Purplebricks has published its results for the year ended 30 April 2021 (“FY21”) and provided an update on its strategy execution.

Purplebricks has published its results for the year ended 30 April 2021 (“FY21”) and provided an update on its strategy execution.

More details on the company’s plans to grow market share ahead of the launch of its new pricing model have also been revealed today.

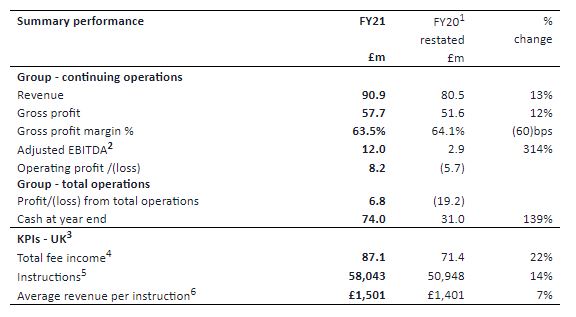

The online estate agency has reported a ‘strong’ financial and operational performance, with revenue up 13% to £90.9m, from FY20: £80.5m.

Instructions increased by 14% to 58,043, up from 50,948 12 months earlier.

In terms of market share, Purplebricks saw its share of properties sold by volume fall to 4.67%, from 5.1% last year.

Average revenue per instruction increased by 7% to £1,501, up from £1,401, while its total fee income increased by 22% from £71.4m to £87.1m.

Adjusted EBITDA of £12m (FY20: £2.9m) was recorded, up 314%, while repayment of £1m furlough monies received has been confirmed.

The operating profit of £8.2m reported this morning, including a benefit of £4.3m from non-trading items, is a marked improvement on the £5.7m loss posted last year, while group profit from total operations reached £6.8m (FY20: loss of £19.2m).

Strong trading and sale of the Canadian business contributed to cash at 30 April 2021 of £74m, up from £31m.

The company said that it had ‘high confidence’ in its latest pricing trials in the North West of the country following positive results after the launch of new pricing model in July.

The New Money Back Guarantee (MBG) and simplified two-tier proposition will now be rolled out nationally later this month following the ‘successful in field research and trials’.

Vic Darvey, CEO, commented: “We are excited to be announcing the conclusion of our pricing review this morning, following a successful trial in the North West. The Group has responded to a changing market and we are delighted to offer customers an option of reimbursement of their upfront fee payment if they do not sell their home. This illustrates our commitment to giving customers the best service at the best price and we are very excited about the growth opportunity this new initiative will drive over the next few years.”

With the business ‘in good health’, Purplebricks now plans to launch its refreshed strategy to deliver further growth built during FY21 with investment in ‘leadership, systems, and our people’.

The new leadership team is already in place and working at pace to deliver on its strategic initiatives, as the firm looks to deliver on their medium-term target of 10% market share.

The Group wants to build on what it clearly sees as a strong start to the new financial year, with what it describes as ‘a very clear understanding of its operational barriers to success, and ‘with multiple strategic levers in place to drive its growth’, including the new pricing structures, such as Money Back Guarantee and a simplified two-tier proposition, which launching in July 2021.

Although the market for sales is buoyant at the moment, Purplebricks expect supply and demand to return to more of a balance post Summer.

As such, it says it is too early to quantify the benefit from the new pricing structures to the current financial year. Its current expectation is for FY22 EBITDA to be flat year-on-year, in line with market expectations, with these strategies expected to accelerate revenue growth and drive progress towards the Group’s medium-term targets over the next few years.

Once these initiatives have been successfully rolled out, the Group says it will accelerate its marketing strategy to grow instructions and share. As a result of these strategic changes, the Board expects Purplebricks to be able to deliver annual revenue growth in excess of 20% in the medium-term, with confidence in the Group’s ability to deliver against its growth strategy.

Darvey continued: “We are excited to be announcing the conclusion of our pricing review this morning, following a successful trial in the North West. The Group has responded to a changing market and we are delighted to offer customers an option of reimbursement of their upfront fee payment if they do not sell their home. This illustrates our commitment to giving customers the best service at the best price and we are very excited about the growth opportunity this new initiative will drive over the next few years.

“We’ve had a strong year and I am particularly pleased with our revenue growth and operating profit, as the Group continues to grow from strength to strength. This great performance has been achieved in the shadow of the Covid-19 pandemic, and it remains a great source of pride that Purplebricks has come through the year stronger than ever.

“Most importantly, today we present Purplebricks 2.0 and I believe that we now have the right management team, right strategy and right technology to continue to grow the business.

“With a simplified proposition and our new pricing structure in place, I am confident that Purplebricks is well placed to gain market share and to accelerate revenue growth and drive progress towards our medium-term targets. I would like to thank all colleagues for their efforts over the last year and look to the future with considerable optimism.”

