Purplebricks has published its annual report for the year ended 30 April 2021, which you can view by clicking here.

Purplebricks has published its annual report for the year ended 30 April 2021, which you can view by clicking here.

The online estate agency recently announced its results for the year ended 30 April 2021 (“FY21”) and provided an update on its strategy execution.

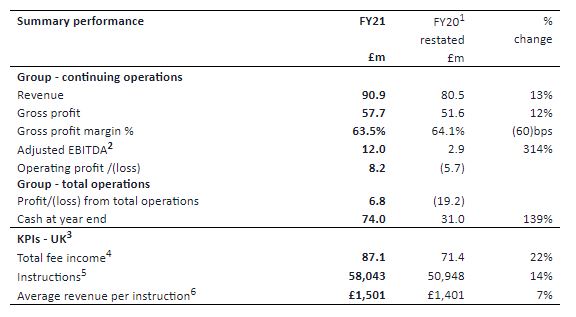

The online estate agency reported a ‘strong’ financial and operational performance, with revenue up 13% to £90.9m, from FY20: £80.5m.

Instructions increased by 14% to 58,043, up from 50,948 12 months earlier.

In terms of market share, Purplebricks saw its share of properties sold by volume fall to 4.67%, from 5.1% last year.

Average revenue per instruction increased by 7% to £1,501, up from £1,401, while its total fee income increased by 22% from £71.4m to £87.1m.

Adjusted EBITDA of £12m (FY20: £2.9m) was recorded, up 314%, while repayment of £1m furlough monies received has been confirmed.

The operating profit of £8.2m reported this morning, including a benefit of £4.3m from non-trading items, is a marked improvement on the £5.7m loss posted last year, while group profit from total operations reached £6.8m (FY20: loss of £19.2m).

Strong trading and sale of the Canadian business contributed to cash at 30 April 2021 of £74m, up from £31m.

The company said that it had ‘high confidence’ in its latest pricing trials in the North West of the country following positive results after the launch of new pricing model in July.

The New Money Back Guarantee (MBG) and simplified two-tier proposition will now be rolled out nationally later this month following the ‘successful in field research and trials’.

Vic Darvey, CEO, commented: “We are excited to be announcing the conclusion of our pricing review this morning, following a successful trial in the North West. The Group has responded to a changing market and we are delighted to offer customers an option of reimbursement of their upfront fee payment if they do not sell their home. This illustrates our commitment to giving customers the best service at the best price and we are very excited about the growth opportunity this new initiative will drive over the next few years.”

With the business ‘in good health’, Purplebricks now plans to launch its refreshed strategy to deliver further growth built during FY21 with investment in ‘leadership, systems, and our people’.

The new leadership team is already in place and working at pace to deliver on its strategic initiatives, as the firm looks to deliver on their medium-term target of 10% market share.

The Group wants to build on what it clearly sees as a strong start to the new financial year, with what it describes as ‘a very clear understanding of its operational barriers to success, and ‘with multiple strategic levers in place to drive its growth’, including the new pricing structures, such as Money Back Guarantee and a simplified two-tier proposition, which launching in July 2021.

Although the market for sales is buoyant at the moment, Purplebricks expect supply and demand to return to more of a balance post Summer.

As such, it says it is too early to quantify the benefit from the new pricing structures to the current financial year. Its current expectation is for FY22 EBITDA to be flat year-on-year, in line with market expectations, with these strategies expected to accelerate revenue growth and drive progress towards the Group’s medium-term targets over the next few years.

Once these initiatives have been successfully rolled out, the Group says it will accelerate its marketing strategy to grow instructions and share. As a result of these strategic changes, the Board expects Purplebricks to be able to deliver annual revenue growth in excess of 20% in the medium-term, with confidence in the Group’s ability to deliver against its growth strategy.

Darvey continued: “We are excited to be announcing the conclusion of our pricing review this morning, following a successful trial in the North West. The Group has responded to a changing market and we are delighted to offer customers an option of reimbursement of their upfront fee payment if they do not sell their home. This illustrates our commitment to giving customers the best service at the best price and we are very excited about the growth opportunity this new initiative will drive over the next few years.

“We’ve had a strong year and I am particularly pleased with our revenue growth and operating profit, as the Group continues to grow from strength to strength. This great performance has been achieved in the shadow of the Covid-19 pandemic, and it remains a great source of pride that Purplebricks has come through the year stronger than ever.

“Most importantly, today we present Purplebricks 2.0 and I believe that we now have the right management team, right strategy and right technology to continue to grow the business.

“With a simplified proposition and our new pricing structure in place, I am confident that Purplebricks is well placed to gain market share and to accelerate revenue growth and drive progress towards our medium-term targets. I would like to thank all colleagues for their efforts over the last year and look to the future with considerable optimism.”

