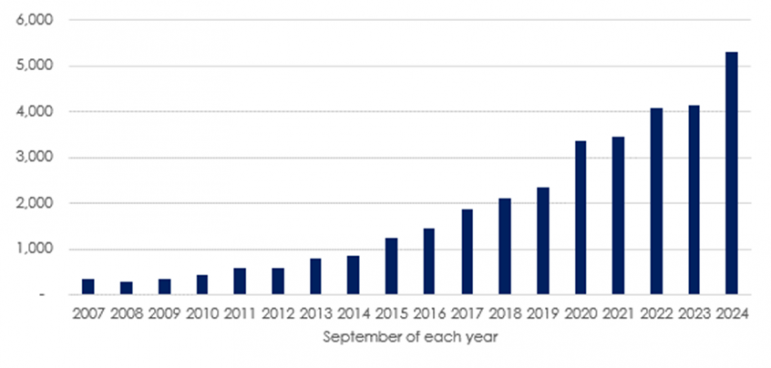

Last month saw 5,312 new limited companies set up to hold buy-to-let property across Great Britain.

Last month saw 5,312 new limited companies set up to hold buy-to-let property across Great Britain.

Hamptons’ analysis of Companies House data shows that this figure now stands 28% higher than the previous September 2023 record. It also represents the third-highest monthly figure on record, following the 5,854 set up in April 2024 and 5,442 in February 2024.

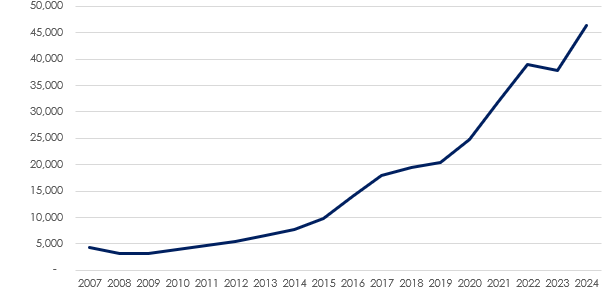

The record number of new incorporations so far this year means there were a total of 46,449 companies set up between January and September 2024, a 23% increase on the same period last year, which itself marked the highest year for new incorporations. This means that more companies have been set up so far this year than during the whole of 2021.

Buy-to-let incorporations in September of each year:

Source: Hamptons & Companies House

The increase has been driven by the different ways buy-to-lets in companies and buy-to-lets in personal names are taxed. With landlords no longer able to fully claim mortgage interest as a cost* (see notes to editors), more new purchases are going into a company structure. Furthermore, existing investors are also shifting their buy-to-lets into limited companies to reduce their tax burden. Given that properties sold by companies are not subject to Capital Gains Tax, any increase will deepen this divide.

Chart 2 – Buy-to-let incorporations between January and September of each year:

Source: Hamptons & Companies House

By the end of October 2024, it’s likely that more limited companies will have been set up to hold buy-to-let property than in the whole of 2023. This means that by the end of 2024, between 60,000 and 62,000 limited companies will have been created, exceeding last year’s total of 50,004.

Some 59% of these new companies have been set up in the South of England, where higher interest rates have hit hardest and where a larger share of households are higher-rate taxpayers. It is these landlords who are most likely to benefit from incorporating.

However, only 42% of properties bought by limited companies so far this year have been in the South of England. This highlights how many Southern-based landlords are investing in the Midlands or North of England where yields tend to be higher.

There are now a total of 382,007 companies across Great Britain set up to hold rental property. Nearly three-quarters (74%) of these have been incorporated since the start of 2016, the point at which landlords who were higher-rate taxpayers stopped being able to fully offset their mortgage interest from their tax bill.

The rising number of companies set up to hold buy-to-let properties means the vast majority of new landlord purchases now go into a limited company. So far this year, 70% of new buy-to-let purchases in England & Wales were made using a limited company, with the remaining 30% being bought in personal names.

