The average household in England & Wales sold their home in 2024 for £91,820 more than they paid for it, down from a record £112,930 in 2022. In percentage terms, the average seller made a 42% gross profit, the lowest return in over a decade.

The average household in England & Wales sold their home in 2024 for £91,820 more than they paid for it, down from a record £112,930 in 2022. In percentage terms, the average seller made a 42% gross profit, the lowest return in over a decade.

London sellers saw their average gain fall below £200k for the first time since at least 2015. They are now equally as likely to sell for a loss as sellers in the North East.

Merthyr Tydfil replaced Barking and Dagenham as the local authority where sellers made the biggest percentage gains in 2024. Just two London Boroughs appeared in the top 10 list in 2024, compared to all 10 being in the capital in both 2019 and 2020.

According to the analysis undertaken by Hamptons, 2024 house sellers saw more price growth over the last five years than flat sellers saw in the last 10 years.

High transaction costs and weak house price growth mean people aren’t moving as often, particularly in London. Just 25% of 2024 London sellers had bought and sold within five years, compared to 34% of sellers nationally.

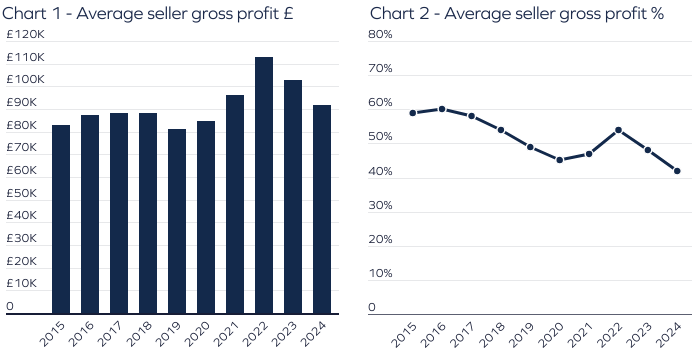

Charts 1 & 2 – Average difference between sale & purchase price in England & Wales

Source: Land Registry & Hamptons

The amount of money sellers make from their homes has been shrinking since the market peaked in 2022. In 2024, the average household in England & Wales sold their home for £91,820 more than they paid for it, having owned it for 8.9 years. This figure has fallen by £10,830 since 2023 and is down from a peak of £112,930 in 2022 when strong house price growth pushed gross gains (before any costs) into six figures for the first time. Despite lower price gains last year, 91% of households selling up nationwide achieved more than they paid.

In percentage terms, returns from property have fallen to the lowest level since at least 2015, when our records began. Last year, the average seller in England & Wales sold their home for 42% more than they paid, down from a 48% increase in 2023. Property gains peaked in 2016 when the average home sold for 60% more than its purchase price. Most of these 2016 sellers bought just after the financial crash, from which house prices generally recovered quickly, particularly in the South of England.

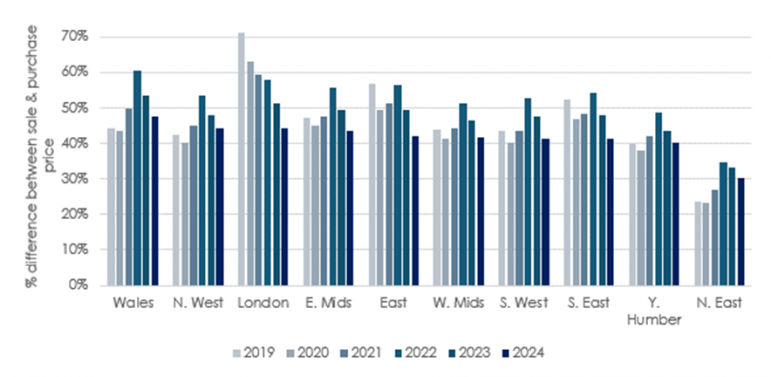

Regional variations

Sellers in every region of the country saw their returns fall between 2023 and 2024. However, Londoners recorded the biggest decrease in cash terms. The average 2024 seller in London saw the value of their property rise by £172,350 since purchase, £31,840 less than those who sold in 2023. This marked the first time that property gains in the capital have fallen below £200,000 since at least 2015. This has been mainly driven by slower house price growth in London over the last decade. In percentage terms, the average London home sold for 44% more than its purchase price, a figure that’s been declining since peaking at 100% in 2016.

