). Yet, its was 23,601 for the same week 11 in 2023. Average for 17/18/19 was 23,341 for Week 11 – therefore, all things continue to look well.

Accumulative Gross Sales YTD: The total stands at 251,854, exceeding the average of 231,252 from 17/18/19 and 227,766 in the same week 11 in 2023.

Average Asking Price of Sold STC Properties: Still staying in the £350k/£360k range at £363,682.

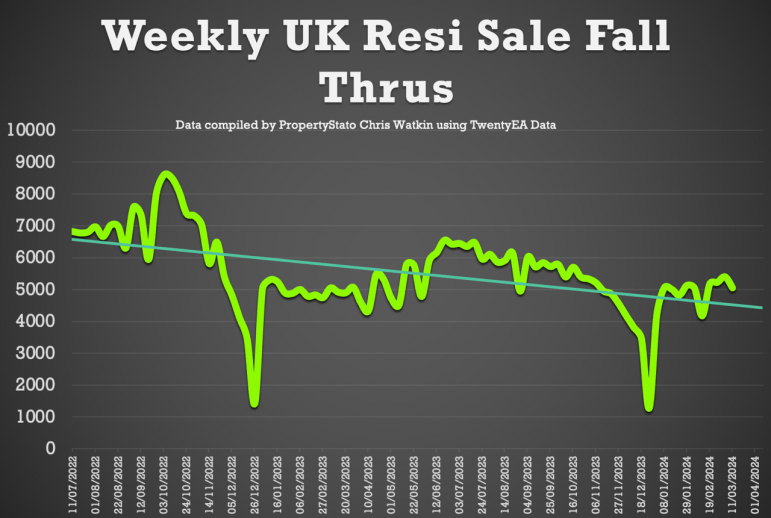

Sale Fall Throughs: Reduced to medium medium trend levels this week at 5,049, still below than the 2023 whioe of year average of 5,382 weekly fall-throughs and 7,590 weekly sale fall thrus in two months after there Truss’onomics Budget in Q4 2022.

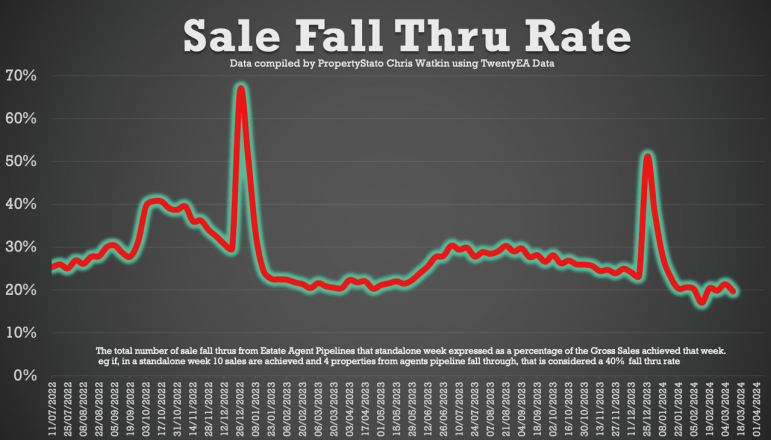

Sale Fall Through Rate: Dropped slightly from last week, continuing its medium term downward trend at 19.63% for the week (8 years average is 24.8%)

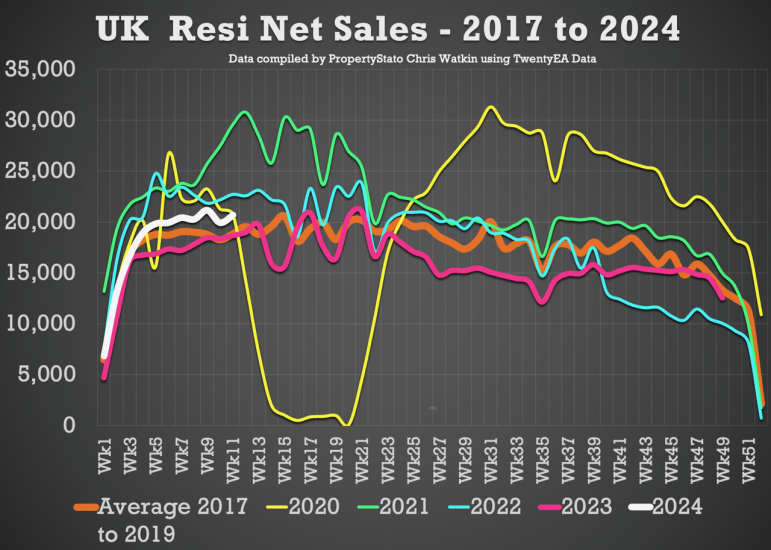

Net Sales up 3.8% from last week’s figures at 20,669 for the week, above the 17/18/19 average of 18,819 for Week 11.

