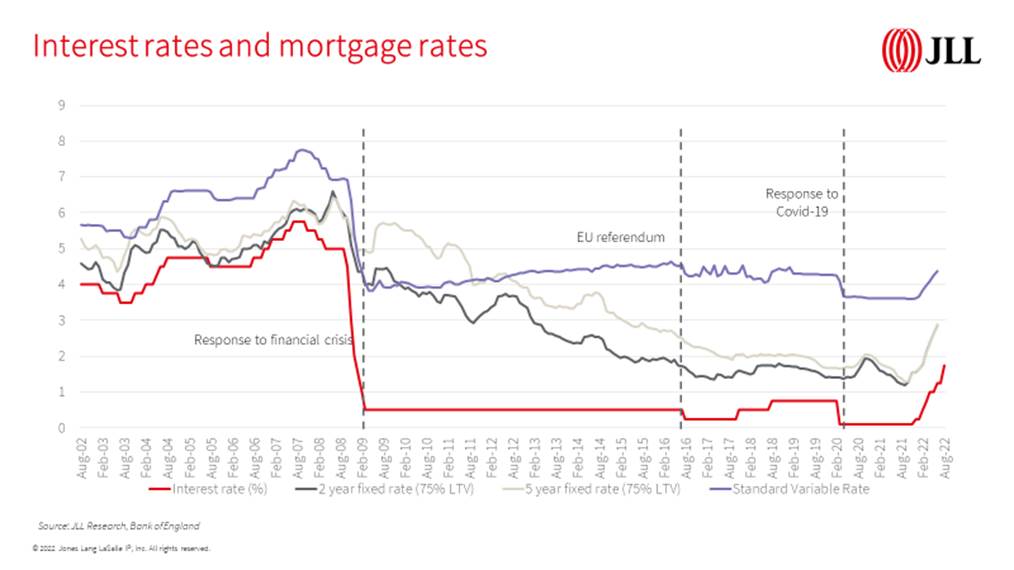

In a move that will have surprised no-one, the Bank of England’s Monetary Policy Committee lifted borrowing costs by 50 basis points, taking UK interest rates to a 13-year high of 1.75%

It is the largest rise in UK interest rates since 1995 but the rate remains far below what was considered ‘normal’ before the financial crisis of 2008.

The MPC took decision in the face of rising inflation and projections indicating that the UK will enter recession in the final three months of the year.

Industry Reactions

Simon Gammon, Managing Partner, Knight Frank Finance:

“Mortgage rates are now changing on a daily basis and lenders are giving borrowers and brokers little notice about repricing.

“We’re seeing two significant impacts on borrowers. Firstly, some homeowners who are nearing the end of their terms are facing a shock when they come to refinance, because they are unable to borrow as much as they hoped.

“Secondly, those who are looking to buy are realising once obtainable properties are now out of reach. The question for them is now not “how much can I borrow?” but “how much can I afford to borrow?”. This is a subtle but very important shift in borrower behaviour that is driving people to re-evaluate the price at which they can buy.”

Nicholas Hyett, Investment Analyst, Wealth Club:

“The Bank of England is playing catch up after some bumper rate rises from the ECB and Federal Reserve in the last month. The resulting rate hike may be the largest in nearly 30 years, but it was also widely expected, and the market reaction has been modest. Instead, the real focus today is on how much further the bank is willing to go as it seeks to bring inflation back down to its 2% target.

“The current inflationary spike is being driven by global food and energy prices, and higher interest rates in the UK will do little to alleviate those pressures. Stronger sterling has the potential to provide some relief. However, rising rates in the US and Europe mean the BoEs actions haven’t helped the pound much, and sterling is currently trading near its weakest level against the dollar in over 40 years.

“The risk now is that higher interest rates start to squeeze consumer and commercial borrowers too much, strangling the life out of the economy without significantly easing the cost-of-living crisis.

“Markets still think the Bank has a rate rise or two in the tank, but to some degree UK monetary policy is now caught in global forces over which the Bank has little control. Inflation will rise or fall according to what happens in Ukraine not Threadneedle Street, and rate decisions are dictated by moves at other central banks as much as by the MPC.”

Tom Bill, head of UK residential research at Knight Frank:

“Rising rates will dampen demand in the UK housing market but there won’t be a cliff edge moment. With mortgage offers lasting for up to six months and the majority of homeowners on fixed-rate deals, the impact will be more gradual.

“The Bank of England’s decision is a step back towards normality after 13 years of ultra-low borrowing costs. At the same time, supply is rebuilding following the distortive effects of the pandemic and stamp duty holiday.

“As rates and supply normalise, the current period of double-digit house price growth will come to an end.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“Wrestling inflation under control and reducing the cost of living is the number one priority at the moment. Ultimately, this is key to ensuring that people can keep up with their mortgage and rent payments.

“Those on a tracker mortgage or people moving onto a standard variable rate will see their repayments increase again, adding to the pain from the surge in the cost of energy and essential goods.

“Homeowners on fixed-rate mortgages are in a better position, with no immediate effect on repayments. Keep an eye on the date when you are due to remortgage, as our research shows that around 1.5 million fixed-rate mortgages will end this year.

“These decisions could also affect house prices in the coming months. Over the last two years, we have seen unprecedented demand for property, which is in large part due to the ultra-low interest rates that have made getting a mortgage easier.

“As more people have wanted to get their foot on the property ladder, house prices have soared. Another consecutive interest rate rise could make potential buyers more hesitant about taking on a mortgage. If it does, we will likely see property prices cool off in order to entice more people to buy.”

Jason Tebb, CEO of OnTheMarket:

“This latest rate rise was widely expected, given continued high inflation, but we don’t expect it to quash positive buyer and seller sentiment in the housing market.

“As long as buyers remain confident about obtaining the mortgages they need and being able to afford them, increases in rates, while unwelcome, are unlikely to result in a slamming on of the brakes.

“Even with this half-point rise, it is still a comparatively cheap time to borrow money; in a few months’ time, the picture could be very different.”

Frances McDonald, research analyst Savills:

“Today’s increase was not unexpected and will have been factored into many buying decisions, though successive rate rises are undoubtedly contributing to slowing house price growth. Rates are in line with our forecast assumptions for 2022, with the expectation that annual price growth will slow to 7.5% by the end of the year, down from its current 11.0%.

“The five base rate rises we have already seen over the last six months have caused a significant increase in the cost of mortgage debt. For someone borrowing a 75% mortgage, the average quoted 2-year fixed rate more than doubled over the year, from 1.39% in June 2021 to 2.88% in June 2022.

“Although these rate rises will have the greatest impact on new entrants to the market and those on variable or tracker mortgages, they will also affect those wanting to trade up the housing ladder, particularly given the strong price growth we’ve seen of late, unless we see lenders absorbing some of the increases.

Comments are closed.