Percentage difference between purchase and sale price by region

Source: Land Registry & Hamptons

2024 seller gains by region:

| Region | Average % difference between sale & purchase price | Average £ difference between sale & purchase price | % selling for more than they paid | Average years of ownership |

| Wales | 48% | £66,710 | 93% | 8.7 |

| North West | 44% | £64,830 | 92% | 8.8 |

| London | 44% | £172,350 | 86% | 9.6 |

| East Midlands | 44% | £71,530 | 93% | 8.7 |

| East of England | 42% | £100,270 | 92% | 8.9 |

| West Midlands | 42% | £72,980 | 92% | 8.6 |

| South West | 41% | £96,090 | 93% | 8.5 |

| South East | 41% | £116,560 | 92% | 9.1 |

| Yorkshire & the Humber | 40% | £60,380 | 92% | 8.9 |

| North East | 30% | £38,220 | 86% | 8.0 |

| England & Wales | 42% | £91,820 | 91% | 8.9 |

Source: Land Registry & Hamptons

Consequently, returns are becoming more evenly distributed across the regions. Back in 2016, 29% of homes that sold for over £100,000 more than the purchase price were in London, a figure that fell to 18% in 2024. Meanwhile, the share of homes making six-figure gains that were located in the Midlands and North of England has risen from 17% in 2016 to 29% in 2024.

In percentage terms, for the third consecutive year, house sellers in Wales made the biggest gross gains, with the average home selling in 2024 for 48% more than the purchase price.

Top 10 local authorities where 2024 sellers made the biggest % gains:

| Rank | Local Authority | Region | Average % difference between sale & purchase price | Average £ difference between sale & purchase price | Years of ownership |

| 1 | MERTHYR TYDFIL | Wales | 68% | £59,590 | 9.4 |

| 2 | SHEPWAY | South East | 64% | £128,500 | 11.3 |

| 3 | TRAFFORD | North West | 63% | £146,240 | 9.0 |

| 4 | BLAENAU GWENT | Wales | 62% | £44,530 | 9.1 |

| 5 | CITY OF NOTTINGHAM | East Midlands | 60% | £70,200 | 9.3 |

| 6 | BARKING AND DAGENHAM | London | 60% | £112,520 | 10.7 |

| 7 | LEICESTER | East Midlands | 60% | £84,100 | 10.1 |

| 8 | RHONDDA CYNON TAFF | Wales | 60% | £53,130 | 8.5 |

| 9 | OLDHAM | North West | 59% | £64,800 | 9.9 |

| 10 | WALTHAM FOREST | London | 59% | £178,750 | 8.4 |

Source: Land Registry & Hamptons

Merthyr Tydfil replaced Barking and Dagenham as the local authority where sellers made the biggest percentage gains nationally in 2024. Here, the average seller in 2024 received 68% more for their home than they paid. Just two London Boroughs (Barking & Dagenham and Waltham Forest) featured in the top 10 list in 2024, compared to all 10 located in the capital in 2020, 2019 and 2018.

Londoners are now equally as likely to make a loss as those selling a property in the North East. In 2024, 14% of London sellers sold their property for less than they originally paid, the same share as in the North East. Back in 2016, just 2% of London sellers sold at a loss, compared to 32% in the North East.

Most of the Londoners who sold at a loss in 2024 were selling properties in Inner London, having bought within the last nine years. Those selling in Tower Hamlets were most likely to sell their property for less than they paid, with 28% doing so, despite the average seller in the area making a £77,960 gross gain.

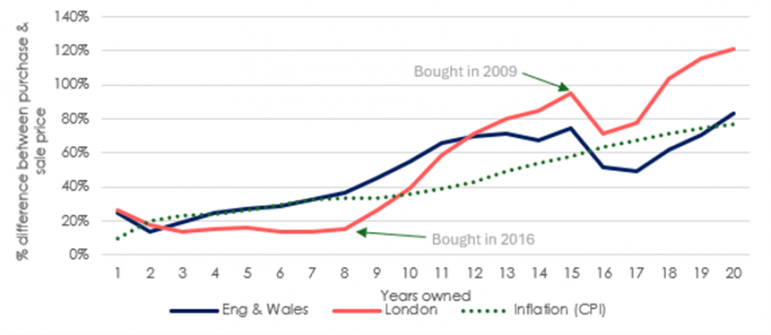

Gains by length of ownership

Average seller gain (%) by length of ownership:

Source: Land Registry & Hamptons

Given that property prices across the country have risen over the long term, those who have owned their homes the longest typically made bigger profits. The average homeowner in England & Wales who sold in 2024, having bought 20 years ago, saw the value of their property rise by 83%, triple the gross gain made by those who bought five years ago (27%).

