Property recruitment specialist, Rayner Personnel, has revealed that despite the stick UK estate agents receive for their so-called high commission fees, they actually rank mid-table when compared to other prominent property selling nations.

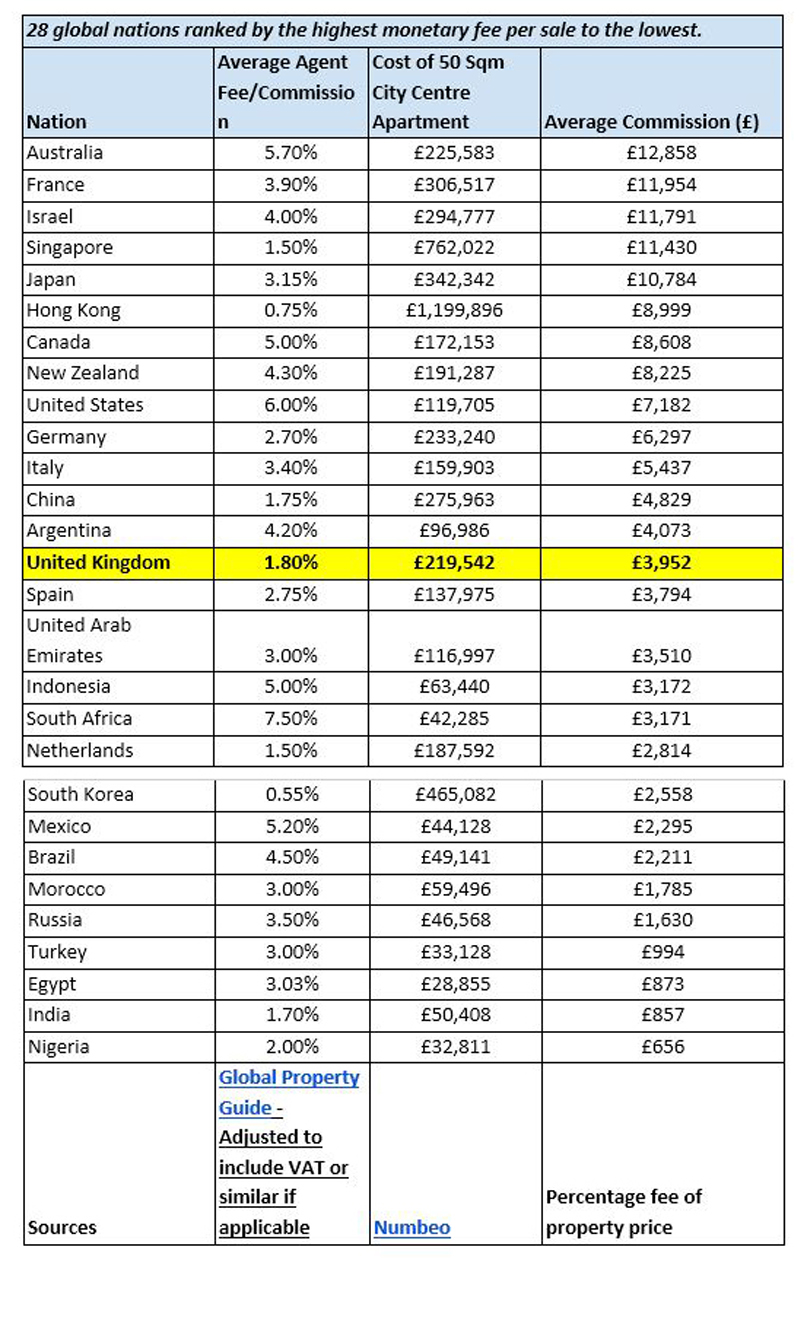

They looked at the average agent commission fee across 28 global nations, factoring in VAT and other similar taxes where applicable, and found that at 1.8%, the UK was actually home to one of the lowest fees going.

In fact, only China (1.75%), India (1.7%), Singapore (1.5%), Netherlands (1.5%), Hong Kong (0.75%) and South Korea (0.55%) come in lower.

The highest was in South Africa, where according to the Global Property Guide, agents charge a whopping 7.5% average commission on a sale. The United States (6%), Australia (5.7%) and Mexico (5.2%) were also home to particularly high estate agent fees.

Of course, while UK fees might be some of the lowest, the high price of UK property means the actual money earnt pushes UK estate agents up the table.

Rayner applied each nation’s fee to the average cost of a 50 square metre city centre apartment to see how the monetary fee re-jigged the running order.

