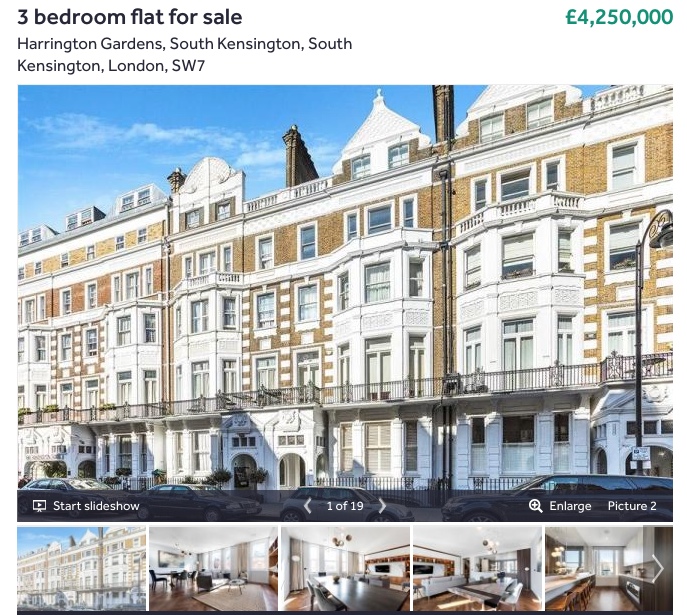

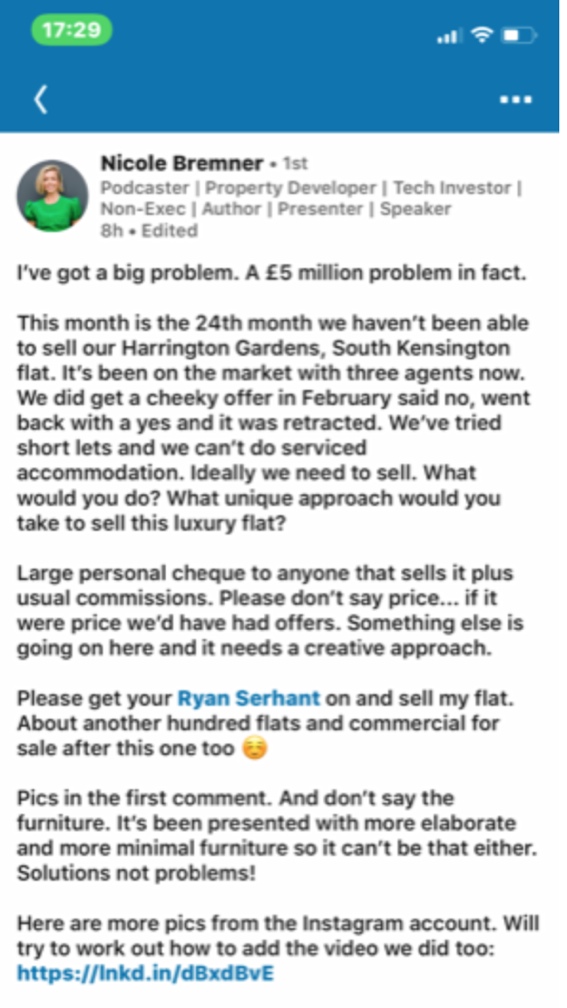

A property owner who has been unable to sell a flat for two years has taken to social media in desperation.

Nicole Bremner is offering a “large personal cheque” to anyone that sells it plus the usual commissions.

She is also dangling the prospect of “about another 100 flats” for sale.

Bremner, who describes herself as an author, speaker, investor, developer and mother, said she has had the property, in South Kensington, London, with three different agents.

She is calling it her £5m problem.

She said: “We did get a cheeky offer in February [but we] said no. Went back with a ‘yes’ and it was retracted.”

She says it has been presented with different sorts of furniture and re-styled three times. And she definitely does not think the price is the problem.

It was first marketed at £5.25m but is now on at £4.25m.

However, those who have responded on Twitter insist that the price is the problem.

It seems buying agent Henry Pryor thought it was worth £3m back in February 2018 when it was on with Knight Frank.

One poster suggests she invites the ten best local estate agents over, and lock them in.

Curiously, the property has other investors as a result of some crowdfunding about three years ago. In a video, Bremner admits that some are losing patience as they’d expected their money back.

