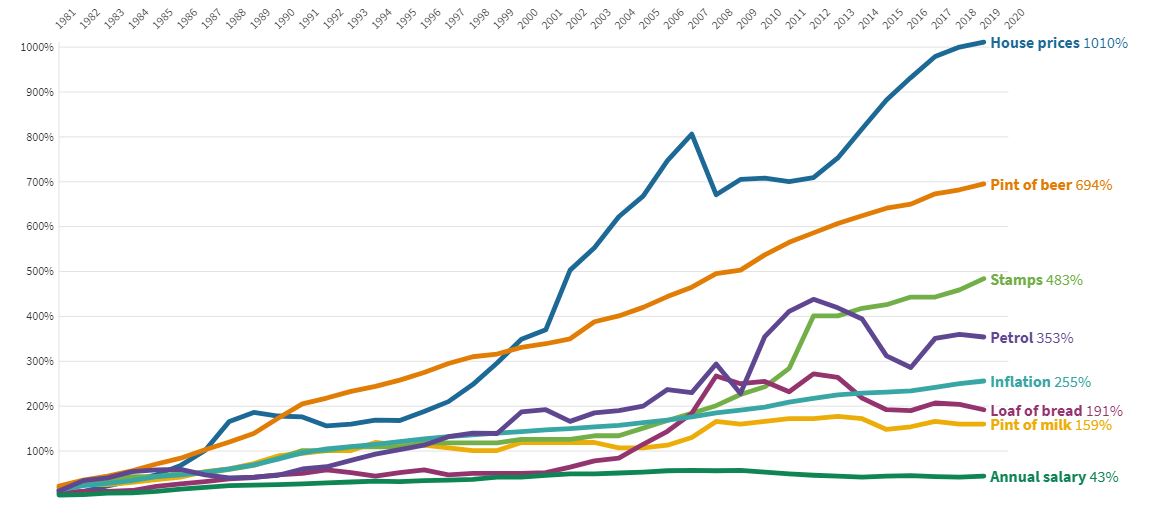

House prices have increased by 1010% since 1980, and that’s 24 times the rate at which annual salaries have increased, according to personal finance comparison website finder.com.

Finder’s historical price tracker has analysed the average price of a range of common items since 1980 to see which ones experienced the biggest increases and how these compare to annual income and inflation.

Since 1980 inflation has risen by 255% while annual salaries have jumped by just 43% meaning that inflation has increased 6 times the rate that annual income has, implying Brits are not receiving enough compensation to cope with the ever increasing cost of living.

However, house prices aren’t just beating salaries, they have also risen far above inflation by sitting at almost 4 times the rate of inflation. As house prices have become more unaffordable against salaries this may explain why Brits are turning to renting more frequently than before.

Similarly, both the cost of 1st class stamps and petrol have increased above inflation over this time period by rising 483% and 353% since 1980 respectively. While, the cost of a pint of milk and loaf of bread sit below inflation, jumping only 159% and 191% respectively.

How did the items fare in 2019?

The only item analysed that rose more than inflation (1.74%) in 2019 was stamps, which increased by 4%, almost 2.6 times ahead of the inflation rate.

All other items sat below inflation in 2019, including house prices that increased by only 0.99%, which is 1.75 times below inflation. This is a rare occurrence with house prices increasing above inflation for 26 years of the 40 analysed.

While all the other items increased in price during 2019, both the cost of petrol and a loaf of bread decreased in price by 1.4% and 3.8% respectively. However, this trend isn’t expected to remain the same for bread this year. The worst wheat harvest in 40 years means the cost of a loaf of bread is predicted to increase 12.5%, which is far above predicted inflation for 2020 of 1.4%.

The difference is that over the last 40 years interest rates have come down dramatically. On average around 9 to 10% (even up to 14) , down 1 or 2% . I remember in the early 90’s as a young family my mortgage was almost £1000 a month whereas my Son’s mortgage all these years later in a similar house is around £900. What has not changed much is the multiple they will let you borrow. 3 times in the 80’s to possibly 4 or 5 times now. Therefore if house prices have gone up over 1000 percent and salaries by only 43% then it is no wonder young people can’t afford mortgages as the múltiples just never add up to enough. The reality is they are then paying more in rent than a mortgage would have probably cost them, had they only been allowed to borrow the money. I also think in the 80’s and 90’s we must have allocated a lot more of our disposable income to mortgages rather than holidays, technology and going out etc. We must have as he earns a lot more than we did and yet my mortgage was more!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register