Based on an apartment costing £219,542, the average UK commission would result in a monetary fee of £3,952, bumping the UK from the 22nd most expensive percentage fee, to the 14th most expensive in a monetary sense.

While estate agents in the likes of Indonesia, Mexico and Brazil earn a much higher percentage fee, the lower property prices in each nation see them fall below the UK in terms of actual money earnt.

The lowest fee of all is in Nigeria, where the average city centre apartment costs just £32,811 and the average agent will earn just £656 selling one.

However, the UK was still eclipsed by the earnings per property sale in Argentina, China, Italy, Germany, United States, New Zealand, Canada, Hong Kong, Japan, Singapore, Israel, France and Australia, where agents earn between £4,000 and nearly £13,000 a sale.

Founder and CEO of Rayner Personnel, Josh Rayner, commented:

“There’s a pretty unfair perception in the UK that estate agents get paid a lot for very little, but when you compare the average commission fee to other nations around the world, it’s clear this simply isn’t the case.

“That’s not to say estate agency can’t provide a fulfilling and lucrative career path for those that opt to work in the sector and those that put in the effort will be rewarded with great earning potential.

“While we could still do with some form of regulation, we’re lucky to work across a property market that remains largely consistent in terms of transactional volume, holds its value almost whatever the weather and can provide so many with such rewarding work, day in, day out.”

Having spent the past 20 years researching fee techniques and specialising in helping British estate agents increase their otherwise pathetic commission percentage, I do have some observations here! Firstly, I’m not sure that the percentages quoted for some of these countries is anywhere near correct. Having trained agents in both Australia and France, I can tell you that you’d struggle to find an agent charging as much as 5.7% in Australia – the average is usually 2%-3% (as professor Google will confirm). Likewise, you’d be very lucky to find an agent charging as little as 3.9% in France – where up to 10% is the norm (possibly the poorest value in the world – they are always at lunch!)

However, that aside, the issue is not how much relative fees are in monetary terms, but the value an estate agents brings to the sale. In South Africa, where I consistently charged 7% for several years, once the sale is agreed, the agents’ fees are due, as they are in the USA (6%). No linked transactions, no liaising with solicitors or surveyors, not gazumping/gazundering, etc. Arguably poor value compared with the hassles we have to deal with in the UK to hold a sale together. We do an incredible amount here, but most importantly, it’s our ability to negotiate a better deal than the seller could have done themselves, as well as all the onward sales progression that easily justifies a higher fee. If we can’t secure 5%-10% more than the seller then we are not worth our fee, which frankly should be at least 2% as it is for many of those agents who have attended my fee-raising seminars over the years. And by the way, now is the perfect time to increase yours too! Have a great day!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Regulations differ state by state but most US real estate agents have to deal with title and escrow documents (the conveyance), not to mention negotiating over requests for repair, deal with home inspection (surveyors), rent back terms etc. Sales do fall out of contract just like in the UK. I would argue US agent have to do a lot more to justify their fee of 3% (only 6% IF they’re lucky to close both sides).

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

UK fees are almost always “both sides” whereby the only agent who can find a buyer is the selling agent. Buyers are usually unrepresented (although watch this space). The issue is that US consumers pay 6% and UK consumers pay less than a third of this for the same end result – to move house! 🙂

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Totally agree with Richard. With such a lack of instruction coming on agents are dropping their pants daily. We’re still charging 2% plus vat but the other pathetic agents in our patch are typically 0.8% – 1%. They are actually proud of themselves when they win instructions whereas I would be ashamed of my lack of skills. One ultra pathetic High Street agent in our area claim on their website ‘we will match any fee!’, this recently involved them doing a fee for free ‘because they had to’. Unless agents learn a better skill set and charge decent fees they won’t survive the recession!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

100% agree Sunbeam! No pride, no skill, no business acumen, low self-esteem, and very poorly managed/trained. With that sort of agent around it should be easy to shine! Bring it on! 🙂

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

VERY true Richard.

I attended one of your seminars in Leeds many years ago. Since then I have rarely charged under 1.5% and often I get 2%. It works and it brings in more revenue and creates less stress.

I remember discussing at the time – it makes more sense to sell 50 houses per year at 1.5% than 75 houses per year at 1%… The same amount of money comes in at the end of the year. but you can look after the clients properly. At 2% you can make some money too!

I would say to any agent in these buoyant times – try pitching at 2% for a week. Be brave. You’ll be surprised.