Now on with Rickman Properties, it’s described as immaculate.

EYE wondered if for that price we’d want a bigger kitchen, the option of a lift and some garden rather than a small empty terrace.

And maybe more than three bedrooms?

However, we’re not estate agents.

So, over to you . . .

How would YOU sell this property?

https://www.rightmove.co.uk/property-for-sale/property-60734736.html

https://twitter.com/HenryPryor/status/1168928938355245057

https://www.simplecrowdfunding.co.uk/property/detail/south-kensington-investment-opportunity

Looks like a classic case of chasing the market down.

Any property will sell – at a price. Whether a vendor is realistic in their expectation and is willing to accept that price is another matter.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Delusional. Can’t miss the Aussie accent hiding in there either… Nicole, you purchased it for £2m in Feb 2016, renovated it and expected a £5m return a year later. What university business unit did you do that made you so confident that you could find the most naive buyer on the planet? You, Nicole, are the absolute poster girl for “deluded know it all.” My valuation in £2.5m, but be prepared to accept an offer for £2.2m if that’s the highest we can get on the table.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

This video didn’t make a lot of sense. The presenter claims that the flat wouldn’t even sell for £1. What is there we don’t know? Of course prices for top end London are dropping from the bubble highs. But there is still a market. She should reduce the price to something reasonable and retain a good local agent and I am sure it will sell in no time.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

It’s not the flat it’s the seller. Clearly in a financial mess and either has been unprepared to be guided on price, or such guidance hasn’t been offered. I’m not in the London market, but even getting it slotted into what is the right price, may not do the job, because the London market in this price bracket for such a property, just has so very few buyers.

If she was my client and wanted that sort of money, my advice (probably unwelcome) would be to rent it and wait, (probably for 2/3 years min) for market growth. That’s of course if she and her crowd funders ( another example of people being conned into investing in something they don’t understand) can afford such a strategy.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Sounds to me as if the problem is her investors wanting their money back and she doesnt want to crystallise the loss

Auction !!!

The sprat to catch the mackerel.The teaser

“About another hundred flats and commercial after this too!”

Sounds like she has hundreds of problems !

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Price is the issue, a property will go quickly based on price. To find the true value, shove it in a property auction.

We’re going to see a lot more people like this as the London property market tanks.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

https://www.simplecrowdfunding.co.uk/property/detail/1010

Here is one she put out for crowd funding with a very bullish projected return on capital in hipster Hackney . Completion date May 2019

No signs of any sales on Zoopla

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The simplecrowdfunding.co.uk prospectus shows an estimated 53% return for 36c Harrington Gardens !

https://cdn2.sharein.com/simplecrowdfunding/1af1d0dc-34e3-4b61-97cf-55da0ff3e03c.pdf

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Looks like the costs are standing her in for £3.245m .

Project been completed for over 2years so add in notional interest costs at £12k pcm +insurance service charges Looks like the crowdfunding investors might get around of drinks -if lucky !!

Silly move putting her marketing conundrum effectively “I haven’t got a clue” a big red flag on social media as they are seeking fresh investment in other projects.Investors are going to head for the hills

A Ratner moment if ever there was !

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Top floor with no lift probably wont help….

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Not sure that posting on social media will help. Just exaggerates the problem. As others have said, auction or drop the price. This may sound radical but sometimes you LOSE money with property!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I’m in agreement especially with Hillofwad71

SEPTEMBER 6, 2019 AT 07:27

The prospect of 100 overpriced units and commercial (no doubt to sell & core) is not motivating any agent.

I wonder what the £’s psf is for this unsaleable unit? Might just be a clue for the clueless

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The prospectus says 2770 sq ft but that may include the 4th bedroom which wasn’t added ?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I have found the floorplan which suggests 2,544 ft2 representing £1,671 psf on £4.25m. I am sure that one could find examples of optimum sized apartments achieving this sort of level but not a rambling apartment over 3 floors.

I think Nicole is a very sharp cookie and if nothing else she has tongues wagging. They say (whoever they are) “bad publicity is better than no publicity”

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Andrew,

Very sharp cookie?

How about: “attractive and used to people falling for her bs”

She tripped over crowdfunding, made impossible estimations, and is akin to Russell Quirk or Michael and Kenny Bruce.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

We could crowdfund to buy the seller a rope, each taking a share, then throw one end of the crowdfunded rope down the deep hole that the seller is sitting in ……then request a large sum of money to haul the seller out of that very deep hole. Hey Presto ……a positive return on our collective rope investment.