However, slower house price growth in recent years has suppressed gains. Those who sold in 2019, having owned a home for 20 years, saw the value of their property more than treble (220%), significantly outperforming 2024 sellers who owned for the same period due to the strength of price growth in the early 2000s.

For most of the last 20 years, increases in property values have outpaced inflation. However, those who bought between 2005 and early 2008, just before the financial crash, are likely to have underperformed. The average household in England & Wales who bought a home in 2007 and sold it in 2024 made a 49% gross gain. However, inflation (measured by CPI), has risen 67% over the same period.

The trend is different in London, with London property underperforming in the short term, but outperforming longer-term. The average Londoner who bought after 2014 and sold in 2024 has underperformed inflation and seen smaller gains than homeowners in the rest of the country. However, those who bought pre-2013 in the capital have seen much greater returns, outpacing inflation too. For example, the average homeowner sold their property in the capital last year for 121% more than they paid 20 years ago, outperforming the England & Wales average of 83% and inflation at 77%.

Slower house price growth in London in the medium term has limited people’s willingness and ability to move. 2024 property sellers in London have owned their property the longest, averaging 9.6 years, longer than the England & Wales average of 8.9 years. Just 25% of 2024 London sellers had bought and sold within five years, compared to 34% of sellers across the country.

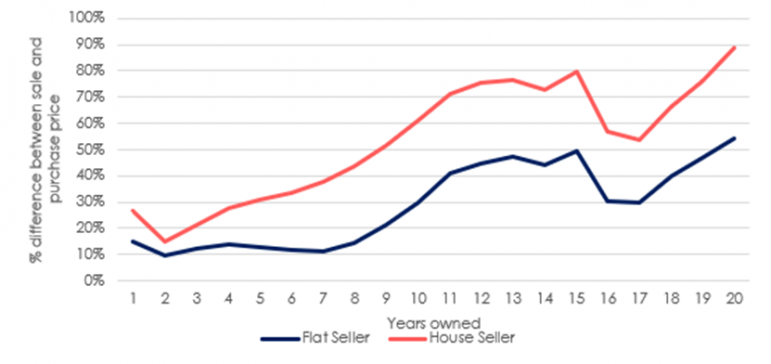

Gains by property type

House sellers saw more than double the gains recorded by those selling a flat last year. The average house sold in 2024 for 47% (or £102,500) more than its purchase price, having been owned for 9.0 years. Meanwhile, the average flat sold for 23% (or £48,050) more, having been bought 8.8 years ago.

Average seller gain (%) by length of ownership:

Source: Land Registry & Hamptons

Slower price growth for flats since the pandemic means that house sellers saw more price growth over the last five years than flat sellers saw in the last 10 years. The typical house seller who sold in 2024, having bought five years ago, made a gross gain of 31%, compared to a 30% gain for the typical flat seller who bought 10 years ago.

This weaker equity growth has limited flat owners’ ability to move. Just 32% of flat owners who sold in 2024 moved within five years, compared to 40% who sold in 2019 having owned that property for the same time.

Aneisha Beveridge, head of research at Hamptons, said: “Despite slower house price growth in recent years reducing how quickly homeowners build up equity, 91% of sellers still sold their homes for more than they paid, with nearly a third making six-figure gains. These proceeds typically fuel moves up the property ladder. However, smaller and slower equity gains over recent years, particularly for flat owners, has made this more challenging.

“2024 sellers generally experienced less price growth than those who sold during the pandemic. Property prices rose 43% across the country between 2015 and 2024, compared to 64% between 2013 and 2022, just before mortgage rates spiked. On top of this, households have had to grapple with higher mortgage and transaction costs, such as stamp duty, making it more costly to move.

“In London, the issue is particularly acute, with property values in some areas remaining below 2016 levels, discouraging moves. Only 25% of 2024 London sellers had bought within the last five years, compared to 34% nationwide. Until property prices recover, or transaction and mortgage costs decrease, homeowners are likely to stay put for longer. Usually, homeowners need to inject thousands of pounds from their own pocket to make a move financially viable, which often scuppers many potential sales.”

The gambling industry continually evolves, offering creative options like themed slots, sports betting, and virtual games. Among these, best skiing games for smartphones bring a unique twist, combining sports-inspired visuals with exciting gameplay https://www.skipeak.net/blog/the-best-skiing-mobile-games/ These themed games appeal to niche audiences, showcasing how modern gambling embraces diverse interests while creating immersive and entertaining experiences.

You must be logged in to like or dislike this comments.

Click to login

Don't have an account? Click here to register