As house price growth grinds to a halt, investors are now making smaller gains when selling their buy-to-let, compared to those who sold last year according to the Hamptons Monthly Lettings Index for July 2023.

So far this year the average landlord in England & Wales sold their buy-to-let for £94,800 more than they initially paid for the property, having owned for an average of 11 years. This gain is down 10.1% from a record £105,300 last year, and is almost identical to what landlords selling in 2016 achieved.

Average gains on the sale of a property by a landlord fell year-on-year in every region for the first time since 2020.

In percentage terms, northern regions recorded the largest year-on-year falls. This reflects both slowing price growth and a shift in the type of home being sold. Smaller terraced houses and flats, which have seen weaker price growth in recent years, made up a higher share of all buy-to-let sales so far this year.

However, in comparison to 2016, investor profits have risen fastest and furthest in the north of the country (chart 2). Investors in the North East recorded a 176% increase in the average capital gain on the sale of a buy-to-let between 2016 and 2023, with all three northern regions boasting a 50%+ increase in gains since 2016. House prices in Northern England have risen the most over the last seven years, while in parts of London and the South East prices have remained static.

Even so, higher average prices mean that in cash terms London landlords who sold up still saw the largest gross capital gains. So far this year this figure stood at £308,500. However, this number is down 3.4% from £319,300 last year and 15% down from a peak of £365,000 in 2016 due to slower price growth.

There are just three regions where the average investor profit is still at six figures (London, South East and East). The South West fell off that list this year when the average capital gain shrank from £105,000 in 2022 to £95,700 today.

It is likely that the amount made by landlords selling up will fall further on the back of both lower prices being achieved and a rising proportion of sellers having bought later in the house price cycle.

The average landlord selling in 2023 bought 11 years ago. This means 65% of landlord sales this year were homes that had been bought since 2009, after the point where prices bottomed out. This figure rises to 70% for flat sellers, who typically have shorter holding periods and therefore tend to see lower capital growth.

Despite the slowing pace of price growth, the number of landlords selling for less than they paid is limited. Just 6% of landlords sold at a loss so far in 2023, slightly up from 5% last year but down from 10% in 2020.

Almost one in five (19%) investors who sold a flat did so for less than they paid, alongside slightly more than one in five (22%) of investors who sold a buy-to-let in the North East.

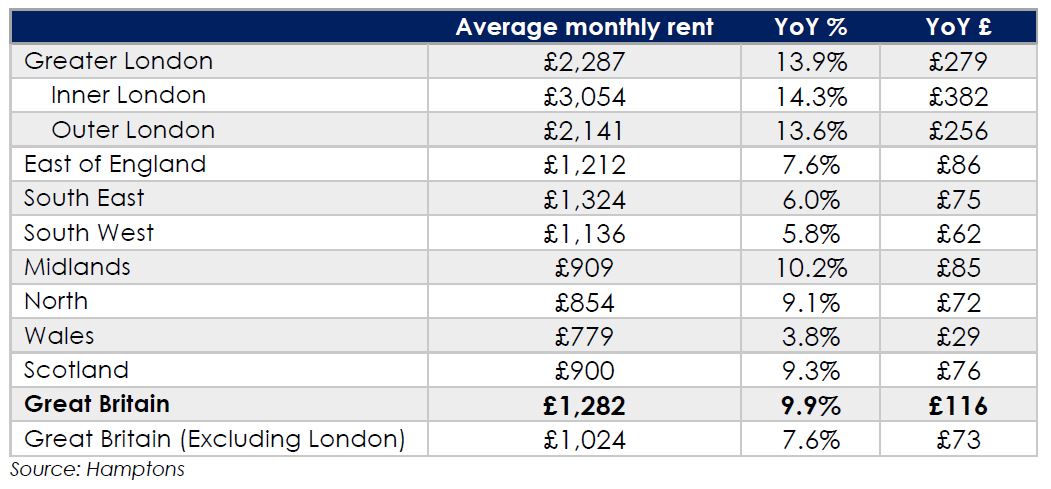

There are few signs that the pace of rental growth is slackening, with the cost of a new tenancy up 9.9% year-on-year across Great Britain to an average of £1,282 pcm. On an annual basis, rents have risen more than 5% for 27 consecutive months and above 7% for the last 10 months. This prolonged period of growth leaves the average rent 28% higher than in February 2020, on the eve of the pandemic.

Over the last year rents in London have continued to rise faster than anywhere else in the country, with the average price of a new let up 13.9% (table 2). Annually, rents here have been growing at a double-digit pace for 15 of the last 17 months. However, the rate of Inner London rental growth has slowed as rents surpassed pre-Covid levels, with growth now broadly on par with Outer London.

Looking back to the onset of Covid, rents have grown faster in the North than in the South. While average rents in London and the South East are up 26% and 24% respectively since February 2020. In the Midlands they are up 31% and in Northern England they are up 33%. Here, rents have risen on the back of higher house price growth as yields have held steady.

Commenting Aneisha Beveridge, Head of Research at Hamptons, said:

“As house prices start to slip back, there are signs that the landlords looking to sell today may have missed the top of the market. Rather, some investors are consoling themselves with record-breaking rental growth which is slowly ironing out the arithmetic for landlords.

“Lower house prices and higher rents will combine to shore up the rental market as more landlords hold off on the decision to sell. On the flip side, this will also weigh down on the government’s capital gains receipts handed over by landlords selling up over the next few years.

“New homes coming onto the market continue to achieve record rents and in the short term it’s hard to see what would put concerted downward pressure on the pace of growth. With around 35,000 landlords coming off fixed rate mortgages each month, the upward pressure on landlords’ costs marches on. In the runup to remortgaging landlords are fighting to balance the books by paying down debt and hiking rents that have dropped below market rate.”

Certainly not a good time to invest, more the time to take cover.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register