By Chris Watkin

In this week’s ‘UK Property Market Stats Show’ on YouTube for week ending Sunday, 28th July 2024, with Bryan Mansell, the headlines for Week 30 of 2024 are as follows:

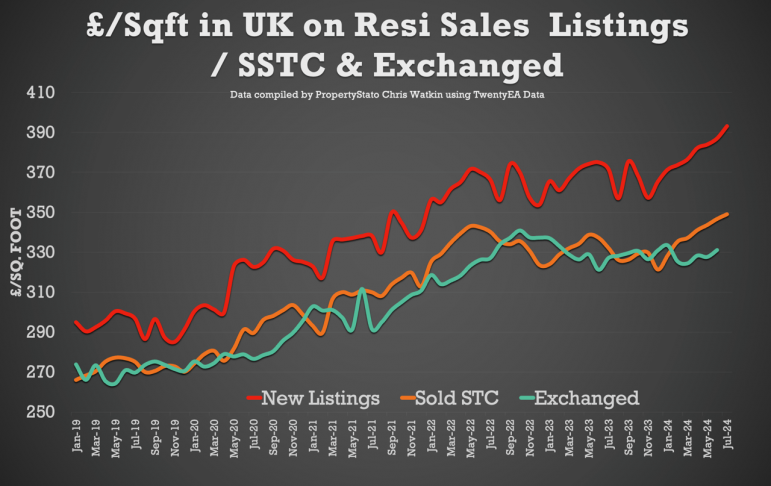

+ UK house prices on homes sold (STC) in July continue to remain strong at £348/sq.ft – meaning house prices are 6% higher than Jan 2024

