Government legislation that came into effect on April 1 2023 could leave England’s commercial property sector facing a risk of £1.4bn in annual rent, according to new research.

Government legislation that came into effect on April 1 2023 could leave England’s commercial property sector facing a risk of £1.4bn in annual rent, according to new research.

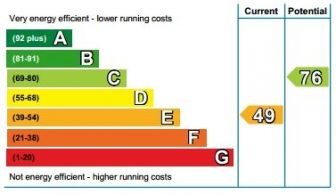

Commercial buildings that do not have an energy performance certificate (EPC) rating of E or above are no longer able to be traded or leased under the new legislation. As the regulations are set to evolve over time, with the minimum EPC rating rising to C in 2027 and B in 2030, the level of regional rent at risk could increase to £3bn and £4.8bn respectively, as legislation tightens.

Analysis from EG, a provider of data, news and analytics for the commercial real estate (CRE) sector, found that London’s commercial real estate market will be the hardest hit, with 24.1 million sq ft failing to meet the regulations. Across the whole of England, the number rises to 95.6 million sq ft.

Tom Flanagan, product manager at EG, commented: “The CRE market will undoubtedly take a significant hit following the introduction of this new EPC legislation. With billions worth of rent taken off the market and assets left stranded, we can expect to see rental premiums put on energy efficient buildings and competition for properties increasing.

“For many CRE landlords, now is the time to take action as the EPC regulations only strengthen over the coming years. By acting now, landlords can ensure their properties are compliant for the years to come and – most importantly – meet the market demand for energy efficient, sustainable buildings.”

Liz McKillop Paley, real estate principal associate at law firm Shoosmiths, added: “The new rules enforced from April 2023 only apply if a building falls under MEES regulations and where there is a valid EPC. If a property is vacant, it can remain so without an EPC. The risk of not making improvements, however, is that a landlord could be left with a stranded or obsolete asset.

“Carrying out cost-effective energy efficiency improvements and meeting the EPC standards – even through making small upgrades during a building’s life cycle – can have a big impact, ensuring a landlord complies with the regulations as they evolve, while also avoiding being left with a property that the market deems substandard.”

Half the properties in the UK including residential will be obsolete assets!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

So more boarded up commercial stock that is worthless. Many UK High Streets do not know what’s about to hit them. Your local town will become a blight on the landscape somewhere you grew up and proud to call your town, until ………………..

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register