Not 10% market share is it Vic? You should resign

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The reinvention of Purplebricks has smell of desperation about it. You do not normally need to reinvent something if the original version is fit for purpose and working well.

I am amazed that they have not been able to increase market share in a sellers market.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Taken from the PB annual report. The consumer research that led to the changing pricing model…

– Firstly, some customers believe the unconditional fee means that our agents aren’t always incentivised in the right way.

– Secondly, some target customers do not fully understand the Purplebricks offering and often see it as a DIY alternative to the high street.

– Lastly, with the absence of a high street presence, there is sometimes a misconception that we lack local expertise.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Marketing cost savings of £78 per listing (RM will claw that back soon).

Interesting that they have finally published the number of refunds (2,195 in the year) amongst other tweeks to the KPIs. By netting off the refunded listings they will be able to claim an improved listing/sales ratio 😉

Their market share is going backwards – Vic will have to spend some of that £74million cash acquiring Yopa/Strike(House Simple).

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Would you or anyone you know use PB? It’s a no from me.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Buried in there is they have confimed they have started this financial year 26% down on Instructions .They have shrunk to their lowest level for sometime

The purple bus is stuck in reverse and are flattered by their cash position effectively bolstered by investors moneywhich theydont seem to have any ideas on to use

They convenientally ignore years 18 and 19 from comparisons as they hit their glass ceilng of 69,892 instructions in 2019

Homeday

Disappointing investment

“No further investment in Homeday was made during the year and no further investment is currently anticipated”

That says it all

Time for Vic to go

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Refunds if you don’t sell…….interesting to see if that continues when the market starts to slow down?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Think by “sell” they mean get an offer of 90% of your asking price within 10 months rather than actually complete.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“Think by “sell” they mean get an offer of 90% of your asking price within 10 months”

Not even that, AgentQ73 – it is the valuation figure:

“The Vendor(s) must accept the Property valuation provided by the LPC. If the customer wishes to publish the Property above the valuation provided the MBG is void”

They do, however, give you the green light to offer your property below the valuation figure and qualify for the “MBG” – how mightily generous is that?!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Tough crowd on Eye heh – PB could deliver £100m EBITDA and they’d still get slagged off on this site. They’ve had a good financial year, that much is true. That said, I’m not going to buy the shares.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Mr London

The reality is they had a ” good “year because they sold Canada increased fees and reduced costs Where do they go to from there ?

A far cry from the 100k instructions forecasted to shareholders who haven’t received a penny Iinstructions levels have fallen well below 69k achieved in 2019

When their listed brethren report it will pale with comparison

All that money in the bank and no ideas what to do with it. Perhaps they ought to give it back to shareholders ?

Howver they have already stated that this financial year has started poorly with instructions down 26% where s since April the rest of the estate agency world have enjoyed their best months yet

Its all relative

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Help them spend it by clicking on their google ads

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“We’ve had a strong year and I am particularly pleased with our revenue growth and operating profit, as the Group continues to grow from strength to strength, said the man that would eat dog S**t and tell you it tasted lovely

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

As H.O.W. says above, they have sold the family silver to allow a positive set of results.

Where do they go from here?

If PB have not become the estate agent of choice in the last 12 months they never will be. In reality they have gone backwards and failed on their market share targets.

I can only see further consolidation in the pay cheap arena, YOPA, STRIKE, PB, DOORSTEPS, 99 HOME none are making money in reality and they need to merge to survive as funding is drying up.

I am also getting more applications from the LPE’s these days.

Sure they will be around for a few more years but in what form?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

LPE’s getting clawbacks on their commissions?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Looking at the turnover they are having in my patch doubt any will stay long enough to get it clawed back.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I have heard this is true and has not gone well at all with the LPEs; many have left or leaving. I have also heard many head office staff have gone.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Well done PB!

Probably PeeBee will be very upset today 🙂

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I doubt it very much, they are still in decline year on year.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“Probably PeeBee will be very upset today “

Au contraire, AgentVX17. I couldn’t be happier.

1. They think it necessary to scream they’ve had a good year in a period where every Agent has had a good year.

2. Despite the ‘boom’ in listings and sales seen over the last year, they are down approx 13.8% on their 2019 reported figure for listings. Also down c. 6.4% on 2018. Using last year as the measure to claim an improvement on is like saying little Johnny could walk a lot further by the time he was two years old than he could the previous year.

3. They have had to admit that they have refunded some 3.6% of the year’s listings – and that over 5% of the previous year’s total suffered the same fate. I’m only surprised the figure was that low.

