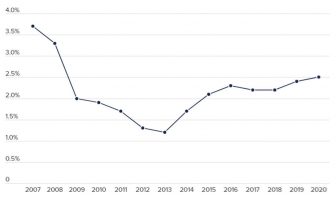

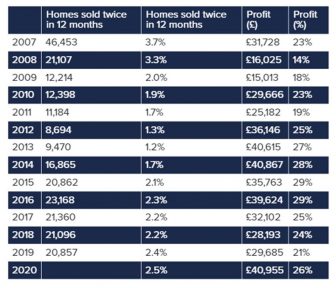

The proportion of homes flipped across England and Wales is now at the highest level since 2008, according to new research by Hamptons International.

So far this year 2.5% of homes sold have been flipped within 12 months, a figure which is likely to equate to around 23,000 transactions by the end of the year, the study found.

The vast majority of homes are being be flipped with greater profits made this year than last thanks to growth in property prices.

According to Hampton, the average profit on a flipped home in England and Wales over the past 12 months has hit £40,995.

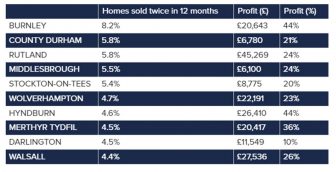

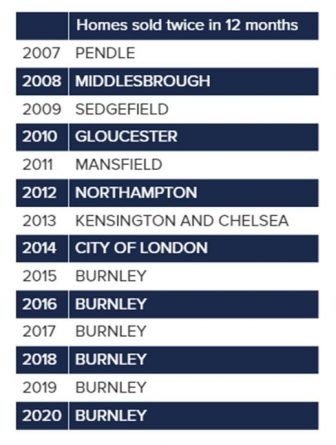

The research also revealed that more homes have been flipped in Burnley this year than in any other local authority in England and Wales.

Some 8.2% of homes sold in Burnley this year have been flipped, of which 81% were bought for £40,000 or less, under the threshold at which stamp duty is payable.

In recent times flipping has increasingly been concentrated across northern England. So far in 2020, six of the top 10 places are located in the North East or North West of England.

It has been two years since anywhere in Southern England made it into the top 10, a reflection of the weakness of the market and the amount of stamp duty payable.

Aneisha Beveridge, head of research at Hamptons International, commented: “Flipping generally involves buying, renovating and selling a home over a short period of time, in most cases for a profit. Flippers play an important role in the housing market by improving housing stock and taking on projects other buyers often won’t touch.

“Since the market weakened following the financial crash of 2007, the number of flipped houses dwindled. However, in recent times their numbers have started to recover.

But the introduction of the 3% investor stamp duty surcharge has served as a cap, with flippers increasingly targeting cheaper areas where they don’t have to pay stamp duty. At the same time, tightening yields and increased regulation have pushed some landlords away from long-term ownership towards buying, refurbishing and selling on.

“Burnley has cemented itself in the top spot for the last six years as it’s one of the few places where investors can purchase a home without paying any stamp duty. And while the current stamp duty holiday will see flippers across the country save money, its full impact won’t be felt until early next year when these homes are likely to return to the market for sale. Given investors in more expensive areas will see larger stamp duty savings, there is potential for Burnley to be knocked off the top spot before too long.”

Comments are closed.