New enquiry levels to estate agents from vendors and buyers remained very strong in the past week, according to the latest Yomdel Property Sentiment Tracker (YPST)

But while new vendor enquiries on the week dropped almost 16% as more people chose to get away on a brief holiday, they remained 79% above the same week last year, while buyers fell slightly. Importantly, the volume of people visiting own-branded estate agent websites was 32% higher than the same week last year.

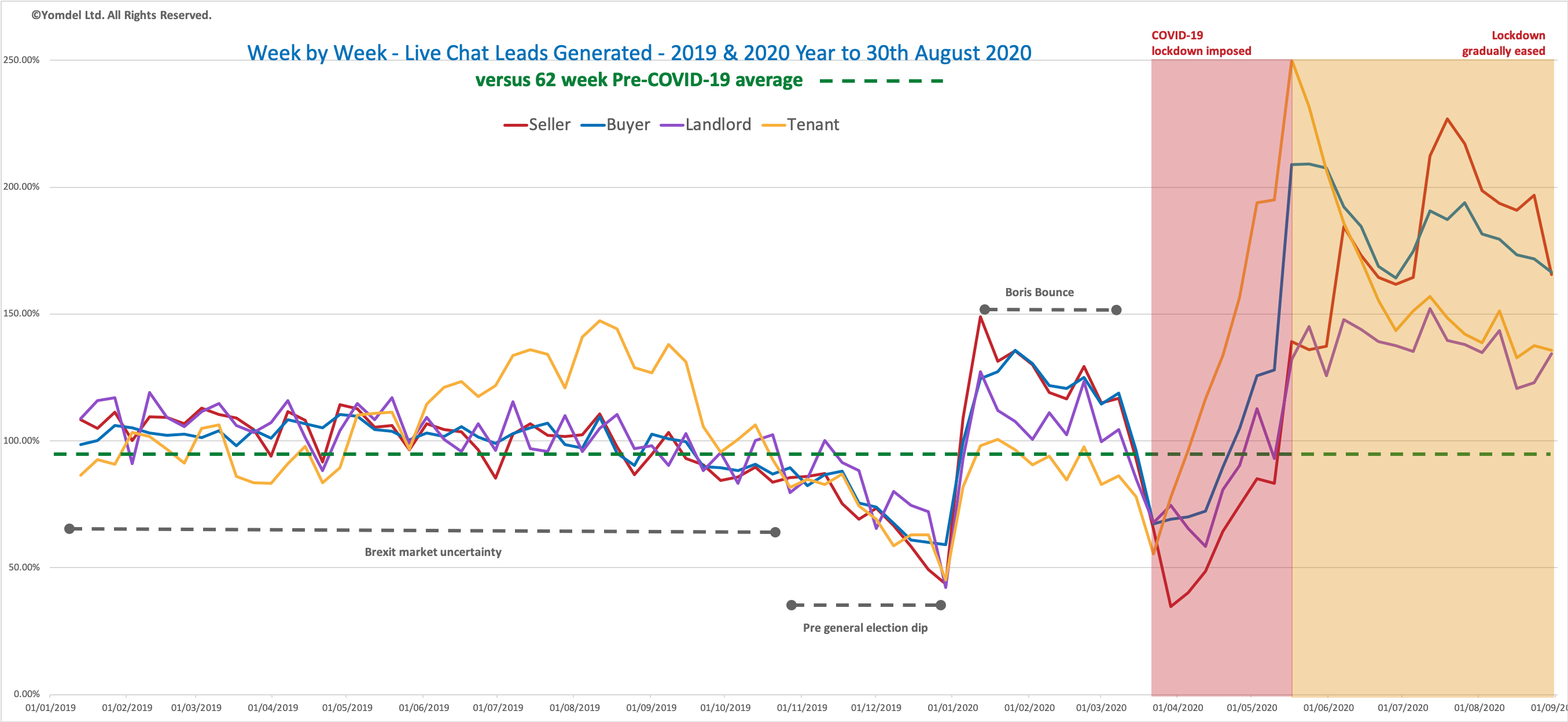

New sales enquiries from vendors and buyers in the week ending midnight on 30 August were 66% and 67%, respectively, above the 62-week pre-covid-19 average. Landlord enquiries remained buoyant, marking a strong rise on the week of more than 9%

“The focus seems to have shifted a little in the past week to camping, caravanning and staycations as people looked to squeeze a last bit of joy out of summer’s end. This has dented new enquiry volumes a little, and while the weekend may have been the coldest August bank holiday on record, there was still plenty of activity to keep estate agents warm,” said Andy Soloman, Yomdel Founder & CEO.

“Our expectation is that elevated levels of activity will persist as the clock is really ticking now if people are to get listed and sold in order to buy property and take advantage of the stamp duty holiday before the end of March. In all reality they need to have offers accepted within the next month to stand a fighting chance of reaping the benefit of this tax break.”

New vendors were down 15.91%, or 31.33, to end the week on 165.58, which while this marked the steepest weekly drop since lockdown began it still left new vendor enquiries 66% above the pre-covid-19 62-week average.

Buyers fell 3.03%, or 5.20 points, to close at 166.55, some 67% above pre-covid-19 average.

Landlords were the winners on the week, rising 9.25%, or 11.37 points, to finish at 134.28, around 34% above the average.

Demand from tenants dipped 1.27%, or 1.75 points, to close at 135.77, some 36% above the pre-covid-19 average.

“We have data for more than five months now since lockdown was imposed, and the trends are well established,” says Soloman.

Comments are closed.