Local agents working for online firms are leaving when their period of guaranteed income ends – and moving on to another.

It is common practice for online firms to subsidise income to a minimum guaranteed level for the first few months.

Ian Wilson, CEO of The Property Franchise Group, said: “There is a type of person who moves around after their guaranteed income period is over.

“They go on to another online or hybrid agent, and then perhaps another when the same thing happens.

“It could happen perhaps three times, but in reality these agents are running out of road.

“There is an element in the online sector where someone is not prepared or does not have the skills for the challenge of having to make all their own earnings.”

Wilson made the remarks while talking about recruitment of franchisees, particularly to TPFG’s own hybrid brand EweMove.

He said that the affordability of EweMove was attracting strong interest.

He said: “It costs £1,000 a month and for that you get support, marketing, software and listings on Rightmove and Zoopla.

“If you were to set up on your own, you would find yourself paying £1,000 just for Rightmove alone.

“EweMove is a very low risk way of taking that step to running your own business.”

Some EweMove franchisees enter the business and then change to – or add – another TPFG brand such as Martin & Co or Whitegates so that they can build up a high street lettings management business.

Wilson said that EweMove’s change of strategy, to recruit experienced agents rather than industry outsiders, was paying off, with 15 experienced estate agents joining the brand last year.

Currently, he said, applicants include local agents who have been working for House Network and Yopa, while a recent recruit has been from LSL.

TPFG announced strong results yesterday, but Wilson spoke candidly about the challenges in the market place.

He said that it is currently “very slow on the acquisitions front”.

An important strategy for TPFG franchisees is to grow their property management portfolios by buying local competitors’ businesses.

But Wilson said: “People seem to be hanging on, as if they are frozen in aspic, waiting for Brexit to be resolved.

“If it isn’t, we are in for two quite difficult years in the housing market.

“As it is, sales businesses are unsellable at the moment.”

The tenant fees ban will have an undoubted impact – “We will all be off a cliff edge on June 1”.

TPFG franchisees on average earn 16% of their lettings income from tenant fees, and the ban will knock £500,000 off income to head office.

Wilson said that as a result of the ban, landlords will find their charges rise, while rents will move up at a faster pace.

The key to success, he said, will be for franchisees to try and keep their current cost base but manage more properties. “The solution is scale,” he said. “Agents will have to be bold.”

The total number of TPFG outlets went down last year – from 403 to 377 – and Wilson said that this was deliberate: “The number will go down further, as we have active consolidation within the group. We would ideally like to have fewer shops, but with our franchisees having larger empires.”

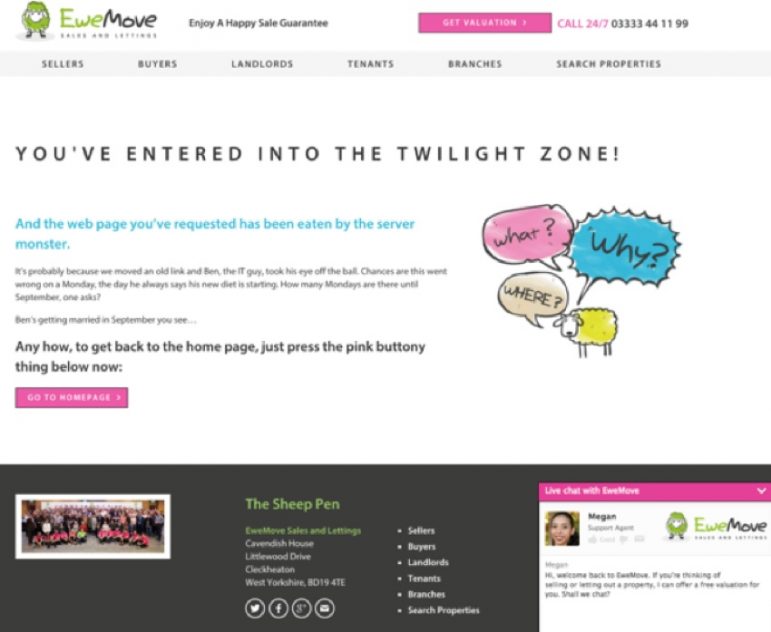

* EYE asked Wilson about a page – pictured below – which appeared after any EweMove franchise closes.

