Better finance for older borrowers could help unlock housing stock for younger people, the Council of Mortgage Lenders has said.

The trade body analysed its lending data and found what many have long known – the older generation hold most of the housing equity while their younger counterparts have most of the debt.

Instead, the CML research suggests better mortgage products to allow older people to borrow to downsize and release equity that can then free up housing further down the ladder.

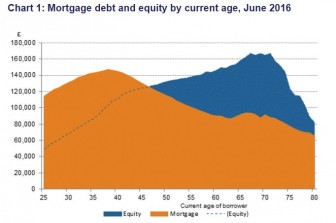

Looking at its data on outstanding mortgages, the CML found that those aged 38 hold the most debt, £147,000 on average, and through to the age of 46, borrowers continue to hold more mortgage debt than the equity they have built up.

Further up the age scale, mortgage debt falls further away and by the age of 60 the average mortgage holder has a debt of £90,000 but free equity of almost £150,000.

But as people get older, the CML says there are now different needs for finance.

The research says: “For a progressively longer-living population, 60 may be the new 50, if not the new 40. A natural part of this welcome progression is that there will necessarily be more and more of the mortgaged population in this ‘younger older’ age bracket. And they will want to continue to access mortgage credit for a variety of reasons.

“On a micro level, facilitating more flexible ways to borrow and draw on housing equity throughout life is likely to be attractive to many. And the same flexibility could offer wider social benefit: for example allowing more freedom for ’empty nesters’ to downsize earlier in life, when they still need mortgage credit to do so but when retirement on the horizon could otherwise prove an obstacle.

“Innovation that removes barriers to a more efficient use of the UK housing stock in this way could have effects throughout the housing market for everyone from first-time buyers through to last-time sellers.”

Interesting article asking plenty of questions. Only trouble is ‘innovation’ and overly burdensome ‘regulation’ don’t normally mix.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register