Some of the first users of the Government’s Help to Buy equity loan scheme face repaying the finance without benefiting from house price gains.

Research from mortgage broker Private Finance, based on 51 local authorities with 100 or more Help to Buy equity loan completions in each year of the scheme’s existence since 2013, found that some areas have seen minimal house price growth over the past five years, leaving home owners facing repaying equity loans larger than their capital gains.

Original adopters of the scheme will start to incur interest on their equity loans next year, providing motivation for them to move up the property ladder, the broker said.

Borrowers in the scheme must repay 20% of the property value at the time of selling rather than the original loan.

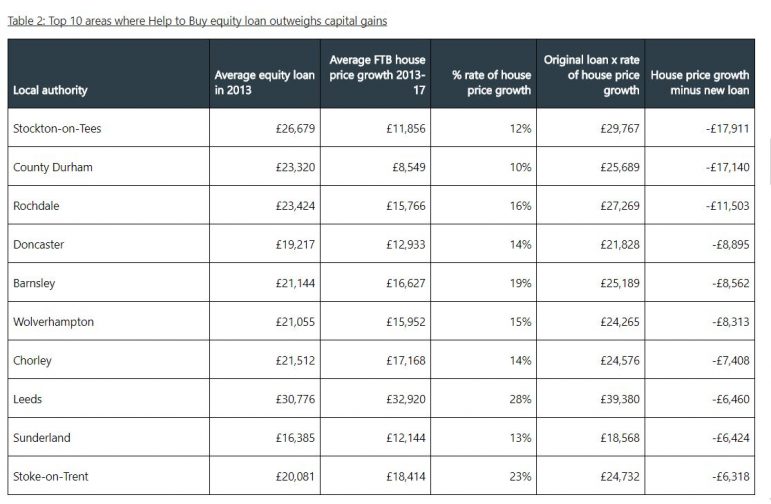

In Stockton-on-Tees, average house prices have risen from £102,409 in April 2013 to just £114,265, an increase of 12%. This is far less than the original average equity loan of £26,679 which would now be worth £29,767. This leaves Help to Buy borrowers in this area with a repayment loan that is £17,911 more than their capital gains.

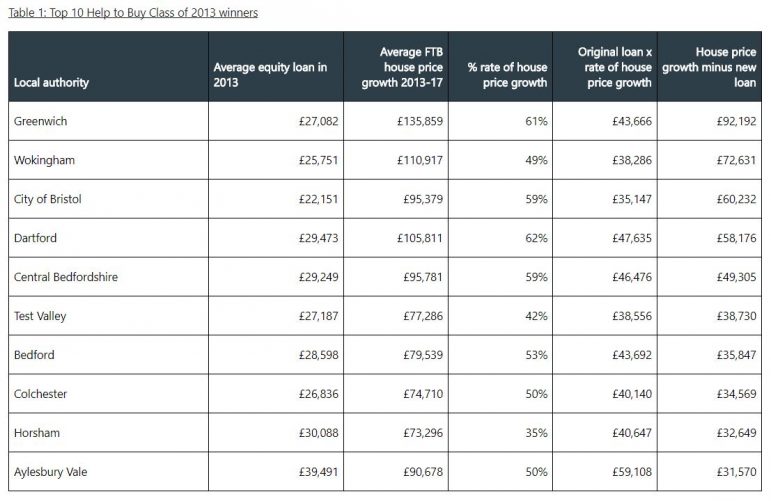

In contrast, average prices in Greenwich have risen from £221,852 to £357,710 since April 2013, a 61% increase. Applying the same rate of house price growth to the original average equity loan in the area increases this from £27,082 to £43,666. This still leaves the borrower with the benefit of £92,192 in capital gains so far.

Shaun Church, director at Private Finance, said: “The early adopters of the Help to Buy equity loan scheme will begin incurring interest on their equity loans next year, which may prompt some to consider moving on and repaying their equity loan.

“Across the regions, some stand to make significant gains thanks to rising house prices, which can cover the equity loan and leave more to invest in a new property purchase.

“However, others haven’t fared as well, with a slower rate of house price growth in the north meaning borrowers in this part of the country are at greater risk of their repayment loans outweighing their capital gains.”

How does your region fare?

Wonderful scheme – Not! I put my son off using it.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Jeeeez. You mean if I borrow money I have to pay it back?! THAT’S NOT FAIR!

Yes, my dear little millenial snowflake, that is exactly what you must do and it was made perfectly clear when you took the deal. Nowhere did it say that house price inflation would pay the loan for you. GROW UP!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Tick tock tick tock…the sound of a time bomb ticking……

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Am I the only person reading this who sees a fatal flaw in the methodology being used?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

This is a bit misleading. Just because a house hasn’t increased in value to such an extent that you can pay off the entire H2B loan through the increased equity doesn’t mean that the house owner is left in negative equity. I don’t think many people taking out H2B loans were expecting to pay off their loans in this manner!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register