Leading investors plan to invest an additional £42bn in residential investment industry, including student, senior living and PRS, over the next five years, having already committed a combined investment value of £62bn across the sectors, according to new research published by Knight Frank.

A survey of 40 leading investors, with a combined £62bn already invested in student accommodation, PRS and senior living rental, signalled further growth for the sectors.

While this year may have presented investors with a new and unique set of challenges, Knight Franks says the results of the survey suggests the appetite to increase exposure shows no signs of slowing.

The current crisis is expected to be a catalyst for this growth. Not only are existing players committing to investing more, but new entrants are also keen to increase their exposure.

James Mannix, head of residential development and investment at Knight Frank, said: “Covid-19 and lockdown have done little to dampen the appetites of investors, and our view is that the current crisis will likely act as a catalyst which will see an increased level of capital committed.

“Not only are current players committing to invest more, but new entrants are also keen to increase their exposure.

“Combined, the student, senior living and PRS markets are extremely resilient, especially in times of economic stress, and we’re seeing this play out in the long-term investment intentions of the country’s biggest funds, developers and operators.”

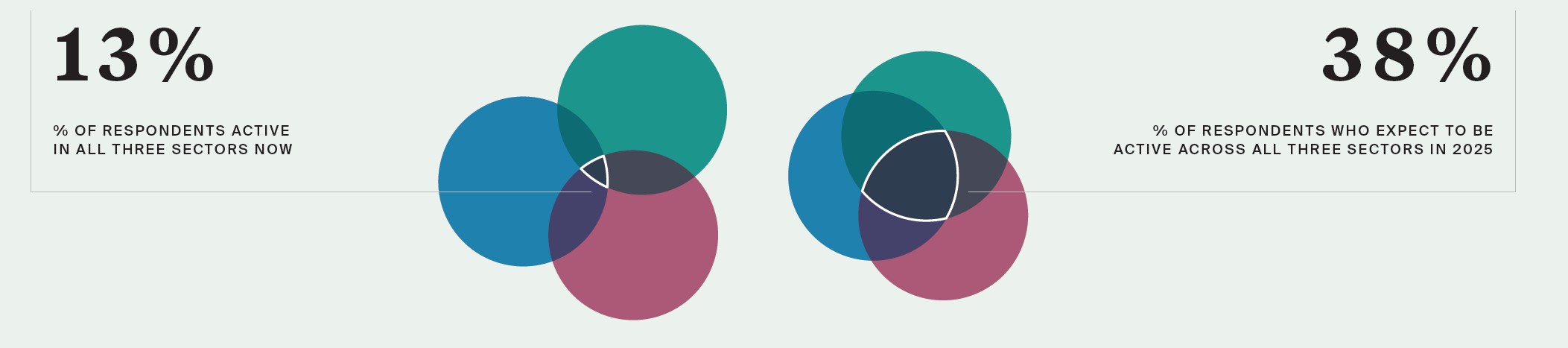

Of the respondents surveyed, only 13% currently invest across all three residential investment asset classes – student, senior living and PRS. This is set to rise to 38% by 2024, as professional investors seek increased diversification within the residential investment market.

The primary reasons underpinning the outlook for investment into income-producing residential markets include a search for diversification, finding value in the granularity of occupiers that comes with individual units, as well as wider demographic and tenure shifts which are taking place across the UK.

Mannix added: “Investors – whether they are currently predominantly active in the student, senior living or PRS market – are starting to see the value of becoming exposed to other similar asset classes, and are broadening their overall exposure in search of portfolio diversity.”

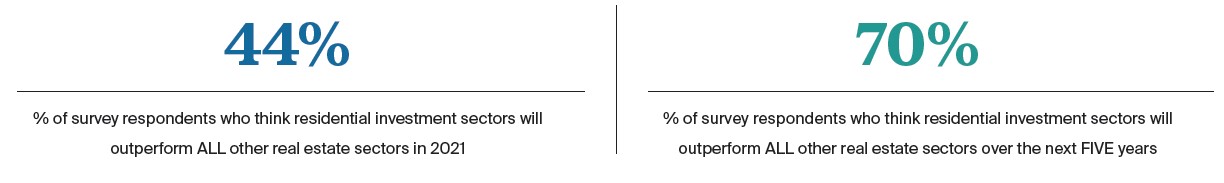

When asked whether the residential investment sector will outperform all other real estate sectors in 2021, 44% of respondents said yes. This rises to 70% who think residential investments will be the top performer over the next five years.

Consequently, investors are taking a long-term view, upping their exposure and increasing their firm-wide activity in residential investment markets.

Oliver Knight, head of residential development research at Knight Frank, commented: “The survey results echo our expectations for increased diversification within the residential investment market, with investors spreading their exposure across age groups.

“While there are significant differences in market drivers, there are synergies – particularly with regards to construction and operations – which makes the decision to move across sectors more appealing.”

Comments are closed.