Last Friday, the Chancellor, Rishi Sunak announced that the Coronavirus Job Retention Scheme is to be extended by one month to the end of June.

It is now estimated that the cost of the Scheme will be £50 billion.

The scheme, which allows firms to furlough employees with the government paying cash grants of 80% of their wages up to a maximum of £2,500, was originally open for three months and backdated from the 1 March to the end of May.

To claim the grants businesses will need to access a new portal and make their claims online.

Last Saturday (18th April) HMRC wrote to businesses by email saying:

“We want to help you get ready to make your claim under the Coronavirus Job Retention Scheme when it goes live from Monday 20 April.”

The email contained links to updated guidance and a ‘simple step by step guide’

EYE pored over the email and the linked documents but found no indication of how to actually access the portal.

So we asked HMRC.

The first response said:

“…we cannot provide a URL for the portal itself ahead of the go live time of 8am on Monday.”

When pressed they told us:

“We’ll be communicating that from 8am on Monday through various channels, namely:

Updated guidance pages

Social Media, our Twitter page is here – https://twitter.com/HMRCgovuk

Press

Direct comms”

So, stand by for 8am this morning when all should be revealed.

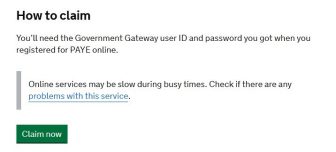

Update: To access the portal click here and then scroll down until you see this section. Then click the ‘claim’ button.

You will need a Government Gateway ID to get in.

Tips for claiming

Nimesh Shah, from London tax and advisory firm Blick Rothenberg, says employers must make sure that their claims are correct and are accurate – those that don’t risk being seen as fraudulent.

“The Government and HMRC are very concerned about fraudulent JRS claims, and the rules and system have been designed to safeguard against this as far as possible. “

“The Government has been vocal that it can and will audit employers and can claw back grants from fraudulent claims.

“Errors with applications are inevitable, given the complexity associated with this untested scheme, and it’s hoped that HMRC will recognise the difference between innocent and deliberate behaviour, but claimants must make sure that their application is as accurate as it can be.

“To introduce a new scheme of this scale, and have an operational portal ready within a month is impressive and HMRC and the Government should be applauded for their efforts.

“It is hoped that HMRC’s system is able to cope with the inevitable demand, and that payments can be processed and paid within the 6 working day timeframe.

“Businesses have anxiously been waiting to make their application as they precariously manage their cashflow on a daily basis.

“They can now make the claim and move forward but they do need to make sure it is accurate

“Our five immediate top tips when making an application are:

1. Businesses need to make sure that they follow correct legal process when furloughing an employee, as it is strictly a change to their employment contact.

2. Careful calculations are required in relation to holiday pay, maternity pay, sick pay, pensions and salary sacrifice as these can give rise to anomalies.

3. The grant can only be paid into the UK bank account of employer making the claim – this is an issue if an agent normally handles a company’s payroll or for an overseas business that does not have a UK bank account.

4. When making the application, all the information must be submitted at once i.e. there is no option to save and return to the form later.

In addition, amendments cannot be made to the form after submission, so it’s important that the application is submitted fully and accurately at the first attempt.

5. HMRC will not provide any e-mail confirmation for submissions and the employer should print the submission record and make a note of the reference number.”

Hi can anyone advise if commission is classed as compulsory or discretionary so we know if we will get 80% of basic pay or off hour annual salary from last year? Thanks

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I think thats a question concerning a lot of employers/employees at this time. The definition is woolly but its a fairly basic question for a lot of industries. If its written into your employment contract then I would say its compulsory and would be fairly easy to demonstrate. If its an unwritten/verbal agreement (as in my case) Im looking through the guidance to see if demonstrating an historic pattern is enough…

After all…you can have verbal contracts.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Suggest everyone reads this, particularly 7.3 through to 7.5

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/879484/200414_CJRS_DIRECTION_-_33_FINAL_Signed.pdf

Also technically most of our staff are a fixed rate employee, so 7.6 and 7.7 we think applies.

Flipping nightmare!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Thanks PaulC for the link. Good spot. Fresh from the horses mouth …so to speak. The ink on Rishi Sunak’s signature is still wet!

Anyone speak horse?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register