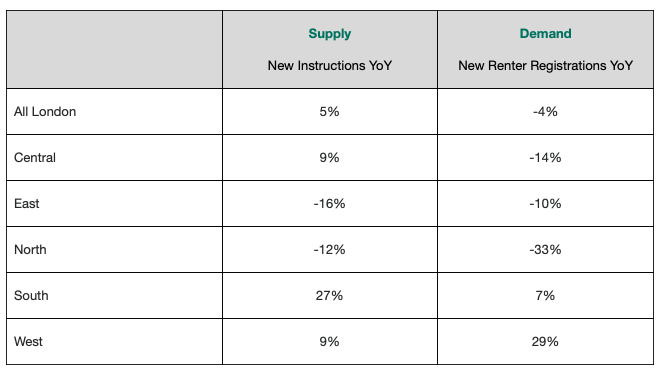

Demand in the London lettings market in January was 4% down on the previous year but up by a huge 77% compared with the corresponding period of 2020, according to Foxtons figures.

Demand in the London lettings market in January was 4% down on the previous year but up by a huge 77% compared with the corresponding period of 2020, according to Foxtons figures.

South London continued to be the most popular among renters, with the highest rental registrations by value compared to other London regions, while West London saw the highest year-on-year increase in demand, at 29%. North London registered the largest drop in demand, 33% down year on year.

There were 19 renters competing for every new property in January 2023, 8% lower compared to the same month last year. Yet this is still significantly higher than the 11 renters per instruction seen in January 2020 and 2021.

South and West London were the most competitive areas in January 2023, with 29 and 27 renters per new instruction respectively.

Foxtons data found that rent has been rising across all areas of London, with increases of 25% in Central London, 20% in South London and 19% in East London. A three-bed flat saw the highest year-on-year increase in average rental price, up 25% on January 2022.

January 2023 had an average applicant budget close to £500 per week, which is the highest figure recorded by Foxtons in any January over the last four years. This is 9% higher compared to January 2022 and 2% higher than December 2022.

Although renters in every area of London increased their budgets from last year, North and East London had the most notable uplift at 15% and 13% respectively.

In January 2023, renters spent 99% of their property budgets on average. This remains consistent with December 2022, but 3% higher than January 2022. In Central and North London, renters spent 100% of their budgets to secure a tenancy, whereas renters in other regions spent just under.

Industry data shows that new listings in January rose 61% higher than in December 2022. However, year on year, new listings were 7% lower than January 2022, continuing the long-term trend towards fewer listings that has been underpinning higher rent prices.

Gareth Atkins, Foxtons managing director of lettings, commented: “With a 7% decrease year on year, January has seen the same long-running trend of low lettings supply that has fed the bottleneck on London’s high demand and driven up competition and prices across the capital.

“There is an opportunity for enterprising landlords to invest in the buy-to-let stock that’s come to the market this new year and contribute to London’s supply of homes to let,” Atkins added.

Comments are closed.