From August, estate agency employers like every other will be required to support the cost of furlough in respect of funding employer national insurance and pension contributions.

From September an additional 10% will be sought as government insists employers pay the 10% difference between the current 80% furlough threshold and a revised 70% government contribution – and then 60% from October.

In July, employers can bring back their furloughed staff on a part time basis and pay them only for the hours that they work and with the government paying the balance up to the maximum threshold of £2500 (80%).

This all sounds quite reasonable, but for large estate agency employers sideswiped by Covid-19 and also hot on the heels of three years of Brexit bleakness, is this escalating expense affordable, let alone the subsequent stomaching the cost of actually removing furlough altogether?

Rayner Personnel has looked at the likely cost to the industry as each stage is proposed to be introduced.

The Data

According to the ONS there are approximately 51,000 estate agents working in the UK (2019).

Additionally there will also be thousands of support and head office staff however these numbers are not summarised statistically.

Typically an estate agent in the UK earns £28,800 annually according to the average from ONS, Glassdoor and a handful of other resources.

On this basis the total salary burden for UK estate agency PLC could be up to £122.4 million each month.

This is the tide that Rishi Sunak is currently holding back with his magic calculator.

And this is just agents and does not include support staff nor management.

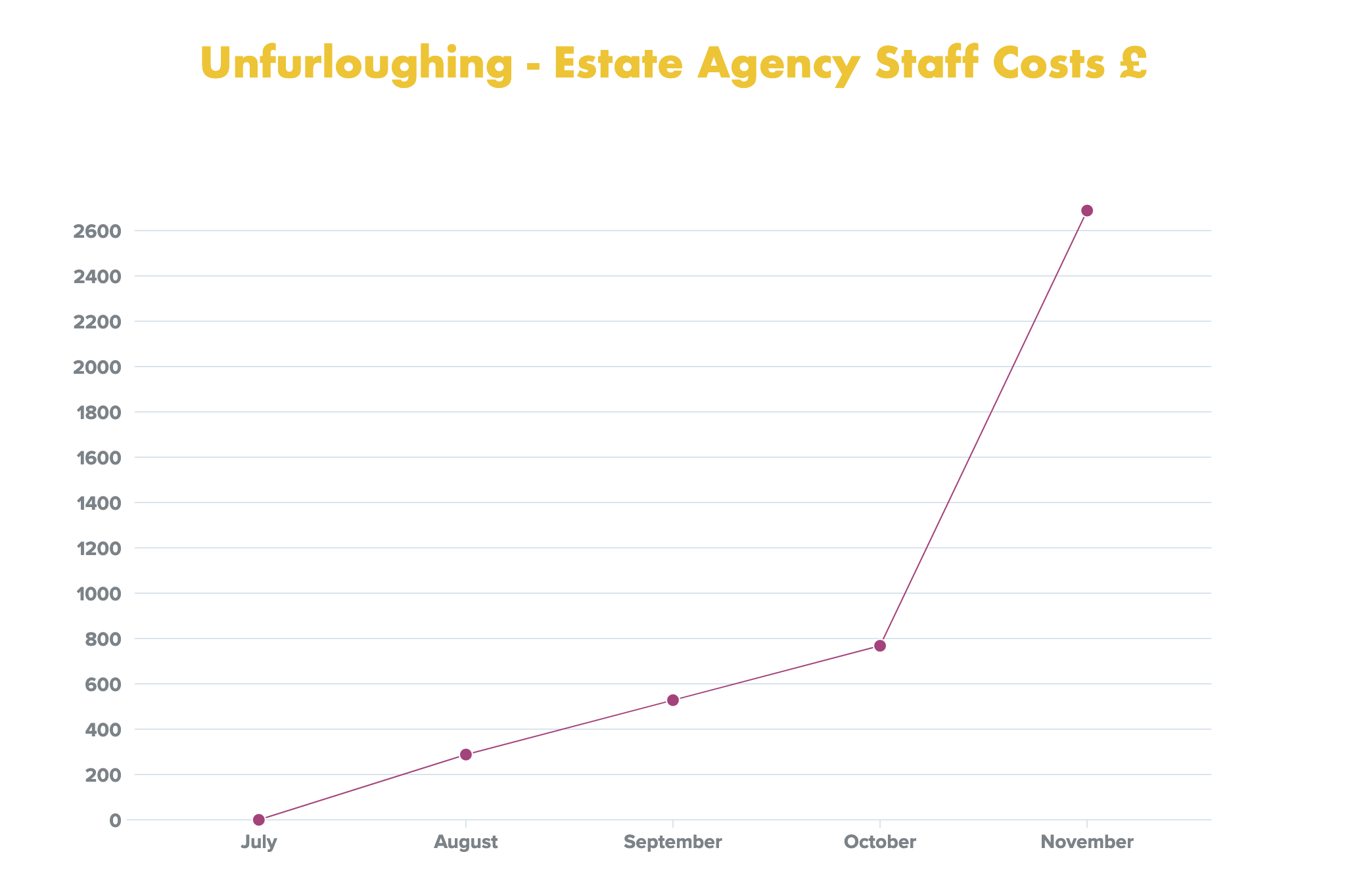

The increasing cost to agencies will manifest itself in stages and in analysing these stages Rayner Personnel states a warning that a squeeze will ultimately kick-in whereby it could well become a big problem for some firms in a few months’ time.

June/July – No change to employer costs unless the employer recalls staff on a part time or full time basis

August – NI and pension costs kick in. 9% and 3% respectively – average additional cost per employee £216 and £72. Total £288.

September – as above plus additional 10% of wages. Total additional cost per employee £240.

October – as above plus another 10% of wages. Total further additional cost £240 per employee.

November – full salary. £2400 plus NI and PAYE. Total £2688 per employee.

“I’d say June and July are looking palatable for agents as they keep many of their staff on furlough, consume their government support funding and bank their completion cheques from their pre-Covid sales pipeline’ says Rayner Personnel CEO Josh Rayner.

“But there’s a warning here in that our research highlights a problem coming down the tracks as the government support starts to dilute because it’s as this happens that cashflow will potentially be most vulnerable – a combination of landlords insisting on backdated rent payments, Rightmove and Zoopla support waning and an absence of deal completions from a barren lockdown period – all make for a collision of circumstances that some agencies may not easily cope with come November”.

