ARLA Propertymark has warned members to ensure they do their due diligence on deposit replacement schemes.

Several deposit-free or replacement schemes have emerged in recent years and providers are pitching themselves to agents as a way to earn commissions or provide extra service to tenants and landlords once the fee ban comes in from June.

An ARLA Propertymark document, seen by EYE, said these schemes “purport to offer faster on-boarding of tenants, fewer voids and potentially less hassle when tenants move out,” but said the model is still “relatively unproven”.

The update said: “Deposit-free schemes are relatively unproven as businesses, and while the early-to-market providers have a few years of experience, several have only recently launched.

“As such, agents who decide to include a deposit-free offering in their business should be careful when choosing their preferred partner.

“Agents should be aware of the potential risks involved in participating in deposit-free schemes and should look carefully at the protection offered and specifically the consequences should their provider fail, and their landlords are potentially no longer protected.

“Agents should also check the small print of any scheme to make sure there are no exclusions or conditions that could limit the protection offered.”

Members are also reminded that this can only be offered as an optional replacement to alternative deposits or they could fall foul of the tenant fee ban and face fines.

The note suggests agents consider if a scheme is regulated by the Financial Conduct Authority, which requires staff to follow certain standards and to have adequate working capital.

Similarly, ARLA Propertymark says agents should check if the product is protected by the Financial Services Compensation Scheme (FSCS).

It warns that those who use schemes without these protections are reliant upon the success of their provider and may lose protection if the firm collapses.

Agents are also asked to consider what type of loss is covered and how it compares to a cash deposit, as well as how much it costs and if there is any dispute resolution in place and how it works.

Where commission or referral fees are paid, ARLA Propertymark reminds agents that this must be made clear to tenants.

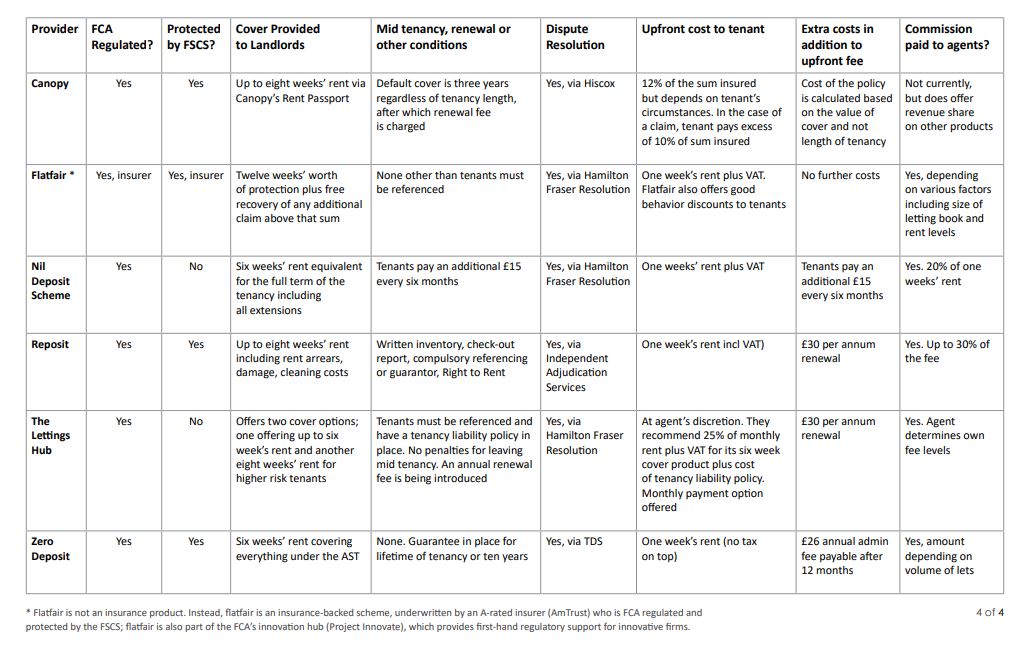

ARLA Propertymark has also produced a table that compares the six main providers on the market.

It shows five out of six are regulated and pay commission, while all offer dispute resolution.

Levels of cover vary from six to eight weeks and only three provide FSCS protection.

Why risk going with an unregulated firm…

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

It’s not your money, stop messing around. Put it in the Deposit Protection Service. Its free, its quick and easy. No further worries. End of story.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

How backward, get with the times

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

It’s all happy smiling faces now but I’ll give it three years (30-months is the average length of tenancies in our Group these days) and there will be some high profile scheme failures. Who will the agent turn to then? If the landlord has suffered a loss and the agent has no cash deposit and no “nil deposit” insurance company to claim against, then they have three options; tell the landlord to take a small claim action against the ex-tenant, claim on their PI insurance (inept choice of deposit alternative is probably covered as professional negligence) or fork out from their own pocket.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Do you some research chump…..

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Strange you should say that, rather than explain yourself. It isn’t your money…. period. The above options are riddled with fees and commissions that are about to be banned. Deposits will soon be banned because of the goings on with the tenants money. Someone seems to forget the real value of a tenant having a commitment.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

As long as there is a fee free option for the tenant then the TFB allows the offering of an option with a fee. i.e. give the tenant the option of paying a deposit (a permitted payment) then a deposit replacement scheme option with a fee is legal.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register