New website enquiries to estate agents continued to decline in the past week, with another significant drop in the number of vendors seeking valuations piling on pressure as active buyer volumes remained significantly elevated versus the norm, the latest data from the Yomdel Property Sentiment Tracker (YPST) shows.

New website enquiries to estate agents continued to decline in the past week, with another significant drop in the number of vendors seeking valuations piling on pressure as active buyer volumes remained significantly elevated versus the norm, the latest data from the Yomdel Property Sentiment Tracker (YPST) shows.

In the rental market landlords continued their disappearing act to drop 12% and end the week 31% below the same lockdown week 2020, and critically, 21% below the equivalent week in 2019, ending significantly below the 62-week pre-covid average, and at their lowest seasonal level in two years.

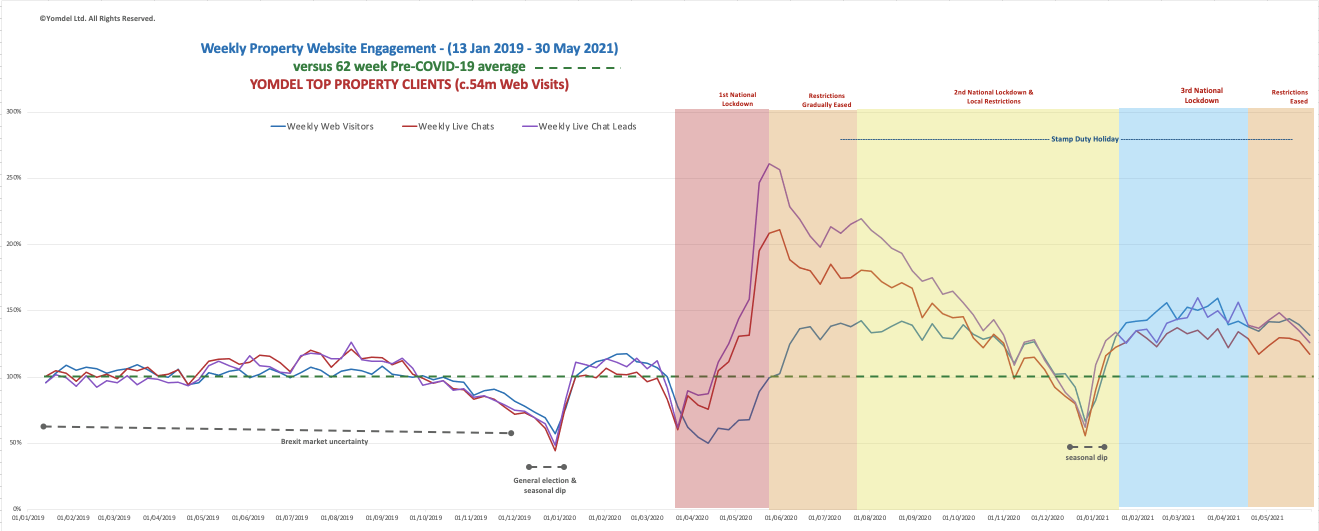

But activity online in the run up to the long bank holiday weekend, and the impending scaling back of the stamp duty holiday later in June, remained strong overall, with traffic to own-branded estate agency websites some 28% higher than the same week 2020, and 32% above that seen in 2019. Live chat volumes and the quantity of new leads generated remain strong at 17% and 26%, respectively, above the 62-week pre-Covid average

Yomdel provides 24/7 managed live chat services to 3,800 estate agent offices in the UK, handling more than a 2m chats per year. It has analysed the data and leads captured in live chat going back to January 2019, up until week ending 30 May 2021. The website visitor data is a sample across major estate agency groups in the UK and covers in excess of 53 million unique website visits back to January 2019.

“By the end of the week the sun was finally shining and there was a long bank holiday weekend that led to half term at schools, and these played a role in reducing interest in estate agents. But the critical issues here are there are simply not enough vendors in the market, too many buyers, the impending end of stamp duty reductions and rapidly rising property prices,” said Andy Soloman, Yomdel Founder & CEO.

