Rental prices in London’s prime locations have recorded significant growth due to increased demand from tenants returning to central London for both work and study, according to a new report.

Rental prices in London’s prime locations have recorded significant growth due to increased demand from tenants returning to central London for both work and study, according to a new report.

The number of properties available for let has consistently trended down from the peak of available stock in July 2021, with about 75% fewer flats available than in March 2021, London Central Portfolio’s Q1 2022 lettings report shows.

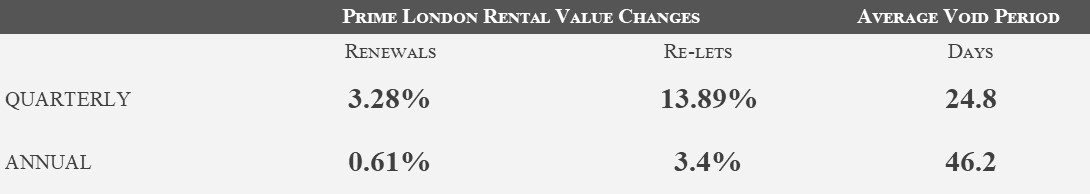

Agreed rents on new tenancies have continued to improve due to shortage of stock and greater competition as students and professionals return to London. Market conditions are now decidedly more favourable to landlords and have resulted in agreed rents on re-lets rising by 13.89% in Q1 2022, London Central Portfolio (LCP) says.

Over 50% of LCP’s new tenants in Q1 2022 were from the UK compared with 26% in Q1 2021. February 2022 marked the end of all UK Covid-19 restrictions resulting in the significant return of UK-based office workers. Tenants from the Asia-Pacific region continued to rise, with a nearly two fold increase since Q1 2021, despite ongoing travel restrictions within some territories

The time taken to let a vacant property has reduced significantly in Q1 2022. The average number of days a property stood vacant was 24.8 days, below the pre-pandemic average of 27.3 days, largely due to a lack of new stock and an increase in demand.

Some 40% of new tenants in Q1 2022 were aged 31-40, compared with under 10% in Q1 2021. This reflects older professionals returning to the office. This trend together with rising rents has resulted in a lower proportion of younger tenants renting in prime London. Less than 50% of new tenants in Q1 2022 were 30 or under, compared with nearly 90% in Q1 2021.

Limited rental stock and increased demand has resulted in tenants extending existing tenancies rather than relocating. Landlords successfully negotiated renewal increases averaging over 3% in Q1 2022. LCP saw rents on renewals increase even on properties let pre-Covid, reflecting the wider strength of the market and lack of alternative stock.

Andrew Weir, CEO of London Central Portfolio, commented: “The markedly improved performance of the prime London lettings market has been welcomed by our landlords with rent increases of 13.89% on re-lets in LCP’s managed portfolio for Q1 2022.

“As tenants return to London, increased demand and lack of new stock has resulted in void periods reaching below pre-pandemic levels, at just 24.8 days. The recovery of the rental market has led to a shift in tenant profiles as older tenants return to the office and outcompete young professionals and students.

“The summer of 2022 could well see an acceleration of existing trends with limited stock availability and increased competition as international travel restrictions continue to ease. Our report illustrates a strong start to 2022 as London continues to be viewed as an employment hub and a diverse cultural centre.”

Have your say: BBC wants to know why there is a shortage of privately rented homes

Comments are closed.