The page jokily suggested that there had been a computer glitch, blaming “Ben the IT guy”.

Wilson, who appeared unaware of the page until EYE sent a link, came back to us within an hour to say he had taken immediate action to withdraw it, and replaced with wording to say the branch was no longer trading.

I think the answer is to go it alone and forget RM. If I was looking for a property I would not only look at RM.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

This page has been used by Ewemove for sometime to hide the fact that franchisees have disappeared confusing to both buyer and seller

https://www.ewemove.com/estate-agents/cardiff/buyers/

It is still there !!!!

“EweMove is a very low risk way of taking that step to running your own business.”

Many of those franchisees suffering life changing losses would disagree with that statement. Those who borrowed the initlial franchise fee from the bank and startup costs and run themselves into the ground with very little evidence of shepherding .

2019 has shown no slowdown in the number of franchises closing down at Ewemove with life changing losses for the individuals involvedIts no consolation to those who started the journey with a substantial investment that the goal posts have been moved for new arrivals

Maybe the Head Shepherd might like to explain why in recent months Cardiff Laindon Park Salford Streatham Croydon Salford Altrnicham Oxford East Barnsley Doncaster have all gone west with hundreds of thousands of debt What help was offered to them ?

These arent migratory birds they have run themselves into the ground

In Chelmsford 2 franchisees went

The new franchisee for Gloucester was excitedly announced arrivingi n January with an established -70 property management portfolio no sign of it on the Ewemove portal? She has 1 sales instructions and no lettings

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“There is an element in the online sector where someone is not prepared or does not have the skills for the challenge of having to make all their own earnings.”

Recent typical example of failed Ewemove franchisee Altrincham Started in 2015 struggled on til February 2019 debt increasing where the latest set of sshowing the company debt had increased to £35k .

What help was offered to that franchisee???

https://beta.companieshouse.gov.uk/company/09894226/filing-history

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Surely Righmove will be Charging the Franchisor a territory fee? Otherwise The Franchise Group and or 1 branch of the Franchise Property Group will be acting as an intermediary which RM will not allow. I need to do a bit more research on this.

The Franchaie Property Group may be making a good profit spinning off franchises for £1000 per month, but the Franchisee themselves are struggling.

How are exact numbers reported to the Franchaie Property Group? As each franchise has different accounting periods.

I done a quick research on the The West London branch of Martin and Co which I understand are part of the TPFG, they have Brentford and Ealing. They have been with Martin and Co for over 10 years and it seems the directors keeps closing and opening new Limited company trading companies as it doesn’t seem to be making a profit. Again I need to do more research in order to give a full picture of what’s actually happening with the franchisees.

So I agree with Hillofwad71 something is not right somewhere.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Yesterday, TPFG reported in their annual statement that they had recruited 26 new franchisees for the year, yet their branch numbers dropped from 403 to 377. This would suggest that 52 were lost/closed? Could this back up everyone elses theories regarding the Ewemove model and the number of struggling franchisees they have in ranks?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The key to success, he said, will be for franchisees to try and keep their current cost base but manage more properties. “The solution is scale,” he said. “Agents will have to be bold.” And this is where all companies fail and very relevant for all on-liners. Base costs are far higher than income stream and delusional expectations of the number of properties that can be achieved. Needing to be “bold” is more about unachievable targets and how many times have we heard that with self-employed LPA or LPE’s. “Hire and fire” or “Hire and burn out” has for decades been wrapped by in cotton wool by some companies that do nothing but cause misery for many individuals and their families. Jumping from one ship to another is a sign of the business knows only too well what it is up to by not being able to retain its staff and on the other side of the coin, the rep is often the calibre of person looking for an easy life = on-line reps.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Incredibly High Profit Potential

With low overheads and by charging premium fees for a high-quality service, our franchises have enormous profit potential. Our top performers enjoy incomes well in excess of £100k each year. How? They follow the EweMove Way diligently and reap the rewards consistently.

