The share of Londoners purchasing property outside of the capital dropped in 2022, according to analysis by Hamptons.

The share of Londoners purchasing property outside of the capital dropped in 2022, according to analysis by Hamptons.

The study of Office for National Statistics data revealed that, last year, Londoners bought 7.3% of all homes sold outside the capital, down from a 14-year high of 7.8% in 2021. Proportionally though, the rate of London outmigration remains above 2019, when 6.8% of homes in the regions were bought by a Londoner.

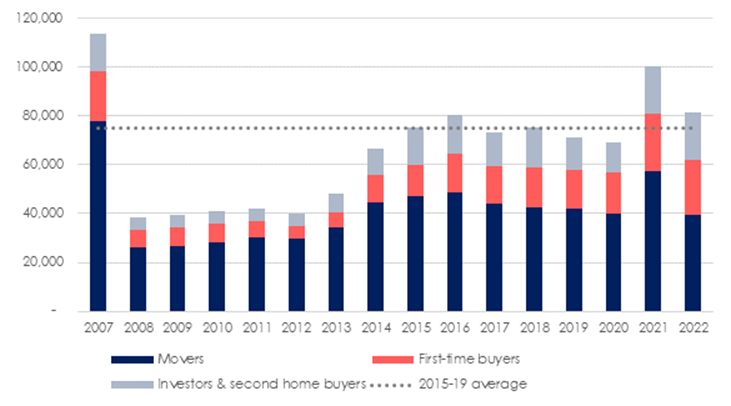

In number terms, Londoners purchased 81,200 properties outside the capital in 2022, nearly 20,000 fewer than the peak of 100,540 in 2021. However, this figure remains 8% up on the 2015-19 average of 74,970.

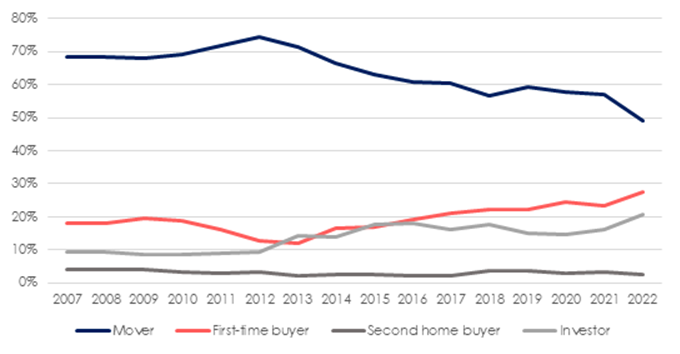

First-time buyers made up a record 28% of those buying outside the capital, equating to 22,470 purchases. Due to lower transaction numbers overall, London-based first-time buyers bought 5% fewer homes in the regions than in 2022. However, mover numbers (those selling a home in London) dropped by 31% year on year. This means that buyers making a permanent move out of the capital purchased 62,210 homes in 2022 – 23% fewer than last year’s peak, but 8% more than in 2019.

Meanwhile, London-based investors made up a record 21% of those buying in the regions, up from 16% in 2021 and 9% a decade ago. The search for higher yields to cover rising costs means that nearly two-thirds (62%) of London-based investors now choose the regions over the capital for their new buy-to-let, up from 26% in 2012. Together with second-home buyers, they spent a total of £4.89bn on property outside the capital in 2022.

The share of Londoners moving permanently to the Midlands or the North rose from 6% in 2012 to 15% in 2022. Meanwhile 54% of London-based investors bought a buy-to-let in the Midlands or North, up from 20% a decade ago.

Aneisha Beveridge, head of research at Hamptons, said: “London outmigration appears to have passed its peak. While 2021 was dominated by space seekers swapping the bright city lights for pastures green, 2022 signalled the return to the office. That said, the widespread popularity of flexible working has meant that Londoners continue to move that little bit further out of the city to gain more space, meaning outmigration numbers remain higher than pre-Covid times.”

Beveridge added: “Next year, we expect the pace of London outmigration to cool further as pent-up demand from the Covid-related trend wanes. But affordability pressures, and in particular the cost of higher interest rates, may mean that more Londoners are forced to move further afield to buy a home.

“Our latest data suggests that first-time buyers in particular are sacrificing location in order to climb onto the housing ladder. And this looks set to put a floor under London outmigration numbers in 2023.”

Comments are closed.