A greater proportion of properties entering the rental market that were previously for sale have an EPC rating of C or higher, as landlords invest in higher EPC rated homes and get ahead of potential legislation changes, a new rental market study by Rightmove shows.

A greater proportion of properties entering the rental market that were previously for sale have an EPC rating of C or higher, as landlords invest in higher EPC rated homes and get ahead of potential legislation changes, a new rental market study by Rightmove shows.

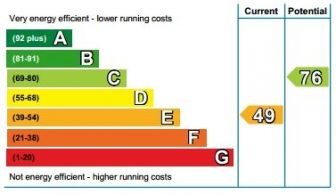

The latest government plans suggest that all rental properties should have at least an EPC C rating by 2028.

The proportion of properties entering the rental market with an EPC rating of A to C that were previously for sale has increased by 16% since January 2019, while the proportion of rental homes entering the market with a D to G rating that were previously for sale has dropped by 11%.

These findings are supported by a new survey amongst landlords, where more property investors said they are avoiding lower EPC rated homes.

Almost two-thirds – 61% – of landlords surveyed by Rightmove said they would not buy a property below a C rating, up from 47% last year, while a third (33%) of landlords who own lower EPC rated properties plan to sell them rather than make improvements to their EPC rating, compared with 20% who planned to sell rather than improve last year.

The poll also revealed that more landlords are aware of proposed changes to EPC legislation than last year, likely contributing to some of their decision making. 80% of landlords are aware of new energy efficiency legislation, compared with 65% last year.

The changing attitude towards lower EPC rated properties comes as landlords face challenges in the market, leading some to sell up. Some 16% of properties for sale were previously on the rental market, up from 13% at this time in 2019.

Concerns about government sentiment towards landlords (47%), rising taxation (41%), increasing compliance requirements (33%) and the rising cost of buy-to-let mortgages (25%) are high on the list for landlords.

However, the study revealed that attitudes towards lower EPC rated properties varied amongst landlords depending on how many properties they own.

Landlords who already own five or more properties are much more likely to plan to increase their portfolios over the next 12 months (27%) compared with landlords who only own one property (10%).

Landlords with bigger portfolios are also more likely to make improvements to their properties below a C rating before 2025, and be more willing to invest in a property with an EPC rating below a C than those who only own one property.

Rightmove’s Tim Bannister said: “Upcoming changes to EPC legislation is a growing concern for landlords, however the data suggests that many are getting ahead and focusing their investment on properties that will meet the new minimum standard and bringing these to the rental market.

While some may sell up, those with bigger portfolios are more likely to be planning to carry out the necessary improvements to increase the EPC rating of their lower rated homes and are more willing to invest in lower EPC rated properties, potentially to improve for the future.

“This suggests there may be a changing of the guard over the next few years, with landlords with bigger portfolios buying up lower EPC properties being sold by landlords with smaller portfolios, to improve and then rent out again.”

Only to be expected, who in their right mind would spend £K’s on a new buy today, they may not be able to rent in the future or costs give the kiss of death.

If government are that foolish to continue with the idea of EPC C, they would be forcing a mass exodus all over the country. If you think its bad now …… wait and see.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register