With the average UK household now set to be up to £1,000 a year worse off from 1st April (according to the Resolution Foundation) thanks to a perfect storm of rising inflation, increased energy prices and lasting effects of the pandemic, Zoopla has uncovered the most affordable towns and cities in Britain .

The average household in the UK can expect to pay four times their combined salary to purchase a home in 2022 – an increase of 5% since 2021, reflecting that annual house price growth (as of Jan 2022) is almost double that of annual wage growth.

To calculate which areas are the most affordable, Zoopla analysed house price-to-earnings ratios, based on a two-earner household on the average salary for the local area.

Towns in Scotland and the North retain pole position as the Britain’s most affordable areas

For the third year running, the town of Shildon in County Durham retains its position as the most affordable town in Britain with an average house price of £71,000 and price to household earnings ratio of 1.1, driven by lower house prices with a dominance of terraced housing.

Three other County Durham locations also feature in the top ten – Ferryhill, Peterlee and Trimdon Station – as buyers in these towns can expect to pay only up to 1.5 times the average two-earner household salary for a property.

Four towns in Scotland also feature, with all areas of historic Ayrshire including Stevenson, Cumnock, Girvan and – the only new entrant – Irvine making the top ten list, thanks to equal steady house price and wage increases.

Cleator Moor, Egremont and Millom in Cumbria round off the top ten affordable towns in Britain. As home buyers continue their pandemic fuelled ‘search for space’, these rural locations across Scotland, County Durham and Cumbria could be the perfect retreat for those looking for extra space and tranquillity.

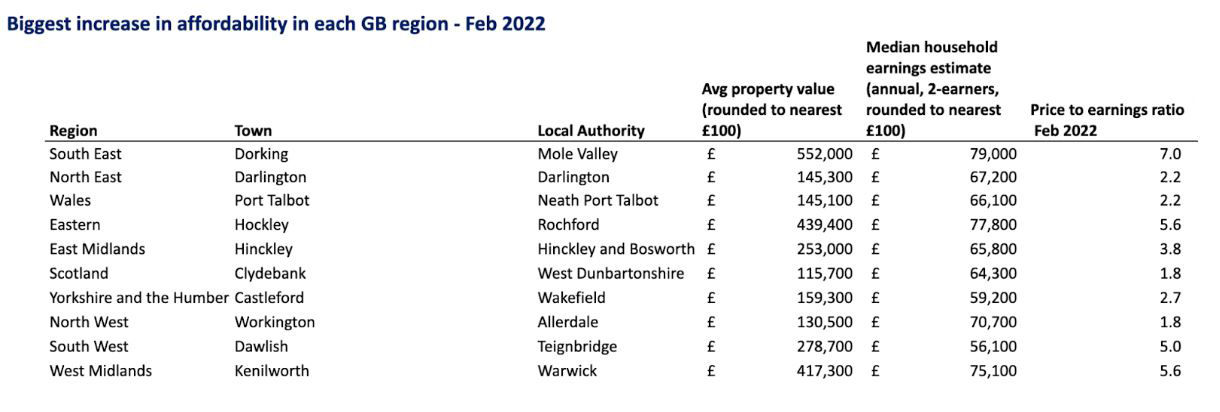

Pockets of improved affordability in each UK region

As the cost of living crisis bites and the topic of affordability becomes more important than ever, Zoopla has found pockets of improved affordability across every region in Britain – helping buyers get more bang for their buck .

In the South East, the commuter, market town of Dorking is the most improved, where buyers can expect to pay £552,000 for an average property at a price to household earnings ratio of 7.0.

For those looking for a quiet life by the seaside, buyers in Dawlish in South Devon can expect to pay 5 times the average two-earner household salary for a property valued at £278,700.

But Clydebank in Scotland sees the lowest average house price of £115,700 and only a price to earnings ratio of 1.8 for potential buyers in the area, making a move to the outskirts of Glasgow affordable.

City affordability

With the level of sales agreed in London so far this year higher than Q1 in 2021 – even at the height of the stamp duty holiday – and demand in Newcastle and Birmingham up 7% and 5% respectively in early 2022, the desire for city centre living is undeniably strong. However, this doesn’t mean that city living comes at an unaffordable cost, with clear pockets of affordability in all major UK cities.

In London, Barking and Dagenham and Bexley remain in the top two spots for affordability, as Croydon enters joint third place with Tower Hamlets. In these boroughs, the average cost of a home is below 5.5 times the annual salary for a two-earner household average salary.

Unsurprisingly, Kensington and Chelsea and the City of Westminster remain some of the most expensive London boroughs, where buyers can expect to pay over ten times the average two-earners’ salary to purchase a home. However, that’s still a 7% improvement on affordability in Kensington compared to last year thanks to wages growing faster than house prices in the borough.

Outside London, Brierley Hill in Dudley is the most affordable Birmingham suburb where the house price to earnings ratio is 3.2 for an average house price of £194,200.

Wallsend tops the affordability list in Newcastle with the price to earnings ratio at 2.1 for a house price of £135,600, whilst Leigh in Greater Manchester is the most affordable there with an average price of £153,000 and price to earnings ratio of 2.5 – all enticing potential buyers, including hybrid workers, tempted to try big city living outside of London.

Grainne Gilmore, Head of Research at Zoopla, said:

“The cost of living crisis has meant that affordability has been pushed to the forefront of buyers’ minds this year, more than ever. Our affordability data helps buyers to make informed decisions about where their money may go further across Britain, especially those who may have hidden equity in their home.

“Once again, we are seeing that many of the most affordable areas for potential home buyers are across Scotland and the North of England which could be attractive to those still searching for the perfect post-pandemic family space.”

Comments are closed.