The attraction of buy-to-let may be waning as far as some people are concerned due to a series of tax changes, but the reality is that property remains a solid long- term savings fund route, viewed by many as a crown jewel of an investment.

The attraction of buy-to-let may be waning as far as some people are concerned due to a series of tax changes, but the reality is that property remains a solid long- term savings fund route, viewed by many as a crown jewel of an investment.

With savers receiving dismal returns from banks and building societies, many people continue to turn to residential property as a means of supplementing their income, supported by record-low mortgage borrowing rates, high demand from tenants and increasing rents.

With investment in the PRS continuing to outperform other major asset classes, buy-to-let remains the investment of choice for many Britons, according to research carried out on behalf of Paragon Bank.

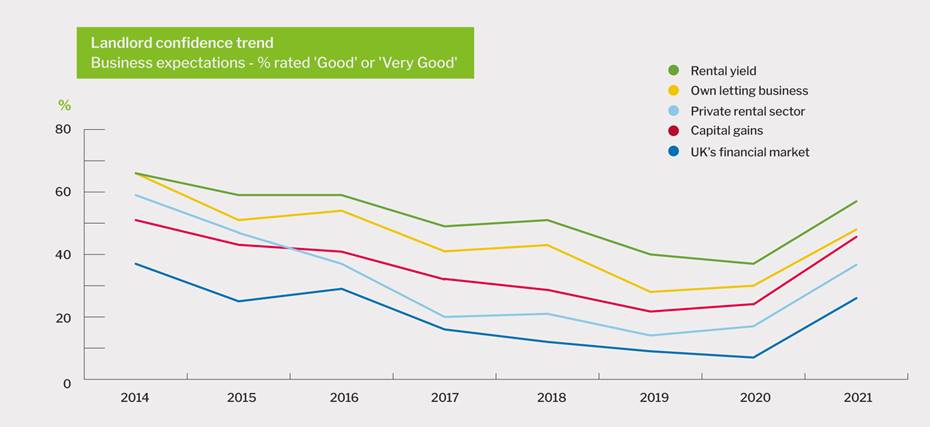

As part of the study, landlords were asked to rate their expectations for rental yields, their own lettings business, capital gains, the private rental sector, and the UK financial market.

The proportion who deemed the outlook for these measures to be either ‘good’ or ‘very good’ exceeded levels seen in Q3 2016, the survey taken just before the Brexit vote, with investor optimism consistently rising following the record low levels seen in Q1 2020.

The survey of over 600 landlords by BVA BDRC highlighted a link between optimism and portfolio size, with landlords managing larger portfolios tending to be more upbeat about the prospects for their own lettings business – 56% of landlords with eleven or more properties felt ‘good’ or ‘very good’, falling to 46% amongst those with between one and 10 properties.

The research also found a correlation between confidence and property purchase behaviour. A positive outlook was noted amongst almost two-thirds (63%) of those who have recently purchased a property, compared to just under half (48%) amongst all respondents. In addition, over three-quarters (78%) of landlords who plan to expand their lettings business in the next year are optimistic, whereas confidence was seen in a lower proportion, 26%, amongst those looking to divest.

Richard Rowntree, managing director for mortgages, said: “Understandably, landlord confidence fell sharply in the first quarter of 2020, as the extent of the pandemic became clear.”

“It is fantastic to see optimism bounce back and rise in the time since; it is an indication of the strength of the sector. Landlords see the sector’s issues and opportunities on a daily basis so measuring their outlook can provide useful insight for the industry and, as we see here, investor confidence can have a real impact on behaviour.”

Is that right. Not what I am seeing. So many landlords are in fear of regulations, licensing (already happened in devolved states) and mounting rent arrears. Covid-19 has stopped the annual figures but it was year on year over 40,000 possession orders per year for rent arrears. Investments carry a wealth warning …. up or down. I wonder how many were asked that and how they would cope when the wheel comes off?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register