EYE has learned that ARPM (Ash Residential Property Management Ltd) has ceased trading and is in the process of possibly going into liquidation.

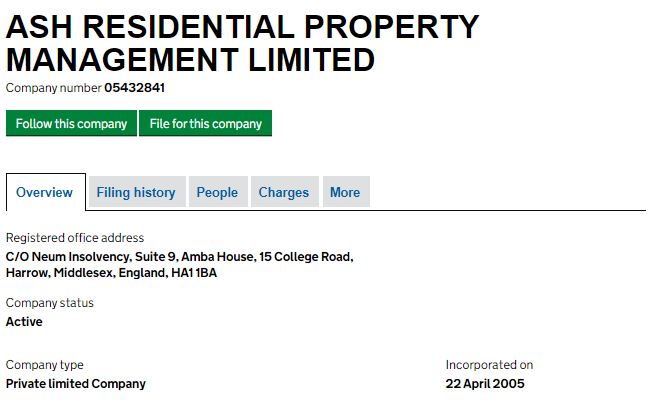

Neum Insolvency of 15 College Rd, Harrow HA1 1BA has been approached and is now the Registered Address at Companies House.

Umang Patel of Neum Insolvency told EYE that ARPM ‘has ceased trading’ and that his firm are in the process of advising ARPM with a view to being instructed to put the company into liquidation.

Patel said that they have been receiving calls from ARPM customers and that he expected more when the firm is formally instructed in the matter.

Neum Insolvency is on 020 3411 9598

Such a shame, but at least if the property is formally placed into an insolvency procedure, then the practitioners can either find a buyer to take the contracts over at short notice, or advise clients to move elsewhere if no buyer is forthcoming.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Does anyone know if – assuming that clients money were being used by the company and its directors, as our experience indicates – can we take legal action directly against the directors? do we need to report it to the police first?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

RICS rule 8 formalises how to deal with client monies. The easiest way to understand the obligation is ‘you cannot rob Peter to pay Paul’s bills’ In other words you cannot borrow from one landlord to settle another’s statement and repay them once the other landlord get their cash in.

Moving forward afresh with no opening balances and nothing in any suspense account is going to be relatively straightforward. Unpicking multiple client cash accounts is going to eat most of cash that’s in the account (s)

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Thank you Robert – helpful as always!

My understanding is that concern is that they allegedly didn’t pay one landlord by another, but that they may have used rents and retained agency fees to pay for their own business needs.

If they cease to trade and go into liquidation, can I launch a formal fraud complaint if the above concern will be verified? and if one is launched, can I claim damages from the directors Tim/Simon?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I would advise seeking legal advice immediately. While people on the forum may be able to point you in the right direction, it doesnt hold a candle to speaking with a solcitor.

Also speak to your inurers and follow up with Neum Insolvency directly.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

One has to ask how?

Their most recent accounts show retained profit, albeit lower than the previous year, and I note dividend payments ate into the retained profit, which is not uncommon for companies to do.

Unless I missed something, the only significant loan appeared to relate to Coronavirus Business Interruption Loan of £245,000, but bearing in mind the strength of the housing market and lettings faired well, why the difficulty.

Something I believe in is that how an agent deals with management of a property has a direct impact on the relationship of agent/landlord and tenant. If the agent/landlord is on top of things and shows a genuine interest in their management responsibilities, it goes a long way towards maintaining an excellent working relationship with tenants, that, I believe, helps towards a tenancy running smoothly. Maybe this explains why we did not have issues with non payment of rent during the past 18 months.

Outsourcing removes an agent from this very important relationship.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

I don’t know whether they used a custodial or insurance backed deposit scheme. It’s essential info. If a deposit wasn’t protected properly, there could be additional consequences. Additionally, if the deposit has been swallowed up, the onus is on the landlord to repay it.

Whilst the CMP Insurance will cover such matters, the CMP provider could technically subrogate their loss on to the landlord. Register your interest with the insolvency practitioner.

You should contact the CMP insurer and inform your PI insurers and follow their advice. Do not delay as FNOL (first notification of loss) is a key reason for claims being rejected. Inevitably there will be lots of very unhappy landlords. Communication is so important as you will all appreciate.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

anyone here use them?

what was the cost to outsource?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

The cost to outsource?? The real cost will be those letting agents who will no doubt go to the wall either by having to make up the shortfalls to their landlords or by landlords jumping ship to go to agents who keep everything in house. As is normal in these situations the owners of ARPM will probably walk away and will be running something similar within a few months.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

– the financial cost: £35 pcm per property / 50% of the management fee (something along those lines)

– the “actual cost”: loss of control of a major aspect of your business. If they do a bad job it reflects badly on your agency.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Maybe that explains it then, £35 a pop is not worth getting out of bed for.

We all know what happens if you pay peanuts, and, for some, it can cause a life threatening allergic reaction.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Bit short sighted – they’re not only managing one property are they? That’s just the monthly charge for one property.

That’s a bit like saying McDonalds only charging £1 for a burger isn’t worth getting out of bed for. It’s worth it if you sell enough of them, frequently.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

“That’s just the monthly charge for one property”

Ahhh, now that makes sense. Thanks for clarifying it for me.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

A less facetious reply to the one provided by jeremy1960 is that it “costs” a set amount per property, per month to have your properties managed by a white label company.

Depending on how many properties there are, it can be a LOT more cost effective than employing a member of staff, and you don’t get the headaches of holidays, sickness, resignations or compliance.

I appreciate the loss of ARPM will look like a much bigger headache than the above right now, but in reality, this is the first high profile failure of a company like this, who to be fair to them, lost several key members of staff to set up competing businesses.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Look, it’s not rocket science FFS. Outsource those areas of your business with either a yes or no answer for example referencing, credit checks etc. If you try to outsource the important and personal areas like management where relationships are all important not only for swift resolution but also for the reputation of your company then you don’t deserve to survive as your cutting corners. Money follows the quality of services

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register