Property data network, LonRes, has published its latest report on the London residential markets.

The positive signs emerging in June didn’t last long, with the prime London sales market slowing down again in July. Average achieved prices fell by 2.6% compared with a year earlier. All three sub-markets across Prime London recorded falling sale prices in July, with Prime Central London’s 3.4% drop the largest. While the market is often quieter as the summer holidays start, last month’s activity was low compared to the typical July.

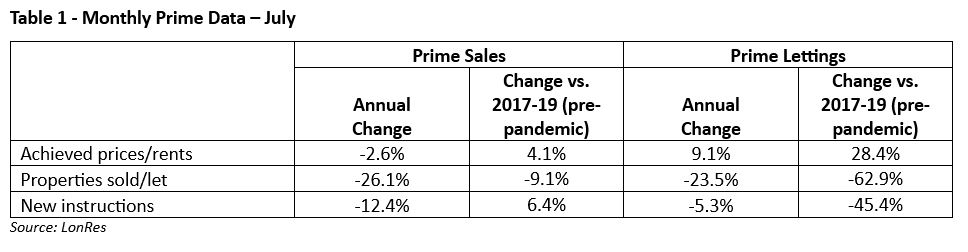

Transactions in July were 26.1% lower than the same month last year, and 9.1% lower than the pre-pandemic July average, i.e. from 2017 to 2019 (table 1). New instructions in July were 12.4% lower than a year earlier, but for the calendar year to date they were up slightly, by 2.6%. The July figure was also 6.4% above the 2017-19 average (table 1).

The number of properties going under offer followed a similar pattern. Under offers were 29.6% lower than last July but 8.0% above the 2017-19 average. These figures suggest that, while the market has clearly fallen back compared to 2022, activity is returning to more normal conditions.

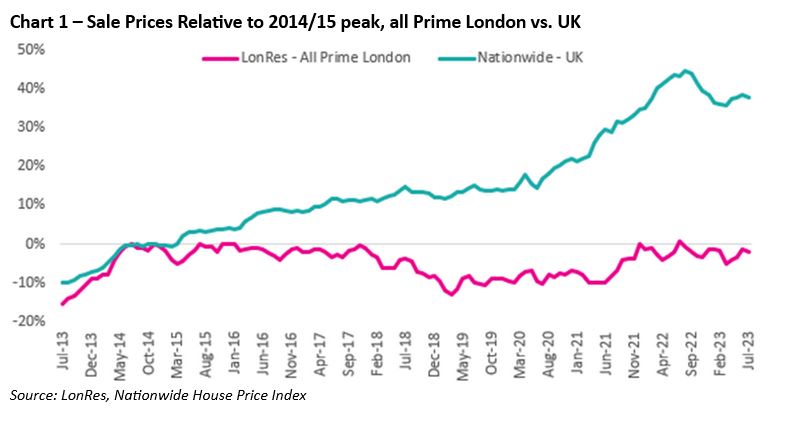

The trajectory of the prime London market has been very different to that of the wider UK one over the past decade. Values across all Prime London in July were 2.1% below their peak from November 2014, according to LonRes average achieved sale price data (chart 1). Nationwide’s index shows that the average UK house price has grown by 38% over the same period. Much of this growth came between early 2020 and the peak (at +45%) last August.

While these data series are not directly comparable due to different methodologies, the contrast is very clear. This analysis suggests that whatever path the UK housing market takes from this point, the prime London one could be very different.

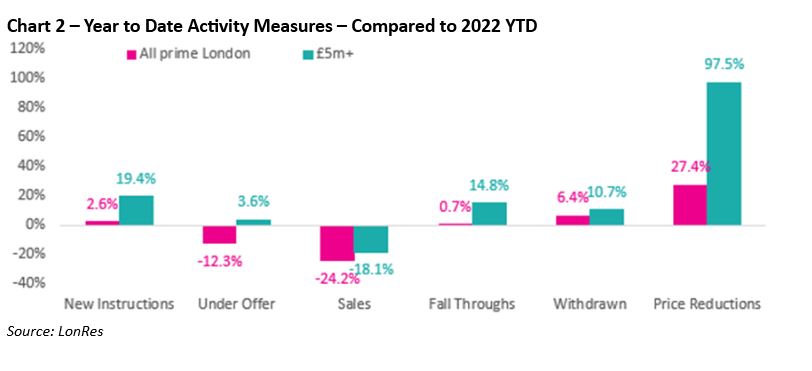

July saw continued high levels of new instructions of properties priced at £5m or more. These were up 30.3% on the same month a year earlier and 78% above average 2017-19 levels. However, sales activity has dropped back from recent highs, with transactions in July down by 23.8% and down 18.1% for the year to date, both compared to 2022.

The number of properties going under offer is less negative than actual sales. Properties going under offer recorded an annual fall of 14.3% in July but the year to date figure is 3.6% higher. If these deals conclude, the sales figures over the coming months may look healthier, but the number of fall throughs in 2023 to date is 15% higher than last year so that is not a given.

The number of price reductions in the £5m plus market in 2023 so far has almost doubled compared to the same months in 2022. This is a much larger change than the wider prime London market, whereas other indicators are more in line over the same period (chart 2). Combined with continued growth in new instructions, buyers at the top end of the market should have more choice over the rest of the year.

Annual rental growth in July was 9.1% across prime London. This figure took rents to 28.4% above their 2017-19 (pre-pandemic) average (table 1). All areas and sub-markets have seen similar levels of growth but prime fringe recorded the highest annual rise of 12.3%.

Activity in July remained low, with an annual fall of 23.5% in lets agreed and a 5.3% fall in new instructions (table 1). Overall, despite continuing high demand the stock of properties available to rent appears to be starting to recover from its low base. At the end of July there were 25% more rental properties available across prime London than a year earlier. But this remains around 57% below the typical pre-pandemic level for this time of year (chart 2).

Commenting on the findings, Nick Gregori, Head of Research, LonRes said:

“The second half of 2023 has started much like the first, with an uncertain sales market reflecting weaker sentiment from both buyers and sellers. The impact on values remains small – average achieved prices fell in July but not significantly – while transaction levels are subdued after two strong years.

“Many agents are reporting healthy levels of buyer enquiries, but a lack of urgency is limiting the number of deals actually being agreed. Longer conveyancing times are adding to the general sense of nervousness in the market, with agents attempting to find the right balance between smoothing a deal through, without exerting pressure to the point at which it falls apart.

“With the summer holidays now underway the market is in its traditional slowdown period. September signals the start of the autumn selling season and that will be key to how 2023 finishes up. If borrowing costs have settled down by then and the economy starts to perform better, we could see a stronger close to the year. But if the recent volatility continues it is likely transaction numbers will remain suppressed and values could come under more pressure.

“At the top end of the market the dynamics remain slightly different with high levels of new instructions and sales a little down on last year. While the volatility of the mortgage market has less direct impact in this equity-driven sector, it undoubtedly affects sentiment, creating uncertainty among both buyers and sellers alike.

“The prime London lettings market saw a slight increase in available stock in July but this is off a low base. New instructions fell in July but agreed lets fell more. In general demand is still strong, particularly for more affordable properties.”

Prime London analysis includes properties within the following postcodes:

Prime Central London: SW1Y, SW1X, SW1W, SW1A, SW3, SW7, SW10, W1S, W1K, W1J, W8.

Prime Inner London: NW1, NW3, NW8, SW1P, SW1V, W1T, W1H, W1U, W1G, W1W, W2, W11, W14.

Prime Fringe: SE1, SE11, SW4, SW5, SW6, SW11, W4, W6, W9, W10.

Comments are closed.