Chancellor George Osborne had a cunning plan when it came to his reform of Stamp Duty Land Tax.

His own economists “expect that the change will make buying a home more expensive for the average buyer because the lower rate will cause house prices to rise by more than the reduction in Stamp Duty”.

This is the translation offered by Shelter to an impenetrable statement by the Office for Budget Responsibility on the change in rates.

For those good at jargon, here it is: “…for prices, the costing is based on a 1 percentage point change in the average SDLT rate leading to a 1.4% change in the house price. The same elasticity is applied across the price distribution.”

Shelter interprets this as saying that money saved by sellers on the Stamp Duty front will go into the pockets of house sellers in the form of higher prices.

“It’s a bit like a supermarket offering you 20% off, but only after jacking up the price by 30%,” says Adam van Lohuizen of Shelter.

In other words, it won’t really help first-time buyers.

Well, we don’t always find mainstream housing experts to agree with Shelter.

David Newnes, director of Your Move and Reeds Rains, did not suggest that the changes in SDLT will themselves result in house price inflation – indeed, he says that most buyers will be better off.

But he went on to say: “It is not only about today.

“Yes, the majority of buyers will be better off. But these price bands aren’t going to be reviewed again until 2020.

“With house prices rising 10.5% a year according to our latest analysis of the market, thousands more properties will have fallen into higher tax bands by then.

“This element could be seen as cunning use of fiscal drag.”

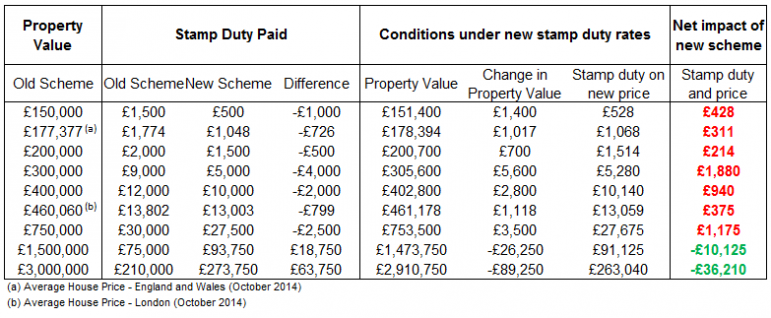

Below is how Shelter, working to those impenetrable Office for Budget Responsibility guidelines, says property prices will change: basically up, if purchasers are currently buying at below £750,000, and down if they are buying above £1.5m.

By the very nature of the changes more people will be attracted by the prospect of home ownership. First time buyers particularly in the North will not find the prospect of stamp duty such a financial deterrent. Having in the main little spare cash, being mortgaged up to the hilt and then having to find money to pay stamp duty, would have left many thinking their savings had gone into stamp duty and not into the investment, with virtually no fat of equity to face a downturn in the market. A long last a move in the right direction, yes we can expect prices to move upwards assuming no national calamities, as more people will chase the same stock. Perhaps now landlords and investors should be given tax breaks in order to encourage them to release un-wanted wanted properties to the market, which currently by the existing tax system are not tax efficient to release?

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Will rising property prices wipe out savings on Stamp Duty?……..Of course they will (in the areas we operate, anyhow) . In areas where the £250k threshold was holding buyers back we are already seeing bids immediately going to £255/260. …and that's before the agents get really stuck into the next rounds of over-valueing……I can see some agencies jumping straight from £250 -£275K on vals just to get the instruction and see where the sale price lands up afterwards. In truth, where £250 has been the main sale price for the past 10months it is difficult to say what people are actually prepared to pay now there is a fairer stamp duty.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register

Of course a reduction in stamp will lead to a greater increase in home prices, for two reasons. First, a rational buyer should be willing to pay more for something that will appreciate in value vs. something that is a sunk cost. So if I pay £350k all-in with stamp in the old regime (of which >£9k is stamp), I may be willing to pay £360k+ now, since I'm effectively getting a "free" £5k piece of equity that will appreciate over time. Also worth noting is that for those who finance their purchases, the upfront £ are often the limiting factor, and even though the actual purchase price might be higher now, the "real" purchase price might actually be less considering the incremental savings from stamp can now be rolled into the mortgage.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register