Art tops the Knight Frank Luxury Investment Index (KFLII) , but growth is starting to slow or even reverse for other luxury asset classes, and rare whisky is unpalatable for the time being.

Art tops the Knight Frank Luxury Investment Index (KFLII) , but growth is starting to slow or even reverse for other luxury asset classes, and rare whisky is unpalatable for the time being.

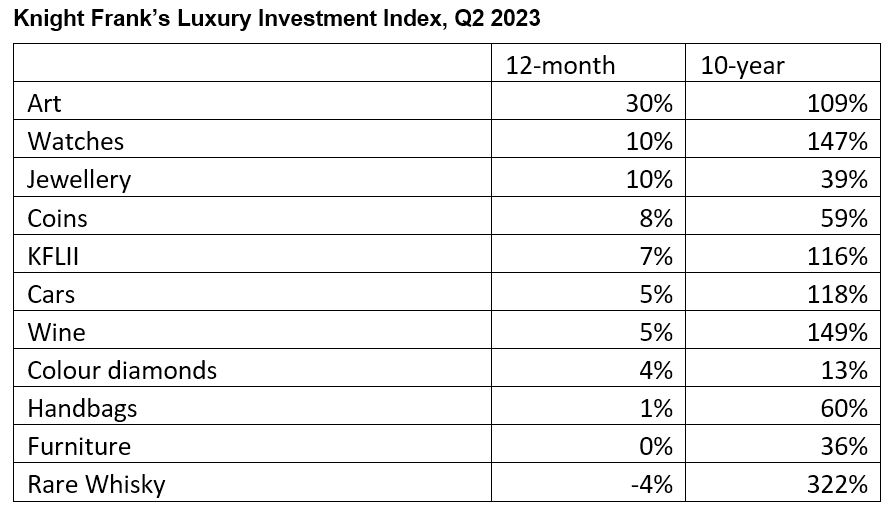

The index, which tracks a weighted basket of 10 luxury collectibles, rose by 7% in the 12 months to the end of June 2023.

This compared with house prices in Prime Central London which were down 1% over the same period; the FTSE 100 index of equities, which rose by 5%; and gold which was up in value by just 1%.

It was, however, the weakest annual performance by KFLII since Q2 2021, proving that even tangible assets are not immune to market uncertainty.

Art tops the Knight Frank Luxury Investment Index with 12-month growth of 30% as measured by AMR’s All Art index but auction results so far this year suggest growth has peaked.

“The auction season’s spring sales are the first measure of market confidence and recent results suggest growth is already starting to slow,” said AMR’s Sebastien Duthy.

Watches (10%) and jewellery (10%) complete the top three rankings of the KFLII, highlighting that people are still willing to spend on personal luxury items.

Coins come in fourth place with price rises of 8%, followed by the KFLII average at 7%.

However, it is the slowdown in the wine (5%) and classic car (5%) markets, both in sixth and seventh place respectively, where double-digit rises that have often underpinned the index’s performance, that have tempered growth. Despite the car market being up 5% on an annual basis, it has fallen 7% so far this year.

“The performance of classic cars has been mixed,” said Dietrich Hatlapa of data provider HAGI. “After a strong performance in 2022 when the value of the most investable classic cars rose by 25%, this year has seen the market slip into reverse gear due to macro-economic factors.”

Andrew Shirley, editor of the Knight Frank Luxury Investment Index said: “Economic uncertainty and higher interest rates will cast a long shadow on luxury collectibles. Novice collectors should focus on what brings them joy, perhaps that’s more important now that value appreciation is far from guaranteed in these asset classes.”

Coloured diamonds come in eighth place in the index, up 4% in the year to the end of Q2 2023 as coloured diamonds enjoy a rise in interest.

Handbags (1%), Furniture (0%) and Rare whisky (-4%) complete the rankings.

Rare bottles of whisky, the strongest 10-year performer in the Knight Frank Luxury Investment Index, are the only asset class to see a negative annual performance, according to the index complied by Rare Whisky 101.

“Bottles of rare whisky have had a far more sedate time from a performance perspective over the past three years,” confirms Andy Simpson of industry consultant Simpson Reserved. “Higher value (over £5,000) bottles have re-traced recently due to a myriad of geo-political, social and economic reasons.

“Certain brands have still performed well, while the market leader (from a sheer volume of market perspective), Macallan, has seen particularly punishing losses with its index re-tracing almost 12% over the past twelve months.”

Property has an added advantage that is overlooked here. I haven’t owned all my rental portfolio for 10 years yet, (five in total) but the two I have have more than doubled in value, and the others are on track to do so.

The advantage is the rent. Yields from 8 to 14% across the lot mean the first 2 have repaid the purchase price already. I don’t see art or whisky paying a monthly income AND increasing in value.

From a humble redundant retail manager to a property developer/landlord I can only say this has been an experience – but a very rewarding one.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register