“Landlords too are increasingly scarce while tenant demand remains strong. A fear has to be not just the imbalance between buyers and vendors, but also whether landlords have been increasingly considering selling to take benefit from a soaring market rather than letting out their properties,” he added.

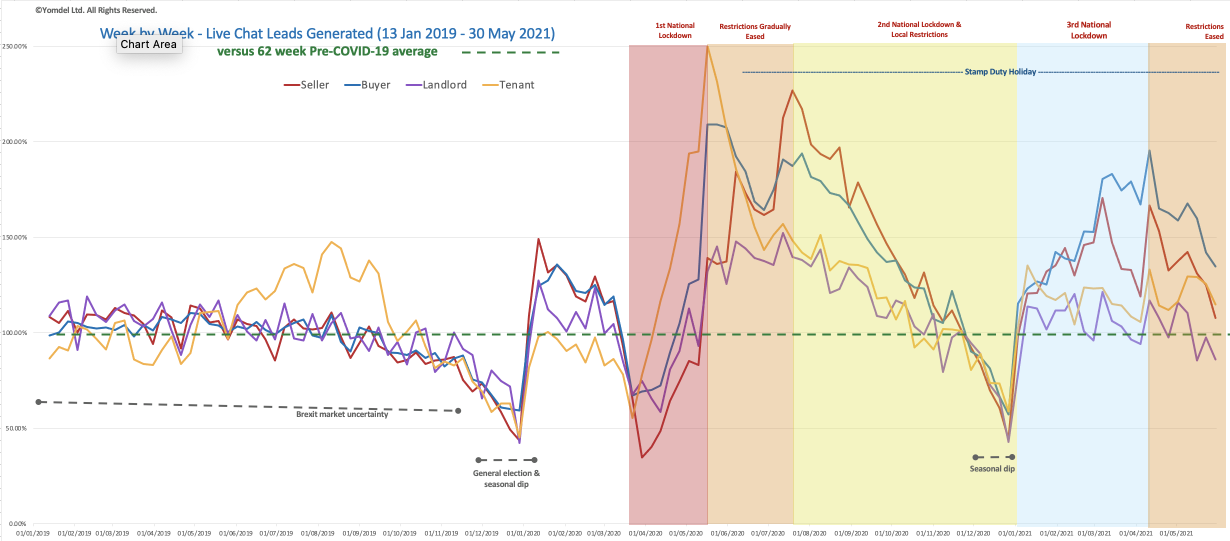

The YPST methodology establishes a base line average shown as 100% or 100, calculated according to average engagement values over the 62 weeks prior to the first national lockdown on 23 March 2020, and plots movements from there according to the volumes of people engaging in live chat, their stated needs, questions asked, and new business leads generated. Data is measured over full 24-hour periods.

New vendors fell 13.67%, or 17.07 points, to end the week on 108.81, some 9% above the average, 21% below the same week last year during the initial lockdown, and 2% above the equivalent week 2019.

Buyers slipped 5.18%, or 7.35 points, to close at 134.61, 35% above the pre-covid-19 average, 35% below the same week 2020 and 30% higher than the equivalent week 2019 before coronavirus hit.

Landlords fell 11.66%, or 11.37 points, to 86.09, some 14% below the average, 31% lower than the same week last year, and 21% below the same week 2019.

Tenants dropped 8.39%%, or 10.52 points, to close at 114.93 some 15% above the pre-covid-19 average, 44% lower than the same week last year, and on a par with the same week 2019.

The following graph looks at the relationship between website visitor volumes, live chat volumes and the volume of leads generated. The data samples more than 54 million visitors to estate agent websites from Jan 2019 – 30 May 2021 and shows how web traffic (blue line) is 28% higher than the same week last year. The volume of people using live chat (red line) and the numbers of new business leads captured (purple line) are 17% and 26%, respectively, above the pre-Covid 62-week average.

Comments are closed.