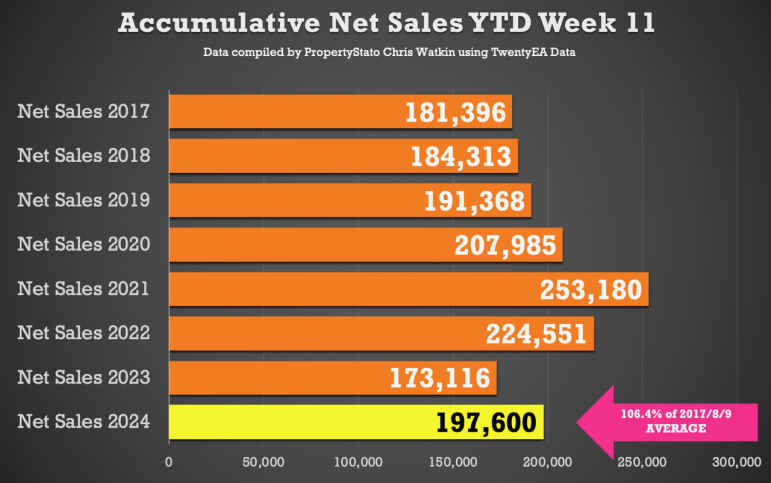

Accumulative Net Sales YTD: The total stands at 197,600, 6.4% higher the 17/18/19 YTD Net sales average and 14.1% higher than the YTD figure for 2023 for Net Sales (2023 : 173,116).

Regional Gross Sales Year To date. 1st January 2024 to 16th March 2024 vs same time frame in 2023.

London – Up 24.6%

South East – up 22.4%

East Anglia – Up 21.3%

Yorkshire – Up 19.6%

East Midlands – Up 18.9%

North West – Up 18.9%

West Midlands – Up 18.5%

South West – Up 18.2%

North East – Up 16.7%

Wales – Up 16.1%

Northern Ireland – Up 14%

Scotland – Up 13.2%

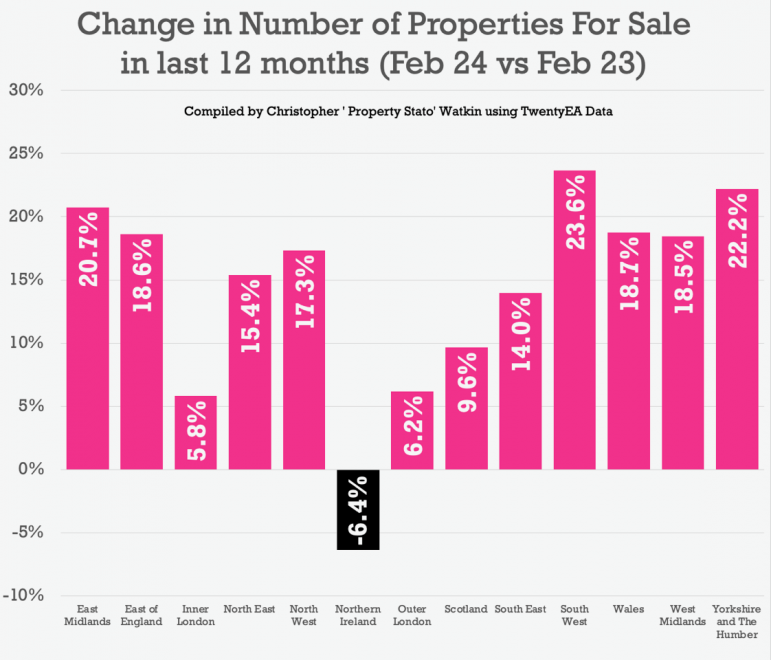

Regional Resi Stock on The Market – Feb 24 vs Feb 23.

Inner London – Up 5.8%

Outer London – Up 6.4%

South East – Up 14%

South West – Up 23.6%

East Anglia – Up 18.6%

Yorkshire – Up 22.2%

East Midlands – Up 20.7%

North West – Up 17.3%

West Midlands – Up 18.5%

North East – Up 15.4%

Wales – Up 18.7%

Northern Ireland – Down 6.4%

Scotland – Up 9.6%

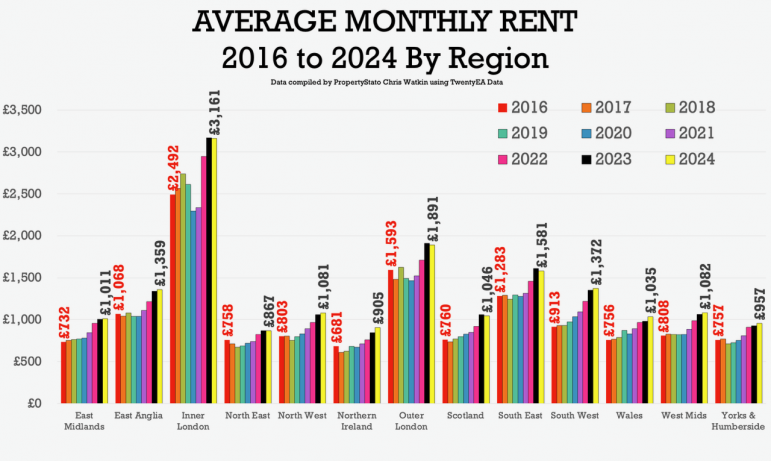

Average Monthly Rent By Region – 2016 vs 2024.

Inner London – £2,462 vs £3,161

Outer London – £1,593 vs £1,891

South East – £1,283 vs £1,581

South West – £913 vs £1,372

East Anglia – £1,068 vs £1,359

Yorkshire & Humbs – £757 vs £957

East Midlands – £732 vs £1,011

North West – £803 vs £1,081

West Midlands – £808 vs £1,082

North East – £758 vs £867

Wales – £756 vs £1,035

Northern Ireland – £681 vs £905

Scotland – £760 vs £1,046

Local Focus

This week’s local focus is on Milton Keynes

But Charlie Lambdin said prices would drop by 35% and a massive crash.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register