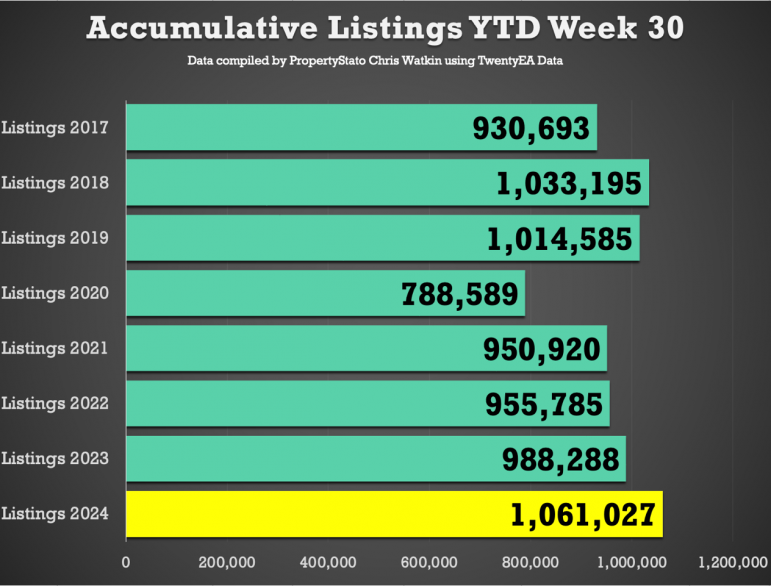

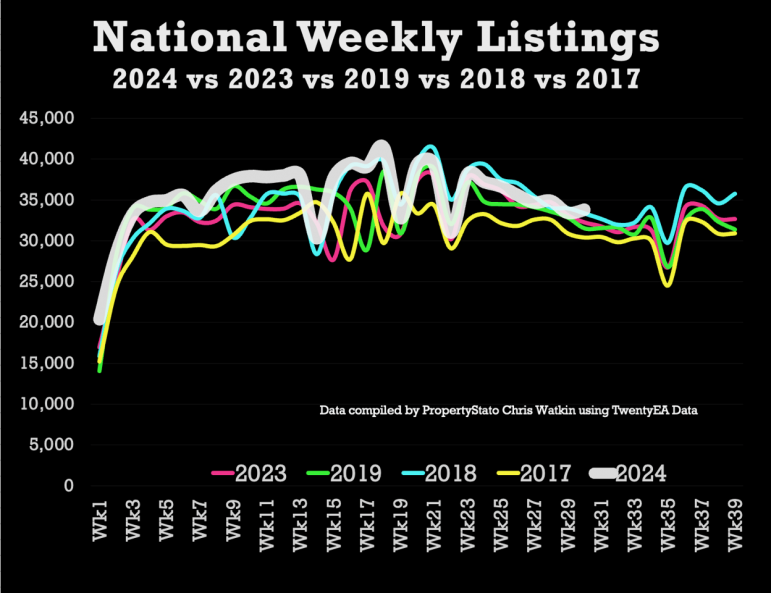

+ Listings – 33.8k UK listings this week. 6.9% higher YTD than 2017/18/19 YTD average

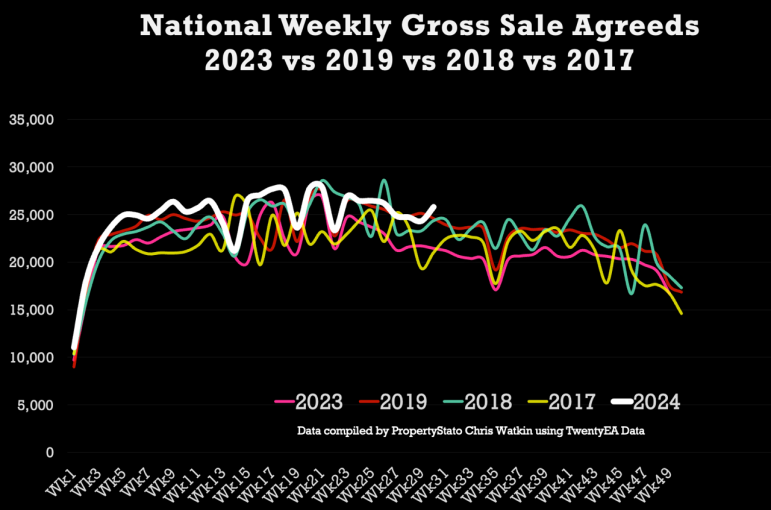

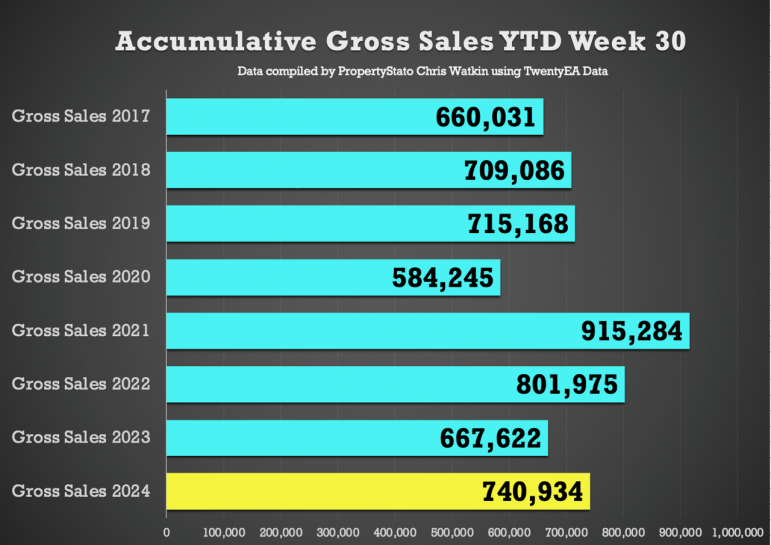

+ Total gross sales – 25.8k – 20.4% higher than the same week in 2023. Also, 6.6% higher than 2017/18/19 YTD levels & 11% higher than 2023 YTD levels