4. They now seek to offer a “money back guarantee” option which, no doubt stuffed to the gunnels with suitably vaguely-worded get-out clauses will result in diminishing revenue in the coming months and years. If they are so confident in their ability to perform, why take the money to potentially have to give it back? Collect it on completion like their High Street superiors. Which leads on nicely to

5. Their long-trialed ‘Gold Service’ offering – a £399 up-front ‘advertising fee’ and £4100 only on sale equates to around 78% over the current “pay regardless” deal when you remove the conveyancing charge. IF bricks are achieving the infamous 88/78/77/pick-a-number % success rate, surely that is excessive to say the least? Isn’t it a case of penalising a customer for taking this option? Which is what they have claimed to stand up against from the very outset.

There are SOOOO many more Purplereasons why I’m a happy PeeBee today, AXV17 – but I doubt you’d want to process them. The above are more than enough for you to chew on for now – and they all point to the same thing…

…more and more of the public have spotted the Emperor’s winky (credit: Robert May) – and don’t like what they are seeing.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

https://www.purplebricks.co.uk/terms/money-back-guarantee surprise surprise they don’t actually have to sell it to get out of giving money back

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“surprise surprise they don’t actually have to sell it to get out of giving money back”

Surprise surprise – the scheme you refer to has already ended. From the webpage:

“When does the MBG offer start and end?The MBG offer commences on 10 May 2021 and ends on 20 June 2021. Any MBG’s entered into during this period will be honoured for the 10 month period as per below”

But putting that little tasty morsel to one side – here’s a few more for you to chew on to no doubt give some equally inane responses as that above…

“a guarantee made by Purplebricks to the Vendor(s) to reimburse the Vendor(s) the Fee for marketing the Property on any portal in the event the Vendor(s) does not receive a Proceedable Credible Offer within the 10 months of the Property being published and is subject to the terms below”

“The Vendor(s) must accept the Property valuation provided by the LPC. If the customer wishes to publish the Property above the valuation provided the MBG is void”

“If the Vendor withdraws the Property before the end of the 10 month period the MGB is void and no refund will be made. If the Vendor appoints an additional agent and an offer is accepted via this additional agent before the expiry of the 10 month period, it will be classed as withdrawing the property and no refund will be made”

To you… (credit: Barry Chuckle)

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Well in some sort of effort to give the impression that listings are not in a downard spiral so the only way to go is to increase fees and cut costs is some sort of positive then I guess it is well done .

The reality is Vic has done SFA for Bricks hiding behind the scenes and seemigly hasn’t got a clue how to invest £70m to turn a shilling .

Its almost laughable with all those opportunities presenting themselves last year where cash was king to exploit

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Do me a favour, 15M trousered cash for not selling property, makes for a 6M gross profit. In my book in reality a minus 9M cash burn rate.

And cashback – there is no cashback – having marketed over 18,000 properties over 30 years here is what I know about residential sales in the UK. 95% of properties marketed, will get a proceedable offer 10% below the price – eg, 500k, that is an offer of 450K most agents could get that offer in 20 seconds, it then voids the refund.

So the cash back concept is deeply flawed.

I am encouraged though that Purplebricks may yet get to where they need to go. Though they have burnt through over 200M to get to minus 9M by my reckoning … got to be better ways of using capital, I am always open to offers.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

” they have burnt through over 200M to get to minus 9M by my reckoning …”

Interesting… according to Hargreaves Lansdown’s reckoning, they were at -£119.09m cumulative losses for the 5 years to 30/4/20. The claimed £6.8m group profit doesn’t even touch the sides to help fill that void – still over £110m to make up before they will have made a single, solitary, penny profit.

Clearly, the City is unimpressed – share price down 4.23% on the day and dangling precariously close to the 80p ledge again.

I’ll leave the last words to a legend: “Oh dear… how sad… never mind” (credit: Battery Sergeant Major Williams)

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Interesting that all EYEs are on the “Money Back Guarantee” pricing model, and nothing whatsoever is being said about the other Fee model – “The 2-Tier Proposition” – being introduced this month also.

I wonder why?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Pee Bee – They have made losses of £120M and burnt through investors cash of £7M £45M (when they floated on Alternative Investment Market) £126M when Axel Springer bought the shares which then halved in value in the next 18-months, and there was some other cash from AS as they bought some more shares I think when Michael and Kenny et al exited, there were shares flying around, lets call is £180M of investment capital, plus 6 years of revenue on a cash up front model, with low fixed overheads but huge media costs. Do you like their creative accounts as well – dreamy – they show huge gross profit in their accounts – then they take off ‘costs’ and magically for the past 5 years that whopping huge gross profit gets some brackets around it and is several million in the red. The costs that come after the big profit being – well all the costs to run the business the multi-million adverts, advertising spend on digital radio etc. It is a bit like saying as an agent we completed on 200 houses so that is 800k gross profit – and we minus marketing costs, a few incidentals, advertising, hardware, software, adverts, portals, salaries, for sale boards, etc etc – well these come to 900K – oh dear we are 100k in the red. Who are their accountants?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register