Buyer activity in London’s prime property market took a back seat in June and July as summer holidays and financial uncertainty led to a noticeable decline in offers.

Buyer activity in London’s prime property market took a back seat in June and July as summer holidays and financial uncertainty led to a noticeable decline in offers.

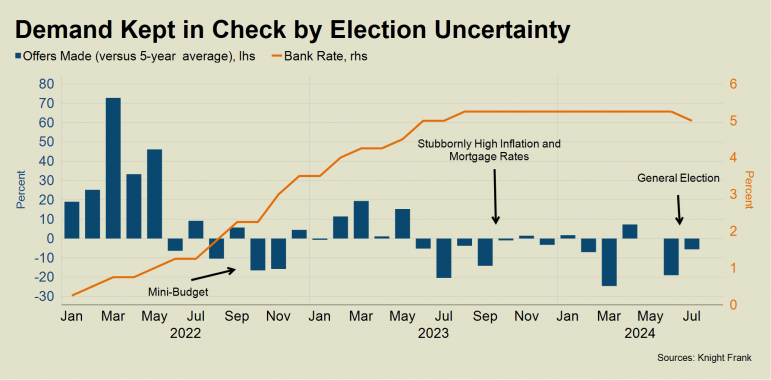

According to Knight Frank data, the number of offers made in these months was 19% below the five-year average in June and 6% down in July. The prolonged wait for a Bank of England rate cut and the distraction of a general election called on 22 May contributed to this slowdown, according to the agency.

Even with the pre-holiday hesitation, the number of property exchanges in London during June and July was 8.4% above the five-year average. This uptick was driven by pent-up demand following a year of high inflation, which also reflected broader trends in the UK property market.

Both Nationwide and Halifax reported rising prices in July, and the Royal Institution of Chartered Surveyors (RICS) noted an improvement in the number of agreed sales.

The prime property market, however, faces additional challenges, Knight Frank noted. The upcoming Budget on 30 October could introduce measures that may dampen demand in higher-value areas, particularly with the planned imposition of VAT on private schools starting in January. Other potential changes to pension tax relief, inheritance tax and capital gains tax could also put pressure on buyers.

In the prime central London market, average prices fell by 2.4% in the year to July, marking the third consecutive month of this annual decline. Prices are now 4.5% below pre-Covid levels and 17.6% below their last peak in August 2015.

In contrast, prime outer London (POL) areas have experienced smaller declines, with a 0.4% drop in the year to July. Prices in POL are still 3% higher than pre-Covid levels, though they remain 7.6% below their last peak.

The market outlook remains mixed, said Knight Frank, with the improving economic situation likely to boost activity in mainstream property markets this autumn. However, uncertainty surrounding upcoming policy changes could create headwinds for London’s prime property sector.

Comments are closed.