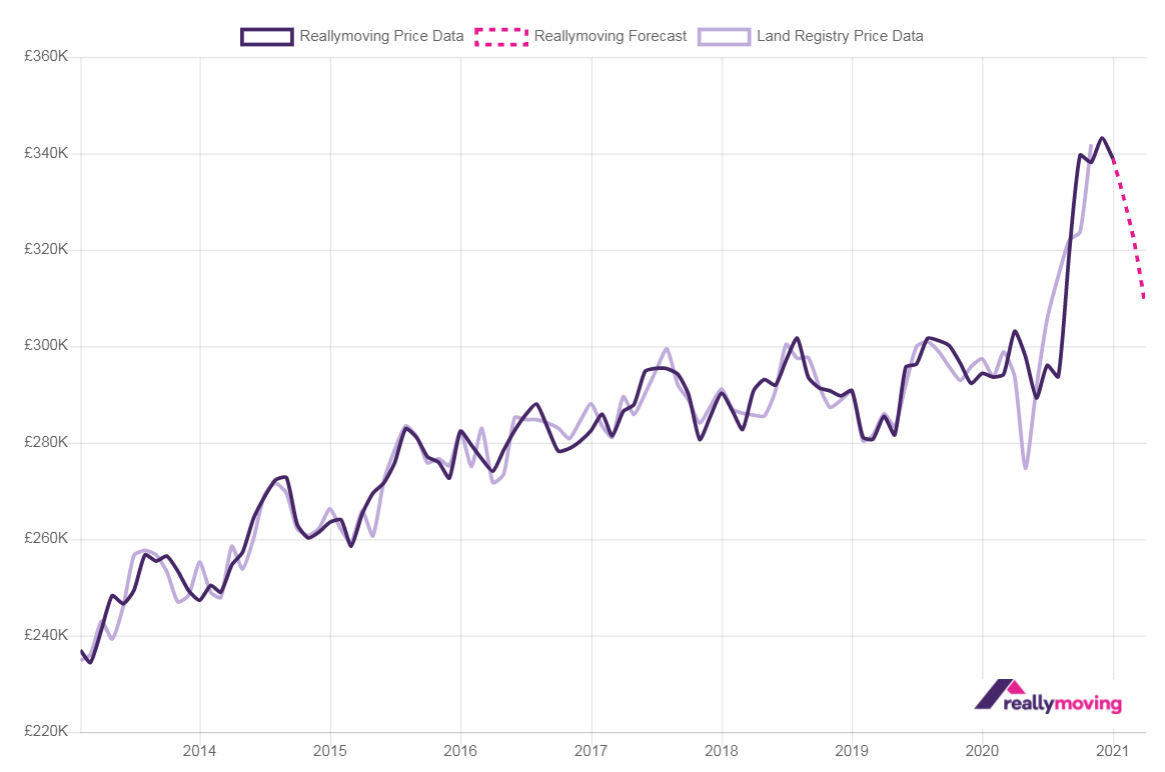

Much of the UK property industry expect house prices to soften in the next three months, as lockdown and the end of a stamp duty holiday cause the market to slow, but one company is predicting a sharp drop in values.

The end of the stamp duty holiday, due to end at the end of next month, will cause residential property prices in England and Wales to fall by an average of 4.1% by April, according to Reallymoving.

The home moving firm estimates that that the average price of a home will fall from what it says was £338,951 in January, to £308,773 by April, as an increasing number of property sales start to fall through.

The company’s three-month forecast, which some agents will find implausible, is, according to Reallymoving, created by analysing conveyancing quotes given through the firm’s comparison tool, which is typically done 12 weeks before completion.

The data provided by the company suggests that prices are rapidly readjusting back down to levels seen 12 months ago, as the stamp duty holiday end looms and the post-lockdown rush to move home subsides.

According to Reallymoving, the new year downward trend in prices is accelerating as we head towards spring, with prices set to fall by 2.5% in February, 2.6% in March and 4.1% in April 2021.

The firm say the impact of the stamp duty holiday end is now visible in the value of deals being agreed between buyers and sellers in January.

It believes those that agreed deals earlier and may not complete before the stamp duty holiday deadline are likely to attempt to renegotiate, or split the cost across the chain, further impacting prices although this will not become evident until Land Registry Price Paid data is published.

It also expects to see some resurgence in first-time buyer activity later in the spring and early summer supported by low-cost high loan-to-value mortgage products, lower property prices and the launch of the new Help to Buy scheme.

Rob Houghton, CEO of Reallymoving, said: “Now, for the first time, we can see the early impact of the end of the stamp duty holiday on prices, with buyers in January agreeing to pay less as they factor in the cost of a tax bill.

“Others who agreed deals earlier will still be hoping to make the deadline, and it’s likely we’ll see a sharp rise in fall- throughs in early April, as well as gazundering, which could impact final sale prices further if sellers are agreeable to spreading the cost – and many will be, rather than see their deal fall flat.

“Transparency and openness are key, and rather than hoping for the best, practical buyers and sellers will be opening up conversations now to try and ensure they can still proceed if they fail to complete by 31st March.”

Who are these people ?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“opening up conversations now” – FFS now is way to late. so how does this guy suggest SDLT is spread across a chain when all parties will incur their own bill? Utter nonsense.

Having had ‘the chat’ with all buyers and sellers months ago I do not believe I will have a single abortive due to missing the deadline, and some will as conveyancing is taking a record slow transaction time.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Who? Maybe they should change their name to “Rarely Moving”!

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

We need a 70% rightmove discount. Its dead out there. Pipeline be gone by April. Good while it lasted I suppose.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register