We should hold onto the rope for future use, as it looks like we could multiple our crowdfunding return by 100+ ……hauling the seller out of another 100+ holes.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

This lady should choose to sell it or rent it if she doesn’t want to move her price. In a rising market i’m sure it would sell at her price in a static or falling market then you have to chase the market (bring your price down).

It’s not a big problem

It’s just being stubborn.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Wrong price to wrong audience. Correct price to the right audience = sold or you are stuck with it.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

This article made me smile – ‘Unsaleable flat – please buy it’.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I think you will all find it is the right price its just the wrong market at the moment 🙂

Anyone that says “its not the price” knows deep down that it is the price…

She’s been doing the rounds as a “property guru” for a while now…

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The flat seems to have several negative points that include in my view:

– It’s too expensive in a tough market.

– I think it could be presented better.

– No lift.

The quality London residential market is not great in 2019. Time to be humble, correct the issues and reduce significantly the price.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

We took this property on after the vendors were so mis-advised by a corporate agent on price, by over a million pounds!! it has no lift, so is price sensitive. it is immaculate and extremely well done with an amazing roof terrace too. we have had viewings, but any sensible agent would know that this is a difficult market and we certainly wont give up and in fact are busier.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Oh dear !! “Mis-advised by a corporate agent on price, by over a million pounds! ”

That has put the cat amongst the pigeons.

She is going to rue the day she has reached out to the estate agent community on social media grandstanding with largesse All she has done is scuppered all her chances on trawling in money on projects she is seeking finance on

Even worse alerted all her traditional finance sources to reinvestigate LTVs. Sounds like a few rivets busting

These property gurus should stick to gurring rather than try and get their hands dirty in the street .

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

AUCTION! without reserve.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

‘Please tell me the problem, but not if I won’t like the answer’!

Guess what – it’s ALWAYS the price.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Seems daft to broadcast that the property is unsaleable when it is just overpriced. I’d recommend that she adjusts the price to no more than the cheeky offer she refused, but it might need to be lower to drive buyers to decide now rather than waiting for political dust to settle.

Make it a new instruction, at a new lower price with a different agent to give it a fresh start and stop drawing attention to its time on the market, that is just damaging the value.

How many times a day do we hear sellers say “I’m sure its not the price”? What other variables are there? And price is flexible to compensate for all other factors, like location, condition, time on the market and even brexit.

With a drop in the pound, maybe promoting through overseas agents might be the answer, but foreign investors will still take advice from surveyors and the likes of Henry Prior, so if the market advises £3m max, then nobody will pay more.

Time to rent it out or take the hit on price.

I wouldn’t recommend an auction, but a low guide price might do it instead.

Best of luck, I look forward to hearing what happens!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Back to basics. Anything will sell or rent at the right price. Just standing empty often makes little sense though.

The hsg mkt is a multiplicity of sub-mkts by region, location, unit & occupant type, age, nationality etc, all moving differently. LOCAL SUPPLY & DMD depend on demographics, hsehold formations, employment conds, international factors etc. which all change over time.

Transaction VOLUMES can be highly variable. PRICE depends on immediate S&D & MONEY SUPPLY available to MARGINAL purchasers in the sub-mkt, & price sustainability requires restricted S in relation to D. Local events can collapse a sub-mkt. Land/property values are infinitely flexible & can be zero or negative.

MS is dependent on CREDIT & driven by professional valns. In a rising mkt, valuers are safe encouraging any purchase. In a falling mkt, valuers retreat to protect themselves & lenders. Both rising & falling mkts therefore COMPOUND. FINANCIALISATION/ CREDIT gears MARGINAL PRICES going up & DOWN. Prices tend to rise up the stairs but fall down the lift shaft!

When a sub-mkt turns down, latest entrants (including quick turn developer/speculators) are the most vulnerable. Everyone loses equity but the last entrants are BOTH INCOME stretched & CAPITAL indebted: equity negative. Failed payments lead to FORCED sales which set further declining values.

Nathan Mayer Rothschild (1777–1836) had the answer to a successful investment business: sell too soon.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Invitations for 10 of the best agents, Ha… first observation is that it isn’t advertised with a EPC!

I’m up in the northeast and I can sell it. But not at that inflated price.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register