Agree Richard?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Absolutely Jonny. Once you know how to defend your position on fees, everything else falls into place – oh yes – and you get the instruction as well! I’d go even further than you suggest – it’s easier to get 50 instructions at 2% than 100 at 1% – especially in a low volume market! Have a great day.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

There couldn’t be a better time what with C19 measures that have to be taken along with a market most agents are struggling to keep up with (certainly in my areas)

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Kinda lose credit when you highlight the UK as an AVERAGE fee of 1.8% maybe 10 – 15 years ago.

These days we all know its circa 1% some of use myself included do charge more but the average will be 1% there or thereabouts.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“We all know it’s circa 1%” – nonsense Smile. Ladies and gents – please don’t believe this negative spin. The 1.8% inc vat is 1.5% net, which is much closer to the average. It’s easy to charge what you believe the average to be – especially if you are an average agent (which I hope you’re not!) 🙂

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

An agent does not get the VAT that goes to the treasury

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Although not on the above list, I have just sold a property myself in Malta, where the Agents fee was 3.5%. I have to say that although the fee was more than I would have expected to pay in the UK, it felt like good value for the outstanding level of service and the swift sourcing of a buyer.

Additionally in Malta, rather than both the buyer and seller engaging their own solicitors, the buyer pays for, and engages a Notary Public, who manages the transaction for both parties.

Lastly, and importantly, the buyer pays a non-refundable 10% deposit once their offer has been accepted and they have provided proof of funds, giving the seller real confidence.

In my own humble opinion, Estate Agents in the UK should be able to charge more for what they do, but I think it will take industry regulation, mandatory professional qualifications and possibly the whole industry and sales process turning upside down for the public to accept this and see the value in what these professionals do and how hard they work to sell property.

Estate Agents in the UK need to be viewed as sector professionals, much like Solicitors, rather than the public having the attitude of ‘anyone can sell my house, so I will engage the Agent with the lowest fee’. It’s been a race to the bottom in terms of fees in many parts of the UK for years – change is needed – only then will the general public accept an increase in fees.

Before anyone jumps on me for this – yes I am a Property Recruiter, but I also spent over a decade as an Estate Agent, so I understand everyone’s frustration.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Too many properties sell themselves (e.g London) and far too many estate agents do little more than host online, walking away from their ‘work’ the moment a buyer and seller are matched.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The main difference between the UK and the other countries ? Rightmove, Zoopla, the massive amounts of free information, very informed buyers and sellers.

Go back 20 years – the agent earned the fee by being an amazing matchmaker, you knew your stock inside out and you developed the skill of interviewing buyers and matching them with their ideal home, you then convinced them of the amount to pay for it, and they trusted you. Sellers really happy to pay a high fee as you convinced the buyer to pay more. The buyers eventually didn’t like the agents as they realised they maybe paid too much. Estate agents become pretty much the most hated job role. Estate agency does little to no PR / marketing to counteract this view, and become the stereotype jag driving, friday afternoon golf players. Sorry to those that didn’t – but we all know the ones that did.

Rightmove arrived, nethouseprice arrived, brokers lending 110% values.

Property crash.

Successful agents with higher fees will claim that it is due to their superior marketing, or their more knowledgable staff etc etc . I think that you will find that the most successful agents with slightly higher fees tend to be the ones with the most stock. Due to a lack of good stock they are able to hold buyers to ransom – if you list your home with ourselves then we will do our best to get you this one you are looking at.

How do agents break this cycle? You have to have very deep pockets do loads of marketing and offer the service for free or at a price that people just can’t resist. Remember how Foxtons took over London.

In regard to agents achieving a higher price for a property – its a great claim as no-one can actually verify it. The onliners will produce stats showing they achieve the most, etc etc

One thing that every agent should look at is to go through their sales pipeline, then go to the buyer in their database and just check if that buyer first saw the property on Rightmove and called the agency. Or did the agency contact them. I would bet that over 90% of buyers first found the property themselves using Rightmove and called the agent, not the other way around. This is where the buyers see the value and they did it themselves !

Until agents are quicker at getting the property details to the buyer than Rightmove or Zoopla do then they will be seen as not doing very much. Agents should always call their own database first to let them know before they see it on Rightmove and Zoopla – this adds loads of value. Agents should tell buyers and sellers not to call their solicitor themselves – inform them that this is a service they are paying for.

I think the market place needs to separate into two streams – one a high quality hand holding service where you pay the agent a fair fee for doing a lot of work for you as you prefer to have someone else do it all. Then another stream which will be the DIY track where companies like Strike will do it for free but you need to do a lot of the work yourself and there are more risks involved.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register