“With the business ‘in good health’, Purplebricks now plans to launch its refreshed strategy to deliver further growth built during FY21 with investment in ‘leadership, systems, and our people’.”

Which “people” are they referring to? An interesting change is happening to the culture. Firstly, how they describe LPE’s/TOs – straight from their Ts & Cs for their new Money Back Guarantee:

“a valuation performed by a Local Property Company (known as an ‘LPC’).”

There it is – a “Local Property COMPANY.” No mention of “people” there – and certainly not THEIR “People”.

And from the Annual Report (P13):

“We employ over 400 people and work with around 600 self-employed agents across our operations in the UK”

work

with

And then – you have the “people” themselves. Here’s how one Territory Owner describes his role on his LinkedIn profile:

“Working in partnership with a leading UK estate agency brand Purplebricks to grow and develop a network of businesses across South Wales, trading as R.Golten Limited.

I am currently working in partnership with 10 contractors to facilitate and deliver exceptional customer service and outstanding customer outcomes, enabling our customer base to maximise the value of their homes, and the profitability of each business I work with.“

“Partnership”… “businesses”… “contractors”… different language to that of the past.

And here’s another – TO Ian Brown describes his role as

“Experienced estate agent working alongside the UK’s most loved estate agency brand”

And one from my neck of the woods – Tony Cooper, who describes his piece in the Purplepuzzle as:

“Responsible for the growth and development of the PB brand right across the North East. Delivering marketing and customer service that are second to none, from the country’s No1 estate agency

Helping my team of self employed business owners grow, through mentorship, coaching and business development.”

Now all the above could have been there since they posted the roles on their profiles for all I know – but the language is vastly different from the old-style bricks where they were our agents… our experts – this seems to be driving a rather large Chieftain tank between the PurpleCamp full of PurpleChiefs and the band of footsoldiers out in the battlefield with their apparently borrowed PurpleUniforms.

Then, from a rather mahoosive back-slapping Linkedin thread, two polar opposite comments – the first from TO Richard Standell posted 2 months ago:

“Having worked with Purplebricks now for some years I can truly say that as a self employed LPC, Things have never been better the future is looking more secure than ever ,”

So – more of the same – seemingly drawing a line in the sand between what was and what apparently now is the craic…

…and then the second comment needing a mention, from ex-TO Simon Taylor, which puts a bit of a damper on what is effectively a collection of dozens and dozens of self-love posts (that, I’m sure, are the product of genuine belief and not dancing to the fiddler’s tune…) with this rather cutting comment:

“For those considering becoming a ‘PurpleBrickster’ be careful – do your homework. Reach out to those that have left the firm & try to speak to those working there currently. They may be able to shed some light & talk ‘off the record’ to give you a flavour of what it’s really like.Here’s a few things you might like to enquire about.In an agency role, can my assigned territory be removed without notice?What happens during a lockdown? Do I receive pay?If I’m really self employed why are there targets for mortgage & solicitor referrals?What happens if a neighbouring local property expert resigns? Is it possible I may have to take over their stock for little remuneration?Is it true CEO Vic Darvey sent letters last year advising many of a demotion but adding & I quote, ‘congratulations though, we’d still like you to stay on’?Is it true that the former finance director was quoted as saying the future of the business lies in more & more automation? If so, what then are the implications for the ‘human element’ of estate agency at the company?What is the attrition rate of ‘self employed’ & ‘employed staff’ leaving the business?Forarmed is forewarned.”

A comment, by the way, which received the full backing of ex-LPE Rob Twinning who said he would be

“very happy to talk off the record with anyone who wants a real overview of the company and their direction.”

So what about it, EYE – the offer is there on the table from Mr Twinning. A real scoop waiting for you – a chance to poke a stick through the cracks in the Purplebricks and see what comes out.

As Detective Harry Callahan would say…

“Go ahead – make some news!”

…after all – this is “WHERE NEWS COMES FIRST”, innit?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

A top notch post. I wonder whether PIE will take you up on your offer.

As far as HMRC is concerned it doesn’t matter what language you use, if an individual “works” for one company exclusively and has no authority to set prices, the person is an employee. I fully understand that it is not black and white and yet it is impossible to disguise an employee arrangement by changing the language that is used in media or regulatory releases.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Purple Haze

The sad reality is that since Vic’s arrival in 2019, Bricks have been in a downward trend .This FY inventory dropping like astone

Today on ZPL

Sales inventory:7807

Rentals :190

This one takes the biscuit

“Instructions increased by 14% to 58,043, up from 50,948 12 months earlier.”

