The combination of a post-lockdown surge in demand for homes in mid-May and the stamp duty holiday introduced just over a month later helped boost property transactions last year, with the volume of sales agreed in 2020 surpassing the level reached in 2019, fresh figures show.

According to TwentyEA, a member of the TwentyCi group, the cumulative volume of sales agreed in 2020 year to date is larger than it was at this point in 2019.

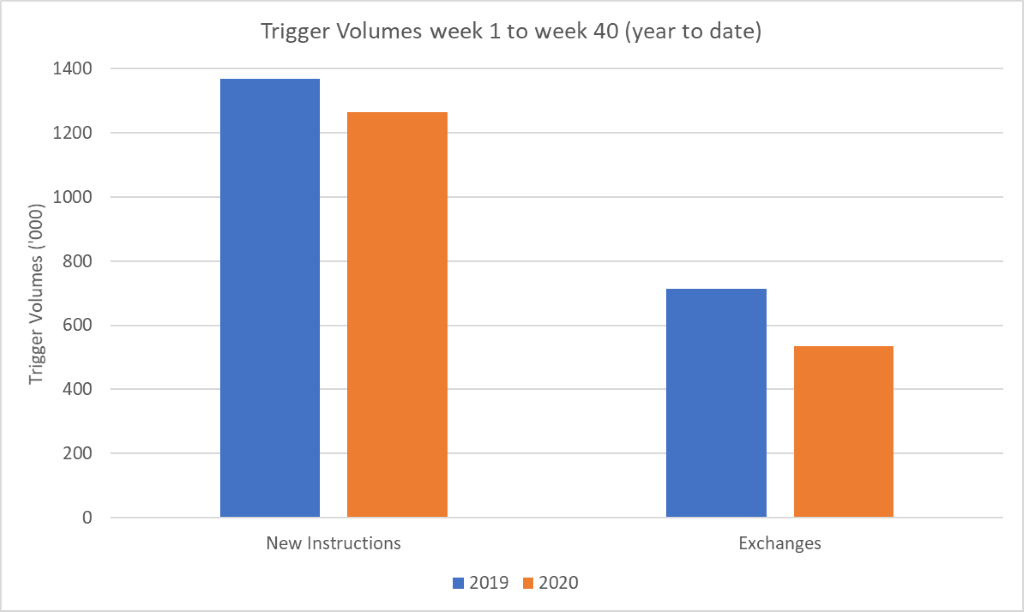

The data from TwentyEA, which supplies business intelligence and prospecting data to estate agents, also shows that the volumes of new instructions in 2020 year to date is 92% of the 2019 like for like number, although the number of exchanges in 2020 are currently lagging behind 2019 by 25% like for like, although ‘big future rises’ are anticipated.

The above chart represents several insights in the same graphic and so is worthwhile taking the time to digest it.

The blue and orange lines show the cumulative volume of sales agreed and suggest that in the first 13 weeks of 2020 (prior to lockdown on 23rd March) sales agreed was just starting to show an increased volume in 2020 compared with the prior year – this was widely referred to as “the Boris bounce”. But in lockdown, the volume of sales agreed were unsurprisingly very low, which is why the orange line is flatter.

In week 20 (13th May) the English housing market re-opened for business and shortly after this time, we see the orange line rise substantially to eventually cross the blue line 2019 in the current week (week 40). Today there have been 967,000 of sales agreed in 2020 compared with 956,000 to the same date in 2019.

To help us understand where the demand increase was generated, TwentyEA has charted the weekly sales agreed volumes with grey bars on a secondary axis. This suggests that growth in sales agreed numbers really starts as soon as the English housing market reopens.

When the stamp duty holiday was announced (8th July), it is clear to see that the effect of the stamp duty holiday on the increase in the volume of sales agreed is marginal when compared to the growth post lockdown.

This would suggest that the stamp duty holiday did not make a massive difference to the volume of sales agreed on a weekly basis – certainly not enough to show clearly in the overall numbers. But what the graph does not show is what the market would have looked like had the stamp duty holiday never been announced.

Anecdotal evidence suggests that the stamp duty holiday is maintaining the volume of sales agreed at the level they rose to post the announcement of the holiday at least to a degree.

It is not yet clear when the high volumes of sales agreed are going to end.

The report from TwentyEA states: “In usual times, we would expect sales agreed will revert to “normal” demand levels when buyers believe that they cannot complete on a property purchase prior to the end of the stamp duty holiday on 31st March 2021.

“It appears this realisation may dawn on many purchasers about the same time as the furlough scheme ends. Could this be a double blow to consumer confidence in early November?

“In normal times it would seem that this points to the potential for a rapid reduction in Sales Agreed before Christmas but, as we aren’t the first to say, these are far from usual times and the reactions of government has the potential to completely transform the landscape.”

When it comes to the volume of new instructions and exchanges, the comparison from weeks 1 to 40 (year to date) between 2020 and 2019 is shown in the following chart for both metrics.

TwentyEA report states: “With respect to new instructions first, 2020 continues to lag behind 2019 but it is getting close and we would expect 2020 to have more new instructions triggers than 2019 by the end of the year. Presently, 2020 is 92% of 2019.

“With respect to exchanges, 2020 has only currently seen 75% of the exchanges seen in 2019 year to date. But this is the trigger we need to look out for as moving forward it will start to rise rapidly as these sales were agreed just after the reopening of the English market. Essentially there is a simple lag effect on exchanges. If sales agreed volumes rise, all other things being equal, c16 weeks later, Exchange volumes will rise.”

Comments are closed.