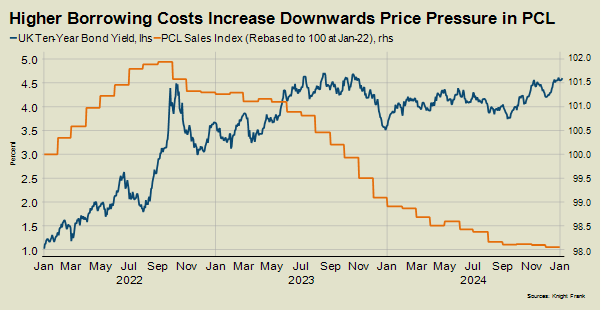

In a reversal of what took place 12 months ago, borrowing costs climbed during the Christmas break and in early January, Tom Bill, head of UK residential research at Knight Frank, points out.

Bill has shared his views on the latest market conditions in the capital’s trental market after Knight Frank’s latest analysis on the prime London property market was published this morning:

“This time last year, rates came down due to falling headline inflation. Any positivity had faded by February as underlying inflation proved to be more stubborn than expected. For the new government at the start of 2025, stubborn underlying inflation is just one their problems.

Markets are still digesting October’s Budget, concerned about the Treasury’s narrow financial headroom and the inflationary impact of borrowing and spending more. It has raised the prospect of further tax rises to alleviate the financial pressure.

The government’s position has been made worse by expectations the US Federal Reserve will cut rates less than expected in 2025 due to the robustness of the country’s economy and their own inflation and deficit concerns as Donald Trump’s inauguration approaches.

The 10-year UK government bond yield was trading above 4.8% last week, more than 30 basis points higher than its peak following the mini-Budget in September 2022 that forced Liz Truss from office. This month, the yield on the 30-year government bond hit its highest level since 1998.

The difference between now and then is that swap rates, which are based on future rate expectations, haven’t spiked so high. Markets are pricing in two bank rate cuts of 0.25% this year and the five-year interest rate swap was still trading just under 4.5% at lunchtime last Thursday. That’s high compared to recent months but a full percentage point lower than it was in late September 2022.

That said, the upwards pressure on mortgage rates must be frustrating for lenders, who would presumably want to begin the new year with some headline-grabbing cuts.

Higher mortgage costs are not just a problem for borrowers.

For those paying in cash, which typically accounts for half of sales in the central London boroughs of Westminster and Kensington & Chelsea, there is also an impact, as the chart below shows.

First, they can help keep downwards pressure on prices. “In a buyer’s market like this, rising mortgage rates assist cash buyers,” said Stuart Bailey, head of London super-prime sales at Knight Frank. “They become more sought-after as they are ready to act and will therefore drive a harder deal.”

Cash buyers can also hesitate if a property market appears to be falling or moving sideways, irrespective of how ready they are to transact.

Average prices in prime central London fell 1% in the year to December 2024, while there was an increase of 1.2% in prime outer London.

The number of transactions in London last year was 0.5% higher than in 2023, Knight Frank data shows. Activity was skewed towards the second half of the year due to falling rates over the summer and a relief bounce in October when it became clear that capital gains tax for residential property would be left unchanged in the Budget. In the final six months of last year, transactions rose 3% compared to the same period in 2023.

Overall, transaction volumes and prices were steady in 2024 but the two questions that hung over the property market were “what will be the outcome of the election?” and “what will be the content of the Budget?”

The key question facing buyers, sellers, and financial markets this year is “will the Budget work?”.

Lettings – 2024: The Year Predictability Returned to London’s Lettings Market

By Tom Bill, head of UK residential research at Knight Frank

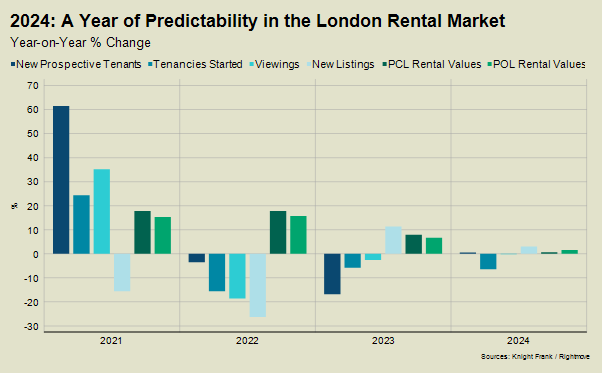

When comparing London’s rental market in 2024 and 2023, the most striking thing is the similarity between the two years.

On the demand side, the number of new prospective tenants was 0.6% higher last year than in 2023, Knight Frank data shows. Viewings were down 0.2%, while the number of tenancies started edged down slightly further, by 6%.

Meanwhile, the number of new listings across prime central and outer London was 3% higher, Rightmove data shows.

The numbers signal some much-needed stability for the lettings market in the capital after several years of stock shortages due to tighter landlord regulations, higher mortgage costs, a growing tax burden for buy-to-ley investors and the disruption of the pandemic.

As a result of more balance returning, the picture was also largely flat for rental values, as the chart shows.

Average rents in prime central London rose by 0.7% in the year to December 2024, while the increase was 1.3% in prime outer London.

It also feels like “business as usual” in the world of corporate lettings, according to John Humphris, head of relocation and corporate services at Knight Frank. “It has been a solid start to the year with activity that has been queued up for several months,” he said.

Corporate relocations to London and the surrounding area are typically from the energy, finance, professional services, legal and tech sectors.

When you compare activity last year with 2023, there is also little change. The number of enquiries from corporate relocation agents fell 3.6% in 2024, Knight Frank data shows.

However, the end of the year was stronger, with a 15% increase in the final six months of 2024 compared with the same period in 2023. The uptick after July was likely caused by the greater sense of certainty that followed the election.

It is too early to assess whether the economic volatility in the early days of 2025 will have an impact on company relocation plans in 2025.

Meanwhile, the other risk this year is that supply may dip as the Renter’s Rights Bill comes into force.

Just as more stability returns to the market and rental values calm down, the new rules could unintentionally push rents higher by decreasing supply.

The Bill includes proposals designed to tip the balance of power from landlords to tenants, which means it may become harder to evict tenants and risks could increase around rental income. That is in addition to a series of tougher green regulations.”

Comments are closed.