People aged 18-24 are more than twice as likely to choose a tracker mortgage than any other age group, research by Uswitch has revealed.

People aged 18-24 are more than twice as likely to choose a tracker mortgage than any other age group, research by Uswitch has revealed.

To investigate how homeowners from different age groups were utilising the potential of tracker mortgages, the comparison service polled over 2,000 UK homeowners and found some 18% of those aged 18-24 took on the risk of fluctuating interest rates influencing their monthly repayments – 14 percentage points more than 25-34 year olds. Standard variable rate (SVR) and discounted mortgages are also much more popular for 18-24 year olds, at 26% and 15% respectively.

While fixed-rate mortgages are the most popular across all age brackets, they are utilised far less by the youngest homeowners. At least half of every other age bracket has a fixed-rate mortgage – with four in five (81%) of 25-34 year olds choosing this rate, but only 42% of 18-24 year olds opted for this deal.

At a rate of 7%, those aged 45-54 are the second most likely to choose tracker mortgages. While far less likely than 18-24 year olds (18%), 45-54 year old homeowners are twice as likely to opt for a tracker deal than those aged 35-44, the least likely of any age group analysed (4%). Standard variable rate mortgages are also more popular with those aged 45-54, as one in five (20%) have taken these mortgage plans.

More than one in five (7%) of those 55 or older have taken tracker mortgages. While only 57% opted for a fixed-rate mortgage, they were still less likely to have tracker deals than those aged 45-54, despite 71% of them having a fixed-rate plan. This is because over a third (36%) of those 55 or older chose a standard variable rate mortgage, the most analysed in the study and 24 percentage points more than those aged 25-34.

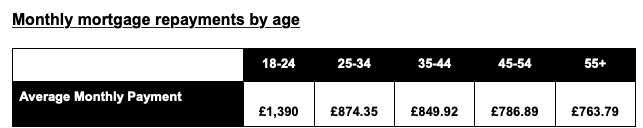

On average, those aged 18-24 spend £1,390.90 a month in mortgage repayments, the highest of all age brackets. This is 59% more than those aged 25-34, for whom the average monthly payment is £874.35 (the second most expensive repayment).

In fact, this difference becomes greater the larger the age gap. Those 55 and older have the cheapest monthly payments, averaging just £763.79. This is 45% less than the average monthly repayments for those aged 18-24.

Comments are closed.