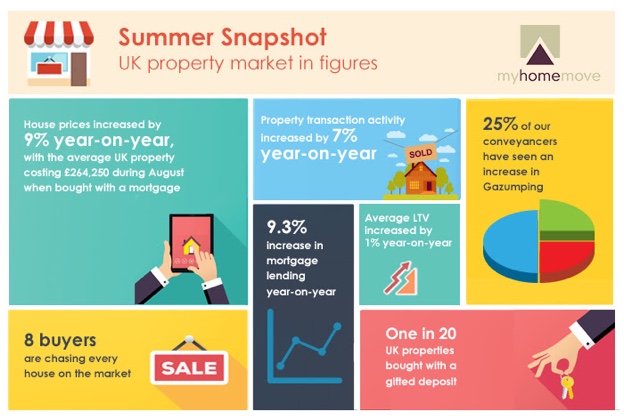

Gazumping is back, say conveyancers.

The UK’s largest conveyancing firm, myhomemove, has confirmed a rise in gazumping, saying that just over a quarter of conveyancers have seen instances where a new buyer gazumped the original purchaser during June, July and August.

The firm also says that 36% of conveyancers have seen an increase in the number of sellers pulling out of transactions, while a further 62% of conveyancers have seen a rise in the number of sellers asking for more money during a transaction.

In statistics released this morning, the firm also said that nearly half (47%) of home buyers who have used the Government’s Help to Buy scheme have needed a gifted deposit.

Doug Crawford, CEO of myhomemove, said: “This means that even with direct intervention from the Government through its equity loan and mortgage guarantee schemes, the cost of property is still too high.

“For many people, the dream of owning a property without financial assistance from the bank of mum and dad is just unattainable.”

The firm says that increasing numbers of both first-time buyers and second steppers are using gifted deposits.

It estimates that over 16,000 first-time buyers will make purchases using gifted deposits this year.

The firm says the average UK property that was bought with a mortgage in August stood at £264,250.

In June, July and August, myhomemove said it helped nearly 13,000 people move home.

Crawford said: “Scale this up for the country and over 525,000 families bought and sold during this period, an increase of around 7% year-on-year, according to Land Registry figures.

“The only question that remains, however, is can this be sustained as demand continues to outstrip supply.”

Separately, Hometrack this morning reported that annual house price inflation across 20 UK cities is running at an average of 8.3%.

Hometrack also says that house prices in the cities are up by 19.9% since their 2007 peak.

The average disguises huge variations, including London, Cambridge and Oxford, where house prices have gone up 41.6%, 43.6% and 34.4% respectively since 2007.

However, these contrast with Belfast, Liverpool and Newcastle, where prices compared with peak are down 46.8%, 13.4% and 7.5%.

On an annual basis, all 20 cities have seen house price inflation, apart from Aberdeen where prices have slipped 2%.

Cambridge has the highest annual inflation at 11.2%, followed by Oxford at 10.6% and London at 10%.

Below, myhomemove’s figures which include the statistic that 25% of their conveyancers have seen an increase in gazumping

Not so much the case in my neck of the woods. Was last Spring. Pretty steady and increasingly price sensitive this year. Low supply of sellers seeing a lower supply of buyers in turn although better volume of supply than last Spring, which was sealed bids galore. Seems vaguely familiar somehow.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register