In total, there are 666,831 properties held inside a buy-to-let limited company structure across England and Wales. This figure has increased 175% from 242,249 a decade ago. But despite most new purchases going into a limited company structure, only around 15% of all rental homes owned by private landlords are held in such a way.

Prior to 2016, the limited company structure tended to be the preserve of larger landlords. However, the growing tax advantages for higher-rate taxpayers have attracted the attention of smaller investors. So far this year, 54% of new purchases have been made by companies who are making their first, second or third purchase.

While the average rent for a newly let property in Great Britain hit a new high of £1,384 pcm in September, the pace of growth continued to cool. Average rents rose 4.5% year-on-year, down from 5.0% in August and 11.7% in September 2023.

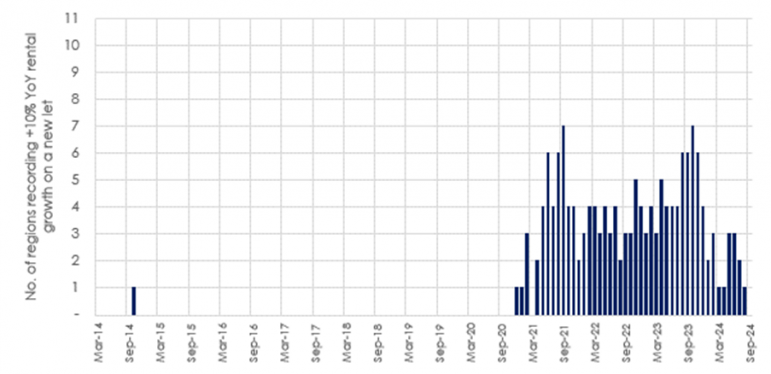

September 2024 marked the first month since March 2021 when no region recorded a double-digit percentage rental increase. Back in September 2023, six of the 11 regions in Great Britain recorded +10% annual rental growth. In August, the North East was the only region to record double-digit rental growth of 12.1%, a figure that slowed to single digits (8.1%) in September.

London tenants who moved into a new home faced the smallest rental increases in percentage terms. Rental growth in Greater London has slowed from a peak of 17.2% in August 2023, to 2.1% in both August and September 2024.

However, there are few signs of rental growth slowing much further in the capital given that these figures have stagnated in recent months. And even though the pace of growth has slowed, tenants in the capital have faced big increases in cash terms. The average rent in Inner London reached £3,284pcm in September 2024, £1,099pcm more than it cost tenants who moved three years ago.

Chart 3 – Number of regions recording double-digit annual rental growth:

Source: Hamptons

Table 1 – Rental growth on newly let properties in September 2024

| Region | Average monthly rent | YoY % | YoY £ |

| Greater London | £ 2,427 | 2.1% | £51 |

| Inner London | £ 3,284 | 6.4% | £197 |

| Outer London | £ 2,264 | 1.0% | £23 |

| East of England | £ 1,315 | 5.4% | £68 |

| South East | £ 1,421 | 4.9% | £67 |

| South West | £ 1,211 | 3.4% | £40 |

| Midlands | £ 994 | 6.3% | £59 |

| North | £ 957 | 7.6% | £68 |

| Wales | £ 816 | 3.1% | £25 |

| Scotland | £ 992 | 4.4% | £42 |

| Great Britain | £ 1,384 | 4.5% | £59 |

| Great Britain (Excluding London) | £ 1,116 | 5.7% | £61 |

Source: Hamptons

Aneisha Beveridge, head of research at Hamptons, said: “While landlord purchase numbers are well down on pre-pandemic levels, there’s been no sign of a slowdown in the number of companies being set up to put them in. Most new purchases are now made in a company structure. However, there’s also been a significant rise in the number of landlords moving homes they own in their personal name into a company to shelter from an increasingly aggressive tax environment.

“While the benefit of being able to offset mortgage payments before being taxed has been the primary driver for new incorporations over the last few years, more recently rumours of potential increases to capital gains tax or inheritance tax are further fuelling the rise. An increase in personal tax rates will only widen the gap between the tax paid by landlords who own homes in their own name or a company name further.”

Comments are closed.