Property demand and sales have both jumped since lockdown restrictions were lifted but Zoopla is warning this may be short-lived.

Analysis by the portal found demand for listings jumped by 88% on weekly basis after the market reopened on May 13th and is currently 20% higher than at the start of March.

New sales agreed, sold subject to contract, were running at 10% of normal levels over the lockdown and were up 12% in the first week since lockdown.

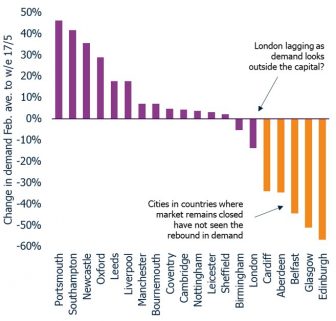

There were regional differences though.

Portsmouth, Southampton and Newcastle saw the strongest rise in buyer demand in the first week the market re-opened, up 46%, 42%and 36% respectively when comparing to the average for the whole of February 2020.

But demand fell in Birmingham and London.

Aberdeen, Belfast, Cardiff, Edinburgh and Glasgow – where property markets are still effectively closed – also saw a drop in demand.

Zoopla suggested this could also be a result of people wanting to trade out into commuter towns as a result of their lockdown experience.

Previous research by Zoopla said there were 373,000 stalled sales during lockdown.

A consumer survey accompanying its analysis found 59%of home movers in the UK are now planning to continue with their search for their next home but 41% said they have put their plans on hold, citing market uncertainty, loss of income, and diminished confidence in future finances as deterrents.

Its latest data showed a small increase in fall-throughs since May 12th but the property website cautioned that it is early days as many agents are yet to fully reopen.

Zoopla’s analysis said: “The level of fall-throughs remains well below this time last year.

“We currently expect a significant proportion of agreed sales to continue but increased uncertainty over the economic outlook will see housing chains tested in the coming weeks.”

The research formed part of Zoopla’s regular UK Cities House Price Index, which showed annual price growth in the country’s 20 largest cities slowed from 2% to 1.9% to £253,900 on average in April.

Further declines are expected in the future, Zoopla said.

Richard Donnell, director of research and insight at Zoopla, said: “The scale of the rebound in demand for housing is welcome news for estate agents and developers, but it is also surprising given projections for a sharp rise in unemployment and a major decline in economic growth.

“The Covid-19 crisis and 50-day lockdown have created an unexpected one-off boost to housing demand.

“Millions of UK households have spent a considerable amount of time in their homes over the lockdown period and missed out on hours of commuting.

“Many households are likely to have re-evaluated what they want from their home. This could well explain the scale of the demand returning to the market. We need to see more supply come to the market to satisfy this demand.

“The economic impacts of Covid-19 will grow in the coming months and uncertainty is building.

“The majority of would-be movers plan to continue their search, encouraged by low mortgage rates and continued Government support for the economy.

“However, we expect the latest rebound in demand to moderate in the coming weeks as buyers and sellers start to exert greater caution.

“Further support from the Government can’t be discounted and would help limit the scale of the downside risks.”

Good to see balanced and realistic thinking. I concur 100% with this view and anyone who has studied economics will surely understand that with average UK personal debt of over £60,000 per household, unemployment rising by the day and looking down the barrels of ‘the mother of all recessions’ the housing market cannot maintain momentum. Take advantage of the spike, keep costs to a minimum, button down the hatches and prepare for the inevitable storm ahead.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Absolutely right. One swallow doesn’t make a summer. If now no longer needing to commute 5 days a week, very good reasons to reappraise what and where you want to buy before jumping in feet first.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register