Yet in 2019 they were 69,892 and 64,376 in 2018 in the UK respectively

Last years figures bloated by the sale of the Canadian business. Now just an overseas

investment in Homeday in Germany which is proving to be very pedestrian.

The SP finished yesterday at 70p reflecting the fact that they are fast becomimg yesterday’s news failng to add new revenue streams

Unablet to attract or retain new talent they have been shuffling the deadwood and moving the deckchairs around on the Titanic

Is Vic there ?

By current reckoning he shoudn’t be. although the recent shares award are trying to keep him sweet and on the premises

Yesterday Sporting Ken’s Purple Power trailed in 7th at Yarmouth at 16-1. Ken now changed his racing colorus from purple to yellow to put some distance

“Prominent,ridden 2 furlongs out no extra”

That about sums it up.

I

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“Strong trading and sale of the Canadian business contributed to cash at 30 April 2021 of £74m, up from £31m.”

I will put this here and wait for the poster aka “Magic” to explain why he thinks PB don’t actually have £74million in cash and short-term deposits.

His response to my previous comment on this subject – “It does worry me that some of the people i work with in this industry do not understand business and accounts.” 🙂 🙂

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Ostrich

Yes even with a hefty investment in Homeday they certainly have enough in the Tommy to fund new ventures and certainly could always borrow if the right opportunity comes along so no excuses for sitting on their hands

Maybe Axel have no appetite at the moment and have their own addenda perhaps waiting to take it private

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I would suggest they have no more than 30m cash to invest, baring in mind we have had some the strongest trading conditions since PBs inception and they still only made a few quid, it will not take long for them to burn through 30m as markets return to normal.

The runway is short and they have not capitalised like the rest of us.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Magic

£30m in cash in the midst of a pandemic most companies would only dream of being in that position

Agreed have been unable to take advantage of recent bouyant conditions

Why do you think they havent invested any of it to produce new revenue streams .Financial Services?Conveyancing ?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Hillofwad71

30m Is needed to prop up value right? so if they spend it and then do not significantly grow there is a risk here. Also they need a sufficient runway to protect them so no large investments will be made at all is my thought process here.

The Model does not work, there is not enough money in ancillary products for the TOC or LPE so why would they choose to push it? As an LPE why would i sell a mortgage product? when my TOC is asking for more viewing packs to earn more?

Until they significantly change the model they will continue to loose control in the field and improve attachment rates.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Less than a week ago, you claimed they had only 25% of the declared cash figure – now you have revised that to £30million.

In case you missed it, I refer you to Note 25 of the Published Accounts. The relevant figures are:

Cash at bank and on deposit with instant availability £22.5 million.

Cash on deposit available within 35 days’ notice £41.2 million.

Cash on deposit available between 36 and 90 days’ notice £10.3 million.

That’s a total £74million at the end of April 2021, so by your reckoning they have spent £44 million in less than 3 months.

Perhaps you could enlighten us as to where that money has been spent !

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

You keep using Zoopla data HoW71 but PB like many other agents often remove their listings at SSTC presumably to avoid a charge? Hence the stats are skewed.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

BV

Just using ZPL as an indicator What is useful about ZPL though as far as PB is concerned is that you can identify those appearing daily as fresh. As they don’t get paid twice you can take out those recycled ones to give a daily total

On that basis there is clear indication that they have started this FY with fewer instructions This is contrary to all the candy floss generated by Zeus

As for lettings which clearly have a quicker turnover its diffcult to see they are actualy letting morethan 100 -120pcm which is little more than a couple of Foxtons branches

Woeful and a busted flush for all the noise they have made

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“…PB like many other agents often remove their listings at SSTC presumably to avoid a charge? Hence the stats are skewed.”

You are correct, BigVillan – a large chunk of “SSTC” listings are removed from the Zoopla figures compared to those of both their own website and that of RM (IF you can be bovvered to try to find what is now a very large number of individual ‘branches’ rather than the previous 21 or so ‘Regional’ centres). Interestingly, up until a couple of weeks ago, there were only something like 250 listings on Zoopla that were badged SSTC. Today – there are over 1000. Something is definitely happening in that respect – and it will definitely impact on the numbers showing as ‘listed’.

That said, in terms of your comment above however, Hillofwad is definitely comparing eggs with eggs. Like myself, he keeps an extremely close watch on the Zoopla statistics, and for your information, when he says

“This FY inventory dropping like astone

Today on ZPL

Sales inventory:7807

Rentals :190″

the comparable Zoopla stats for 30 April (end of FY21) were as follows:

Sales listings: 9470 (today’s total -1663 / -17.6%)

Rentals: 246 (today’s figure -56 / -28.7%)

So he is absolutely on the money with his comment.

Think that’s bad? You should see the figures for this time last year!

(or, worse still, the year before….)

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register