That problem is highlighted in the graph below and shows what some may describe as a slippery slope for the UK estate agency industry as we recover from the health crisis.

The question is, what will estate agency firms do from November when faced with the full on ‘cold-turkey’ of maximum employment costs again?

Even the 10% – 20% contribution is not sustainable for many agencies at the moment.

Unfortunately redundancies will probably start sooner than expected for most estate agents.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

It would be best if it’s not a cliff edge in October though

It’s tempting to keep people on furlough whilst it’s government funded, but might be better to let people know sooner rather than later that there probably isn’t going to be a job to come back to.

Theoretically furloughed employees can seek employment elsewhere whilst remaining furloughed – they were certainly being encouraged to go for fruit picking opportunities etc, although how that works if they find full time employment is unclear.

October time there will more people than jobs – might be better to drop on it early

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

We all know that this is nobody fault; but it would be nice to think that the employer at least tries to get the employee through to October.

Soften the blow if you will.

I understand fully that those running hand to mouth may not have this option.

So we gave.

9m on Furlough

4.2 Universal Credit Claims

2.1m Self Employed Claims

2.0m Jobseekers Allowance

5.0m Public Sector workers

All paid for by the state from a total employment pool of appx 32.0m

Frightening how many are left working, not many !

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Rather surprised at the comparative lack of comment here. To balance the undoubted benefit the government has provided our industry with in the last few months, the phased withdrawal of furlough looks as if it will coincide with the third instalment of Brexit worries as we approach crash-out at the end of the year.

With Brexit deadlines in March and October last year, post-election many of us imagined a better year, this year, before those same fears re-emerge towards the autumn. Indeed we saw signs of a property bubble beginning to inflate in January, just as we saw a similar resurgence in April – June last year.

Unlike Covid-19 (whatever the research into its source might yield) we know that Brexit is a truly man-made challenge that shall affect our business and the sentiment of buyers later this year, whether one supports or opposes it. Coinciding with the withdrawal of this support increases the urgency with which we should ask an enlightened Government to provide a Stamp Duty holiday, along with additional first-time buyer support to get and to keep the market moving.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register