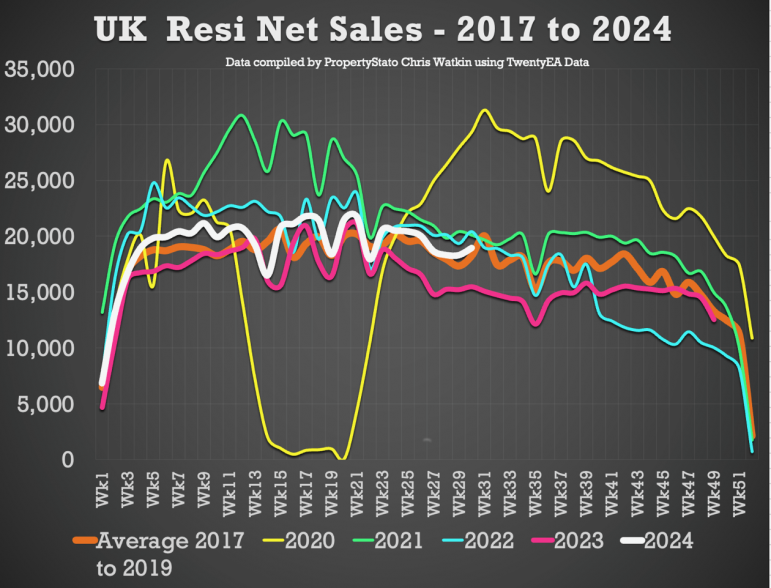

+ Net sales – 18.9k this week, 22.2% higher than the same week in 2023 & 13.2% higher YTD in 2024 compared to YTD 2023

+ % of Homes exchanging vs homes unsold – YTD in 2024, 52.42% of homes that have left UK estate agents books exchanged contracts & completed (ie a legally binding sale), the remaining 47.58% were withdrawn off the market, unsold

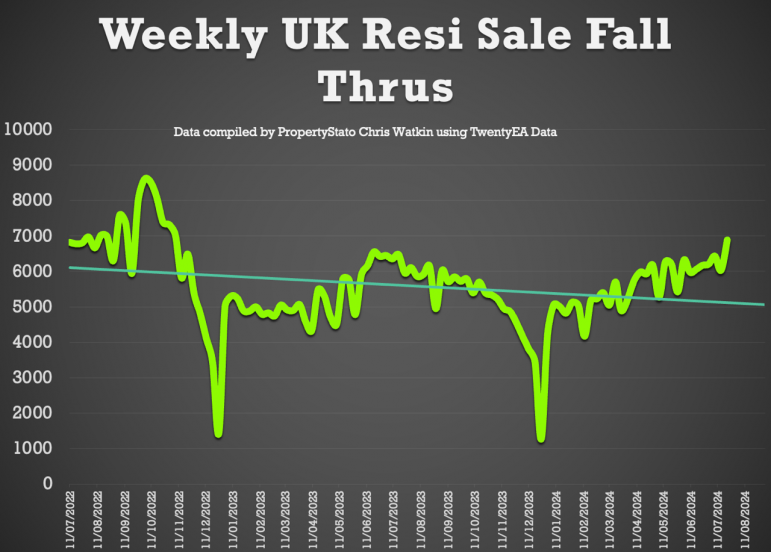

+ Sale fall-throughs – only fly in the ointment is sale fall through rate. In the spring it was an average of 21%. For the last month it’s been 25.6%.This week it has crept up again to 26.7% – yet, everything in context, the seven-year long-term average is 24.8% and it was 40%+ in the Truss Budget

Chris’s In-Depth Analysis (Week 30):

New Properties to Market: The UK saw 33,792 new listings, which is in line with the steady drifting off of weekly listings throughout the summer (see the listings graphs). This year’s YTD listings stand at 1,061,027, 9.9% higher than the historical eight-year YTD average of 992,824, 6.9% higher than YTD 2017/18/19 and 7.4% higher YTD 2023. Just FYI – weekly 2024 average: 35,368.