The pitch onn Ewemove’s site for franchisees sounds very tempting but should come with a Gov’t health warning perhaps a link to Ewemove Maidstone North Ltd who liquidated with a horrendous loss

https://beta.companieshouse.gov.uk/company/09106014/officers

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Ewemove Stourbridge also went down the pan within 18 months of starting. The poor chap had no experience and probably lost in the region of £30k plus

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Is that Ewemove Kidderminster which went down the tubes in February ?Last accounts showing a deficeit of £42k Another one bites the dust

Ian Wilson carefully avoids any discussions about the casualties

https://beta.companieshouse.gov.uk/company/08774150/officers

Well at least they haver removed the computer glitch link for dead franchisees Forgotten however to change the contact details of this property in Cardiif from the recently eparted franchisee What must the seller think Woeful !

https://www.ewemove.com/property-show/?victoria-wharf-watkiss-way-cardiff-cf11-0sd-21952

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

‘TPFG franchisees on average earn 16% of their lettings income from tenant fees, and the ban will knock £500,000 off income to head office’.

Couple of observations:

– £500k at franchisor level equates to the individual businesses collectively being down a cool £FIVE MILLION across the network

– 16% of their gross income will in lots of cases equate to 100% of their net profit margin.

So, good spin by IW when he says the expectation is the number of outlets will go down further; yes they’ll go down but only because the weaker ones will have to sell out to stronger neighbours. Hopefully those sellers will come out whole and be able to move on with their lives but I suspect they’ll be a few with no near neighbours who just go to the wall. All the main franchise players have a track record of walking away from weaker offices, there’s plenty of examples in Belvoir, Hunters, Martin & Co et al, especially when there’s been a bit of client account dipping along the way. And frankly, why wouldn’t they? they’re franchisors not corporate operators.

While I applaud HillofWad being the Jimminy Cricket of ewemove with the level of detail he provides, I do think there is an inevitability about a fast growing franchise brand losing a slice of its franchisees through a combination of scaling up too quickly and not recruiting wisely enough.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Having just finished work I am amazed to see how Hillofwad1 is obsessed with Ewemove and online / hybrid agents . Not sure if he has been rejected by then, scared of the competition or been abused by a sheep in his youth but in an environment of Franchises there will be winners and losers and look solely on the latter. We would all like to see a successful business and maybe you can share your Companies House details so that we can be amazed by your performance. What you have forgot that those who you criticise and embarrassed in a name and shame area are real people and not made up and have feelings. Lets hope you don’t hide from the acidic comments and show us hows it done …is it a simply ( half empty glass ) situation ……..

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

GloTum Yes,I do feel strongly about the Ewemove story and lifting the lid to Pandora’s box.The Head Shepherd has many questions to answer.

TPFG are performing well have some excellent franchises and franchisees including within Ewemove. However the failure rate at Ewemove is disproportionate to the successes and already this year far too many. That is unacceptable .Many of those recently gone have struggled for sometime gradually ground themselves to the ground

Maybe you think that is good shepherding ? Its clear they have been failing this should not have been allowed to happen -either helped or put out of their misery earlier allowing them to mitigate their losses I am not criticsing those franchisees I more than sympathise with their stories and are there for all to see at Companies House Its those that have recruited them with the gushing pitch and lack of real help and mentoring let alone the poor seller who finds out their franchisee far from being a computer glitch has actually gone Not impressed with Ewemoves front of house either as a prospective seller

Maybe you think that is the height of customer service when the chatline operater cant even tell you if you are selling a property whether the franchisee is still in existence?

Pehaps go and have a look at Companies House and study the accounts of the various Ewemove franchisees who have disappeared -Its a little beyond “winners and losers” Some of them never had a chance no property experience and hadn;t even run their own business .2 had lower management roles at B&Q

Well Ewemove set themselves up as the “Nice Guys”with the woolly Little Bo_ Peep image The24/7 service which is effectively an outsourced personal answering service . Despite a background of ever increasing compliance.and requirement for qualifications set out to recruit those with little property experience into becoming estate agents overnight with the prospect of great riches

At least TPFG have changed their recruitment criteria to those with more skin in the game and made it a lot easier financially for those joining

“The shepherd always tries to persuade the sheep that their interests and his own are the same”

Its clear that the original founders suffered no embarrassment taking the King;Shilling .left as soon as they could and didn’t hangaround .Thanks very much whilst far too many franchisees sucked in by their pitch seemingly left to their own devices gradually ground themselves down into personal debt and insolvencyThat reflect sbadly on the whole profession

The leader implicating that these were flibberty gibbets moving around like local property experts at Purplebricks which isn’t the case

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register