Activity in the prime London housing market fell in the final quarter of 2022, according to analysis by LonRes.

Activity in the prime London housing market fell in the final quarter of 2022, according to analysis by LonRes.

Under offers and sales had been consistently higher than pre-pandemic levels in the first three quarters but returned to near those levels in the final three months. However, despite lower sales in the final quarter, sales across all price bands were higher than their 2017-2019 average during 2022.

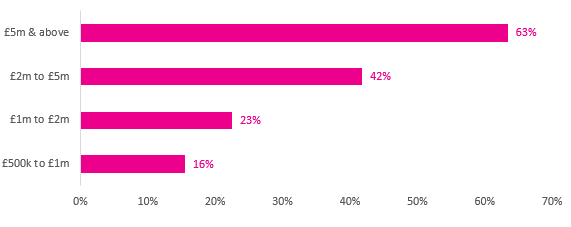

The top end of the market recorded the strongest performance in terms of sales during 2022 – sales were 63% higher than their pre-pandemic average for properties priced at £5m and above. New instructions in Q4 2022 for this price band were 74% higher than the pre-pandemic average.

The increase in new instructions and a fall in sales led to high numbers of top-end properties listed for sale at the end of 2022. Listings were 24% higher than pre-pandemic, although this figure includes under offers.

The £1m to £2m market saw 23% more sales in 2022 than the 2017-2019 average, while the £2m to £5m market recorded a 42% rise over the same period.

Meanwhile, a lack of homes to rent and strong tenant demand helped increase prime London rents to new record highs in 2022, with rents ending the year 13.7% higher and 19.8% higher than the pre-pandemic average.

Commenting on the findings, Anthony Payne, managing director of LonRes said: “The top end of the prime London market was one of the strongest performers of last year. And it’s not surprising, therefore, that it tempted would-be sellers to put their homes onto the market.

“In the final quarter of 2022, new instructions in this rarefied market were some 74% higher than the pre-pandemic average. But this a discrete sector and many of these properties will be marketed quietly off-market – and just as quietly withdrawn if they fail to meet their asking price.

“Meanwhile, the prime London rental market continues in much the same vein as we have been reporting over the last months. A shortage of stock, but no shortage of tenants continues to put pressure on rents, taking them to new highs.”

Comments are closed.