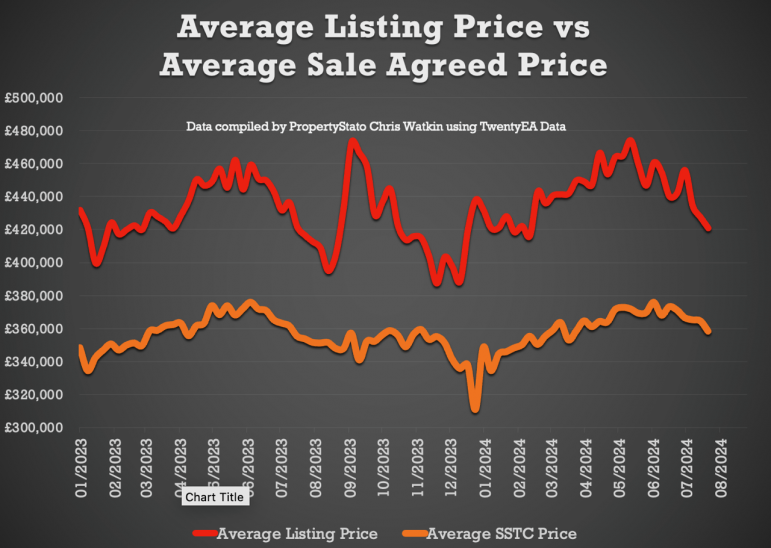

Average Listing Price: £420,852 (2024 weekly average – £442,203)

Average Asking Price of this week’s Listings vs Average Asking Price of the Properties that Sale Agreed this week: 17.4%. Good to see it’s not been the 20%’s for a few weeks. The long-term eight-year average is between 16% and 17%. (Weekly 2024 average 22.6%).

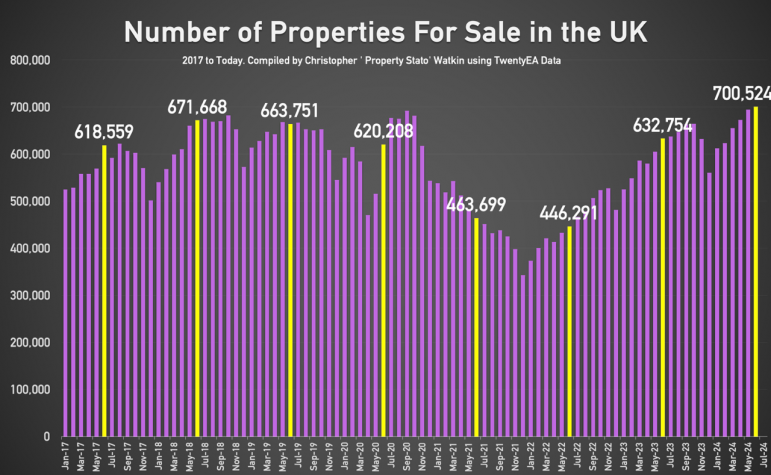

Price Reductions: This week, 22,577 properties saw price reductions, higher compared to the eight-year week 30 average of 17,948. Yet there are higher stock levels. Stock end of month June 2024 (latest data) levels are at 700,524. This means one in seven properties each month are being reduced. Is that enough?

Average Asking Price for Reduced Properties: £396,130. (2024 weekly average – £395,585)

Gross Sales: 25,820 properties were sold STC last week, a 6.2% increase on last week and 2024 weekly average: 24,698 Gross Sales).

Accumulative Gross Sales YTD: The total YTD stands at 740,934, exceeding the average YTD Gross sales figure of 694,762 from 2017/18/19 and 667,622 in the same week 30 in 2023.

Average Asking Price of Sold STC Properties: Still staying in the £350/370k’s range (like has been for 2 years) at £358,488.

Sale Fall Throughs: Fall throughs this week at 6,884 – a back from holiday blip or something more serious? Last three months’ weekly average is 6,094 and 2024 YTD weekly average is 5,554.

Sale Fall Through % Rate: 26.66% for week 30. (Comparison – 23.58% for the last 3 months, whilst the long-term eight years’ average is 24.8% & it was 40%+ in Q4 2022 – the Truss budget!).

Net Sales (Gross sales this week less fall throughs this week) – 18,936.

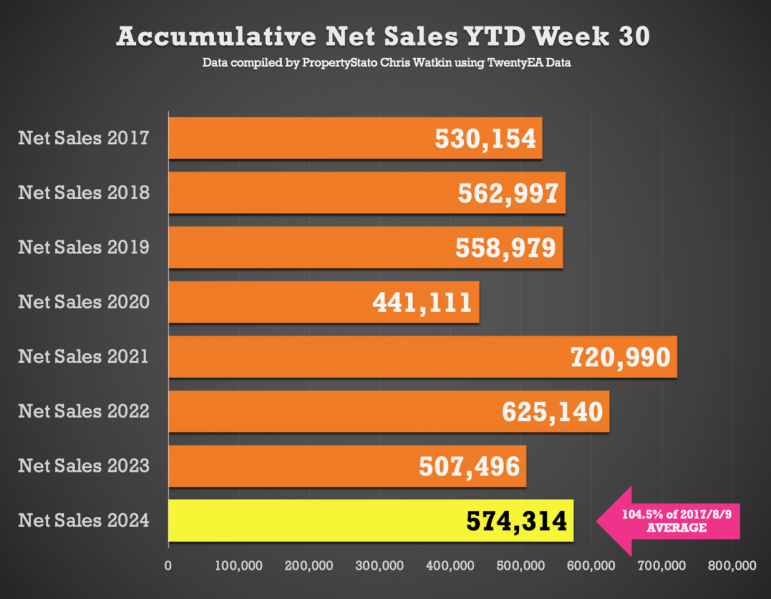

Accumulative Net Sales YTD: The total stands at 574,314, 4.3% higher the 17/18/19 YTD Net Sales average (550,710) and 13.2% higher than the YTD figure for 2023 for Net Sales (507,496)

House Prices on the House sales agreed (SSTC) in July MTD is £348/sq.ft. For comparison, June was £347/sq.ft, May 24 in £343/sq.ft, April ’24 – £341/sq.ft, March 24 – £337/sq.ft, Feb 24 – £335/sq.ft & Jan 24 to £328/sq.ft). As discussed in the show, The £/sq.ft at sale agreed predicts the Land Registry index five to six months in advance with a 92% correlation.

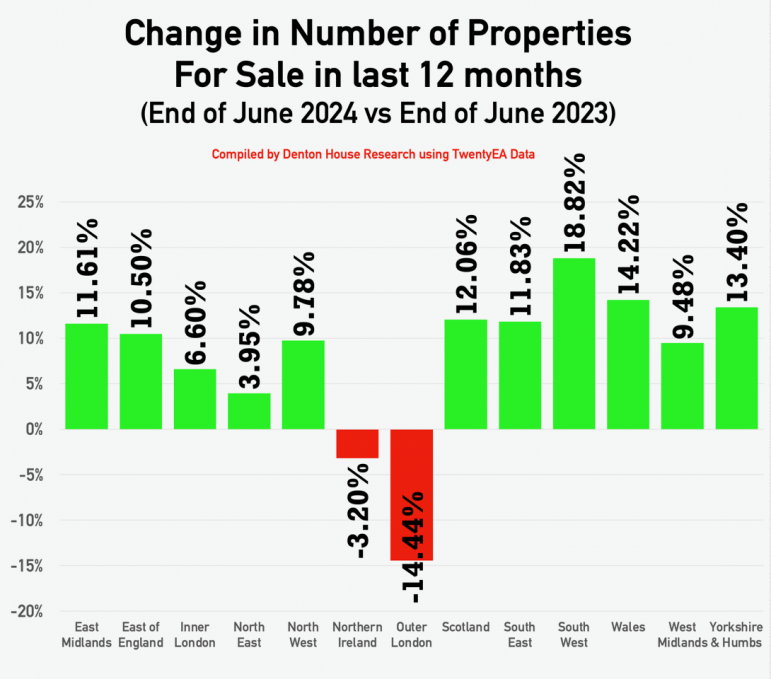

Number of Homes For Sale Now vs 12 months ago: Most regions have more homes for sale today than 12 months ago, apart from Outer London and Northern Ireland

Comments are closed.